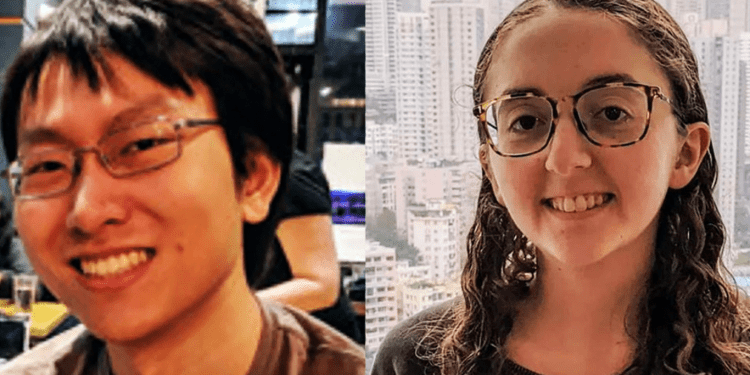

- FTX co-founder Gary Wang and Alameda Research CEO Caroline Ellison are willing to help the DOJ

- US Attorney for the SDNY Damian Williams leads the case

- FBI has possession of former FTX CEO Sam Bankman-Fried who will appear before the judge once he returns to the US

FTX co-founder Gary Wang and Alameda Research CEO Caroline Ellisonwere presented before the Court of Justice. They pleaded guilty to fraud charges and agreed to cooperate with the Department of Justice in investigating former FTX CEO Sam Bankman-Fried (SBF).

According to the United States Attorney for the Southern District of New York, Damian Williams, the apprehension of the top executives is just the beginning of what could be a long-term investigation. The SDNY attorney wants to catch the suspects behind the company’s downfall. With Wang and Ellison under the authorities’ belt, they can use their information to know more about the specifics and reasons behind the shady schemes of FTX and Alameda Research.

“Both Ms. Ellison and Mr. Wang have pleaded guilty to those charges, and both are cooperating with the SDNY,” he said.

On December 13, Williams said the gradual progression of law enforcement led to the arrest of SBF in the Bahamas. The former CEO was indicted for eight counts, including the defrauding of FTX customers and investors. As of press time, the FBI possesses SBF, who will appear before the judge back in the US.

SDNY Attorney Warns Other Involved FTX Personnel

Attorney Damian Williams had told anyone from FTX and Alameda Research that they should “come to see us before we come to see you,” implying that the authorities will not stop after the arrest of Wang, Ellison, and Bankman-Fried. He also said that he and others chasing subsidiary personnel “are moving quickly, and our patience is not eternal.”

The United States Securities and Exchange Commission declared on December 21 that both Gary Wang and Caroline Ellison are charged for a multiyear scheme that manipulated the customers of FTX. They are also accused of other violations that tamper with security laws.

On December 13, following Bankman-Fried’s indictment, the SEC and the CFTC filed separate complaints. The House Financial Committee was supposed to receive testimony from the former FTX CEO that day. The Senate Banking Committee in the United States also looked into the FTX collapse and all involved persons.

While arrested in the Bahamas, SBF was denied bail by the Bahamas Department of Corrections judge. Now under the hands of the FBI, SBF will be brought in for more detailed questioning thanks to the expected answers from his apprehended executives. Authorities are hoping to find more specific individuals besides FTX’s head operators.

Authorities Reaching Out to Other Exchanges

With the turmoil FTX brought to its customers, the SEC and the CFTC are eyeing other competing exchanges, including Binance, Crypto.com, Coinbase, and KuCoin. The CEOs of each mentioned firm have presented proofs of reserves to calm their respective customers and show evidence that they do not participate in malicious acts like FTX and Alameda Research.

Recently, Binance has been under pressure after it posted a blog announcement about Mazars Group – its auditor – ditching all traces of association with the crypto exchange. Mazars erased its web page regarding its partnership with Binance after discovering that it has no other truth regarding the proof of reserves that Changpeng Zhao (Binance CEO) claimed.

Now that the law can put justice for the affected customers and investors of FTX, Attorney Damian Williams, along with the help of the SEC, will see that no culprit shall escape and be unpunished.