- Two dormant addresses belonging to Genesis and Poloniex transferred 22,982 ETH (27.2 million) to two fresh addresses.

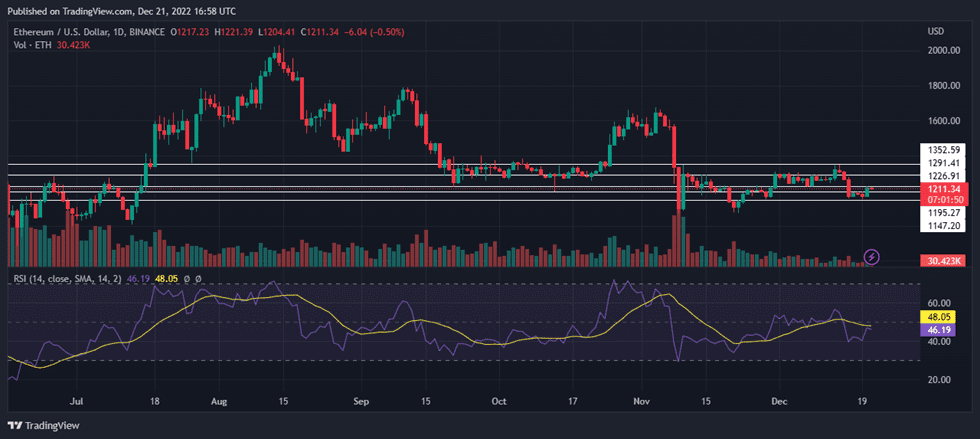

- Ethereum price shows a rejection at $1,220 that has triggered a sell-off.

- ETH price needs to flip the $1,226 hurdle into a support floor and confirm a resurgence in buying pressure.

Ethereum’s price dropped significantly in November following the collapse of FTX, a crypto exchange that was quick to expand and secured a place among the largest in the world. However, the price has been consolidating in the past few days as bears and bulls struggle for control.

In the wake of recent volatile events in the crypto market, the ETH price showed a lack of momentum on Wednesday, December 21. The price was consolidating under the resistance at $1,220 for the past few days before yesterday’s run-up, where ETH price tried to breach the opposition, but the breakout proved premature.

Since its creation in 2015, Ethereum has displayed a notable price increase, with Ether (ETH), the crypto created by Russo-Canadian programmer Vitalik Buterin seeing its value grow from $0.311 in 2015 to almost $5,000 at its 2021 peak and significant price fluctuations therebetween. The token distinguishes itself from other cryptocurrencies as it can serve to fuel and construct new apps, tools, and NFTs on a decentralized software network.

Genesis Moves $27 Million ETH

Genesis moved almost 23,000 Ethereum tokens to a new address on Monday, December 19, marking the first time that much ETH moved in four years.

According to PeckShield, two static addresses belonging to Genesis and Poloniex transferred 22,982 ETH, translating to just about 27.2 million to two new lessons, which last transacted 1,535 days ago in October 2018. Based on the description, the ETH may have been stored in a cold wallet.

Assets linked to the Digital Currency Group (DCG) dived on Friday, sparking concerns on whether liquidation was underway to cover a hole thought to be as much as $2 billion at DCG’s subsidiary, Genesis Capital.

Notably, crypto exchange Gemini provided a staking service through Genesis. In a statement, Gemini co-founder Cameron Winklevoss said:

“Houlihan Lokey, the Financial Advisor of the Creditor Committee, has begun advocating for a plan to resolve the liquidity issues at Genesis and DCG and provide a path for the recovery of funds.”

If the speculation that the moved ETH is actually from Genesis Capital, it may be a sign that the firm is going through something and the assets moved are part of the efforts to see how the situation can be resolved.

Accordingly, there may be some movement on Genesis’ move to suspend withdrawals earlier in November. However, a handful of creditors have become sufficiently concerned about rumors suggesting that Genesis Capital is selling their claim at 35p per dollar.

Therefore, whether the abysmal movement of old coins from the two static addresses thought to belong to Genesis will put off the concerns remains to be seen. This comes as Genesis Capital stays quiet a month after they halted withdrawals.

Ethereum Price Prediction

At the time of writing, ETH’s price is trading at $1,213, up by 0.5% over the last 24 hours and recording a live market cap of $148 billion. The rejection at the $1,350 zone triggered a sell-off that may continue and knock the smart contract token down to critical support levels.

ETH/USD

Ethereum price shot up on Tuesday following the massive Genesis Capital transaction. The move has, however, shown a lack of momentum from the bulls, resulting in a sudden reversal as the price opened the day on Wednesday trading in the red.

As such, if the ETH price breaks down the $1,195 support level, it would be interpreted as the first sign of weakness amongst the buyers, and a continued escalation in selling pressure followed by a daily candlestick close below the $1,150 level would create a lower low, thereby invalidating the bullish thesis.

If such a scenario plays out, Ethereum price could revisit the $1,073 level, collecting sell-stop liquidity resting underneath it.

The only comfort for the bulls after losing some of the gains made yesterday is that the relative strength index (RSI) is approaching the midpoint at 48, which could give buyers a chance to come back if they regain control. For this to happen, the ETH price needs to flip the $1,220 hurdle back into support and confirm a resurgence in buying pressure.

Such a breakout could see the ETH price retest the $1,290 and $1,350 supply zones. Above that, the largest altcoin by market capitalization may rise higher to tag the $1,800 resistance level.

Following the Merge, industry pundits are keeping their fingers crossed, with hopes that the Merge will make Ethereum more enticing and sustainable for mass usage. However, many still wait to see how investors and firms building their software on Ethereum’s platform react to the changes.