- Over 219 million XRP—worth around $500M—was moved between anonymous wallets, sparking speculation due to its ties to a Ripple-activated address and no known exchange affiliation.

- XRP closed its highest-ever quarterly candle above the $2.00–$2.50 resistance, signaling a potential long-term breakout that could attract institutional interest.

- Ripple’s recent bank charter application and rising ETF approval odds have fueled bullish projections, with some analysts eyeing $20–$30 XRP if crypto market leaders stay strong.

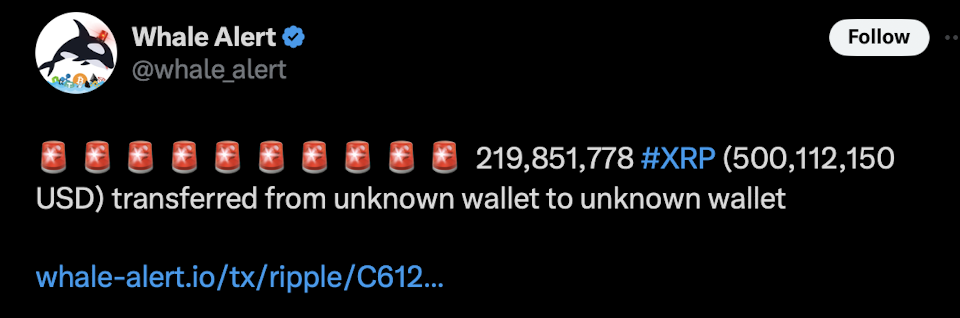

A major XRP transfer involving over 219 million tokens, valued at approximately $500 million, was recorded on-chain earlier today. The movement, flagged by WhaleAlert, showed funds transferred between two unverified wallets with no exchange tags. It occurred as XRP registered its highest quarterly candle close in history, suggesting a notable development for the token.

The sending address was initially activated by Ripple Labs in 2023, and it still retains more than 32 million XRP. The receiving wallet, now holding over 55 million XRP, has no known link to any centralized exchange or custodial service. There has been no official statement regarding the transfer, leading to questions around its purpose.

Large Transfer Between Unknown Wallets Raises Attention

On July 7, blockchain data services recorded a transfer of 219,851,778 XRP, equating to over $500 million. The transaction took place between two anonymous wallets, with no links to publicly known institutions. Both wallets are unverified, with no exchange tags or identifiable affiliations.

Meanwhile, earlier today, in a separate transaction, blockchain data also recorded a movement of 50,000,000 XRP, worth approximately $113.17 million, between two unidentified wallets. Similar to the larger $500 million transfer, this transaction involved no known exchange or tagged custodial address.

WhaleAlert tracked the transaction and confirmed that the sending wallet had prior ties to Ripple Labs. Blockchain explorers show that Ripple originally activated the address in 2023. After the transfer, it still holds over 32 million XRP, suggesting it may remain active. Meanwhile, the recipient wallet, created over a year ago, has a current balance exceeding 55 million XRP.

XRP Price Closes Highest-Ever Quarterly Candle

The XRP/USD chart has accomplished a major technical target, that is, its highest quarterly candle ever. The candle has posted a close above the long-running resistance area of around the zone of $2.00 and $2.50, and is in clean breakout mode after many years of narrowing consolidation. The last time XRP approached this range was in previous cycles but failed to hold above on a closing basis.

The chart, shared by @StephIsCrypto, shows the latest three-month candle closing firmly above all previous closes. The line previously marking the highest close has now been surpassed, which could indicate a shift in long-term momentum. This marks the first confirmed quarterly breakout in the asset’s history.

Quarterly closes are considered by many traders to reflect more stable trends than shorter time frames. These candles reduce volatility and can show sustained buying pressure. This close may attract institutional interest and could influence upcoming trading decisions. However, sustained price levels above $2.25 will be necessary in the coming weeks to confirm the breakout trend.

XRP Price Movement Remains Stable Despite Transfer

In spite of the transfer, there has not been much volatility in the short term in the price of XRP. XRP is still over the mark of $2.25 and it trades in a strained range without much volatility. This implies that the market is not so sensitive to the $500 million movement and there is no much panic selling or quick buying.

Data from derivatives markets indicates a modest rise in open interest and trading volume. According to analytics platforms, XRP futures volume has risen by over 87% to $4.72 billion, and open interest is up nearly 4%. This suggests ongoing participation from traders but without extreme leverage or price swings.

Options markets, however, show a sharp drop in volume of over 68%, while open interest has increased slightly. This indicates that most traders are likely waiting for clearer signals before making large directional bets. The overall sentiment remains neutral for now.

Institutional Developments and Analyst Projections

Ripple Labs recently applied for a national bank charter with the U.S. Office of the Comptroller of the Currency. If approved, Ripple would be allowed to operate as a federally regulated trust bank. This could enable Ripple to offer regulated crypto and stablecoin services directly under U.S. banking laws.

The application has also led to an 18% increase in the estimated odds for XRP ETF approval in 2025. Several analysts believe this may boost institutional confidence in XRP. Some market observers are also speculating that the large XRP transaction might be linked to future OTC provisioning or liquidity flows for institutional partners.

Analyst @CredibleCrypto stated, “If XRP reaches its prior all-time high on BTC or ETH pairings, $20–$30 XRP is not unrealistic.” The analyst suggests that if Bitcoin holds above $100,000 and Ethereum remains near $5,000, XRP’s price could align accordingly if pairwise highs are revisited.