- U.S. Senators Elizabeth Warren and Roger Marshall proposed a bill to combat money laundering and other terrorist activities in the crypto industry.

- Cybercrime in the crypto space has reached an all-time, with over $5bn worth of seized this year.

- The Digital Asset Anti-Money Laundering act will prohibit anonymity in digital asset transactions.

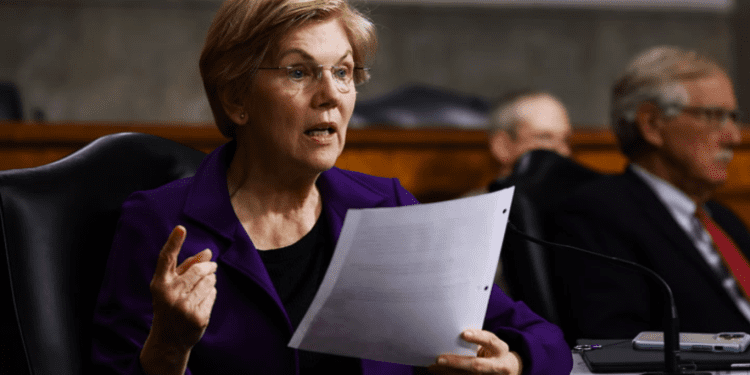

US Senators Elizabeth Warren (D-Mass.) and Roger Marshall (R-Kan.) are introducing a bill to combat money laundering and financing terrorists and rogue nations through cryptocurrency.

Digital Asset Anti-Money Laundering Act will make the know-your-customer (KYC) process mandatory for all crypto users, from wallet providers to miners. The Act will discourage financial institutions from transacting with digital asset mixers, which “conceal or obfuscate the origin, destination, and counterparties of digital asset transactions.”

Digital asset mixers, also known as tumblers, are tools that jumble the amount of cryptocurrency in private pools before spitting them out to their intended recipients.

The Act will allow the Financial Crimes Enforcement Network to implement a rule that requires all US crypto participants engaged in transactions worth more than $10,000 in digital assets via one or more accounts in the country to file a report.

The rule is expected to be enforced 120 days after the bill is enacted, although it will need to be reintroduced when the new Congress is seated.

Cybercrime in the Crypto Space

The Treasury Department, Department of Justice, and other national security and financial crime experts have warned that digital assets are increasingly being used for money laundering, theft and fraud schemes, terrorist financing, and other crimes.

Countries like Russia, Iran, and North Korea have used digital assets to siphon stolen funds, evade American and international sanctions, and bankroll illegal weapons programs.

Last year, US law enforcement seized over 50,676 Bitcoin hidden in electronic devices obtained from the dark web in 2012.

Early this year, the US Department of Justice made the largest seizure in history, confiscating Bitcoin from two hackers attempting to launder the money. Worth $71m at the time of the hack, the stolen funds are now valued at $5bn.

Binance, the world’s largest crypto platform, was also named as an accomplice in laundering over $10 billion for criminals and sanctions evaders over the last few years.

Digital Asset Anti-Money Laundering Act

Financial institutions will also be banned from handling, using, or transacting business with digital asset mixers, privacy coins, and other anonymity-enhancing technologies listed by the Secretary of the Treasury.

Furthermore, all crypto institutions will be restricted from handling, using, or transacting business with digital assets anonymized by digital asset mixers and related technologies.

“Following the September 11, 2001, terrorist attacks, our government enacted meaningful reforms that helped the banks cut off bad actors’ from America’s financial system. Applying these similar policies to cryptocurrency exchanges will prevent digital assets from being abused to finance illegal activities without limiting law-abiding American citizens’ access,” Senator Roger Marshall said.

“Our common-sense bill will make it harder for criminals to finance their criminal activities, like the trafficking of illicit fentanyl through the dark web, that can harm innocent Kansans.

As Doc Marshall says, the Digital Asset Anti-Money Laundering Act of 2022 will marginally reduce the risks that cryptocurrency and other digital assets pose to America’s national security by closing gaps in the anti-money laundering and counter-terrorism financing (AML/CFT) framework.

Curbing the activities of cyber attacks and terrorism perpetuated through crypto routes by regulations will bring the digital asset ecosystem into greater compliance with the rules that govern the rest of the financial system.

In summary, The Act would-

- Expand BSA tasks to include Know-Your-Customer requirements to digital asset wallet providers, miners, validators, and other network participants who validate, secure, or initiate digital asset transactions by instructing FinCEN to designate these actors as money service businesses (MSBs).

- Track and punish digital asset kiosks involved in drug trafficking through cryptocurrency.

- Direct FinCEN to ensure that owners and administrators of digital asset ATMs routinely submit and update the physical addresses of the kiosks they own or operate and verify customers’ identities to reduce the risks of digital asset ATMs being used for illicit finance.

In the words of Senator Elizabeth Warren;

“Rogue nations, oligarchs, drug lords, and human traffickers are using digital assets to launder billions in stolen funds, evade sanctions, and finance terrorism. The bipartisan bill will help close crypto money laundering loopholes and strengthen enforcement to safeguard US national security better.”