- Bitcoin realized $2.46B in profits on June 30, but it’s still far below the peaks of late 2024, suggesting mild—not extreme—selling.

- Veteran holders (3–10 years) led the profit-taking, while short-term holders and whales trimmed just slightly.

- Traders see the move as normal consolidation, not a trend reversal, with many sellers planning to buy back in lower.

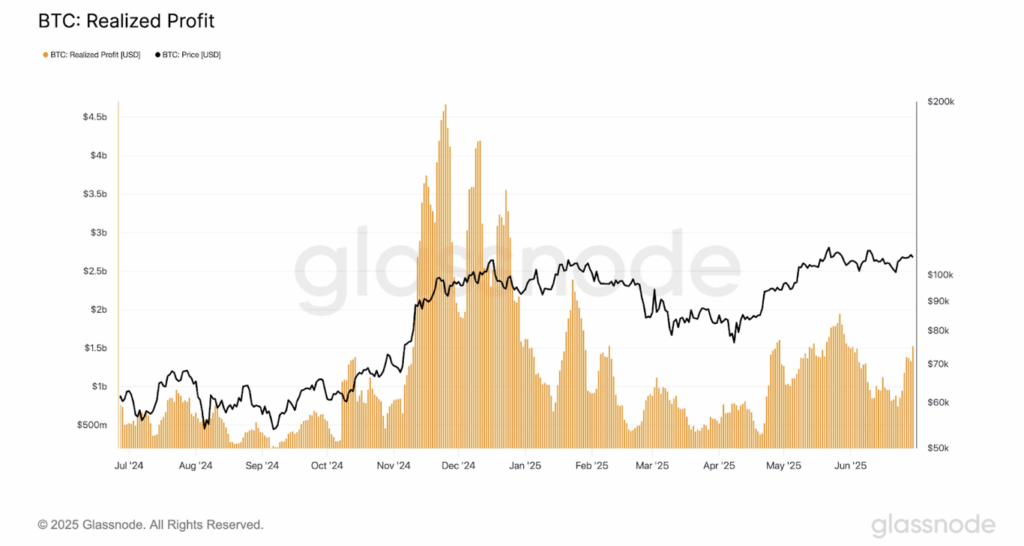

Glassnode’s latest on-chain read shows Bitcoin holders cashed in serious gains at the end of June—but let’s not call it a sell-off just yet. On June 30 alone, BTC realized profits hit $2.46 billion. Sounds big, yeah, but context matters.

That spike nudged the 7-day moving average of realized profits to about $1.52 billion. Pretty healthy above the 2025 average of $1.14B. Still, it’s nowhere near the madness from late 2024 when profit-taking surged to $4 to $5 billion per day. So, yes, the selling has picked up, but it’s still mild compared to last year’s fireworks.

Price-wise, Bitcoin slipped a bit—about 1% on July 1—settling near $107K. That dip didn’t break any support lines, though. BTC’s been basically stuck in a $100K to $110K range since May, and it keeps finding buyers every time it nears that lower bound.

Veteran Holders Ring the Register

Here’s where things get interesting: It’s not the new kids selling. According to Glassnode, it’s the old guards cashing in. Coins held for 3–5 years realized $849M in profits, the biggest chunk. Coins sitting in wallets for 7–10 years followed with $485M, and the 1–2 year cohort added another $445M.

Newer holders—those in the game for under a year—barely made a blip. Less than $6 million. Basically, the short-term crowd is just chilling while the seasoned players trim some gains.

Even whale wallets—those holding 1,000+ BTC—have been easing off slightly. Not dumping, though. It’s more like trimming and redistributing. Some of that is even being scooped up by institutional players, especially via U.S.-based spot ETFs. That shift is seen more as market maturity than bearishness.

Despite the selling, Bitcoin’s stayed remarkably steady. It’s been ping-ponging inside that $100K–$110K zone. When it dipped near $99K in late June? Buyers showed up fast, keeping the range intact.

Volume’s Cooling, But No Meltdown

On-chain activity is slowing a bit. The 7-day average BTC transfer volume’s down 32% from its late-May peak. Spot trading volume in June? Also quieter compared to the 2024 hype cycle. The push to $110K didn’t have the wild retail rush that usually screams “bubble.”

Instead, what we’re seeing looks more like smart money collecting gains—without triggering chaos. Price stayed inside the lines. Demand’s still there. Nobody’s slamming the panic button.

Profit-Taking Looks Like a Breather, Not the End

According to VTrader CEO Steve Gregory, the $100K mark is a natural place for long-time holders to take profits. These folks? They’re not OG whales from 2013, and they’re definitely not your cousin who bought last week on hype—they’re the middle group. Bought years ago, sitting on massive gains, and now taking some chips off the table.

Gregory says they’re not exiting crypto entirely. In fact, many are hoping to re-enter cheaper if BTC dips again. That kind of profit-taking—calculated, unemotional—is part of a maturing cycle. It’s not the beginning of the end. It’s just… a breather.

As this wave slows down, Gregory expects the market to lean bullish again. BTC might’ve paused for now, but if anything, it’s gearing up for the next leg—assuming support holds and sellers don’t get greedy.