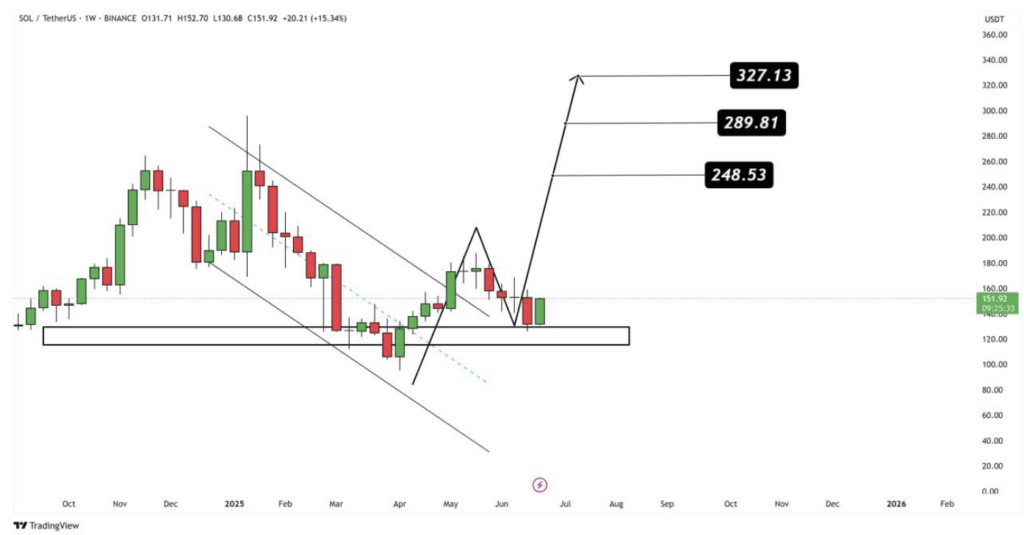

- SOL broke out of a 500-day range and closed last week at $151.92.

- Analyst targets include $248, $289, and $327, with $500 as a long-shot goal.

- Buzz around staking is building hype for a potential major rally.

Solana (SOL) is starting to turn heads again—like, really. After hanging around in the $105 to $138 range for what felt like forever (okay, 500+ days), the price finally pushed through. Last week’s candle closed at $151.92, which is more than a 15% jump. Not bad at all.

Analyst Sees Room to Run as SOL Sets Sights on $327

Crypto analyst Rose Premium posted a chart on X that laid out some pretty ambitious targets: $248, $289… and even $327. These aren’t random guesses either—those levels could actually hit if Solana keeps up the current momentum. According to her, SOL’s been in a long, slow re-accumulation grind, stuck under that stubborn $250 line. But now? Things might be shifting.

She’s calling this the start of a whole new phase. Apparently, it’s been 546 days of buildup. That’s a lot of waiting—enough to test anyone’s patience—but the payoff might finally be kicking in.

Staking Buzz Adds More Fuel to Solana’s Climb

One major thing pushing optimism? Staking. Yep, staking might be coming to Solana in a bigger way, and Rose hinted that this could mean juicy new rewards and more user engagement. That combo of blazing-fast transactions and a solid dev community already makes Solana stand out—but add staking, and it gets interesting.

The idea is, if people can lock up SOL and earn while they wait, more folks might jump in. That could tighten supply and boost demand. It’s not rocket science, but it works.

Big Base, Bigger Dreams: Could SOL Hit $500?

From the current support zone, if volume ticks up, the next leg higher looks possible—maybe even probable. Rose didn’t stop at $327, either. She floated a long-term target of $500. That’s bold, no doubt. But crypto loves its shock moves, and SOL has been there before. Don’t forget, it nearly hit $300 earlier this year.

The big thing to watch now is whether SOL can close and stay above $250. If it does, the doors swing wide open to those $289, $327, and yes—possibly $500 levels. Of course, market vibes and upgrades on the network will play a role, too. But at this point, a major rally isn’t off the table.