- Crypto analyst Javon Marks predicts a 180% upside for SHIB, citing bullish MACD divergence with a target of $0.000032.

- CoinCodex projects SHIB to hit $0.00002198 by January 2026, despite current bearish sentiment.

- SHIB remains resilient, with increased optimism around technical patterns and long-term growth, especially among patient holders.

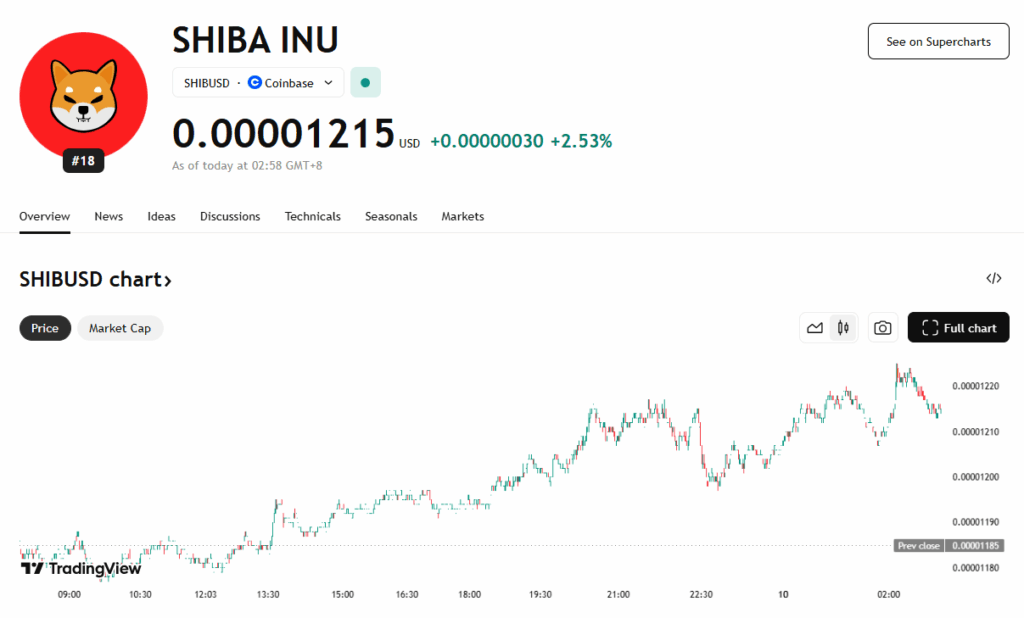

Shiba Inu (SHIB), the beloved meme token, is once again capturing attention amid whispers of a significant bullish turnaround. Despite months of sluggish price action and investor impatience, analysts are now flagging signs of a massive rally in the making. SHIB currently trades at $0.00001193, up 2% in the last 24 hours, and according to crypto analyst Javon Marks, a 180% upside may be brewing.

Bullish Divergence Signals Potential Rebound

Marks points to a “clear bullish divergence” in SHIB’s MACD, a technical indicator often used to predict momentum shifts. He suggests that this pattern could signal a move toward $0.000032—a dramatic surge from current levels. This isn’t just speculation: a confirmed MACD divergence often precedes major price reversals. Marks emphasizes that this move “may only be the start of a much larger positive reversal,” hinting at longer-term bullish potential beyond this first leg up.

Technical Outlook Shows Long-Term Growth

Meanwhile, CoinCodex paints a slower but steady path forward. Their projections place SHIB at $0.00002198 by January 2026—an 86% increase from current levels. Although the platform reports a bearish short-term sentiment, the Fear & Greed Index leans toward “greed,” suggesting investor appetite is still strong. With SHIB logging 43% green days and 4.7% price volatility in the past month, market behavior seems cautiously optimistic.

Patience May Pay Off for SHIB Investors

Shiba Inu’s journey has been turbulent, but the coin has repeatedly shown resilience. As meme coins evolve and aim for greater utility—especially through projects like Shibarium—SHIB’s long-term appeal may strengthen. Technical analysts argue that the brewing bullish structure shouldn’t be ignored, particularly by long-time holders who’ve weathered previous storms.