- Coinbase stock closed at $375.07, hitting a new all-time high with a 40% gain in the past month.

- Circle’s USDC revenue-sharing deal funneled over 60% of its income to Coinbase, bolstering COIN’s performance.

- S&P 500 inclusion and analyst upgrades have fueled investor optimism and institutional inflows.

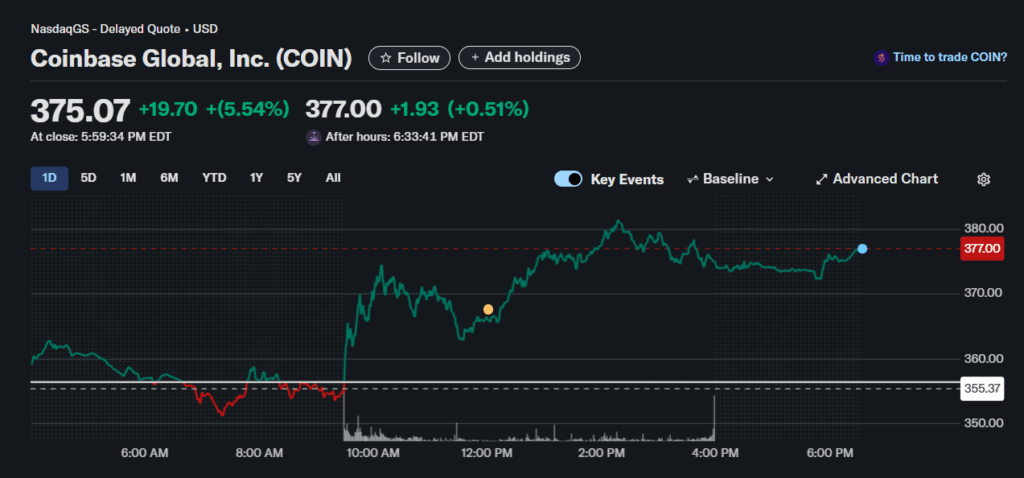

Coinbase Global (COIN) just wrapped up Thursday’s trading with a bang, closing at $375.07 per share—a level it hasn’t seen since its April 2021 debut. That’s a 5.5% jump for the day, easily clearing its previous record close of $357.39 set back in November 2021. Its market cap? Now sitting at a hefty $89 billion.

The stock’s been on fire lately, notching a 24% gain over the past five trading sessions and up 40% over the last month. A lot of this momentum has been fueled by the breakout success of Circle Internet Financial (CRCL), which listed on June 4 at $31 and has since skyrocketed more than 500%, closing Thursday at $213.63.

Circle’s Big Payday Is Coinbase’s Windfall

Now here’s the kicker—Circle, the company behind the second-largest stablecoin USDC, gave over 60% of its reserve earnings in 2024 to Coinbase. That’s thanks to a revenue-sharing agreement where Coinbase gets 50% of all remaining interest income from USDC reserves.

Even though USDC still trails USDT in dominance, it holds a hefty $61.45 billion in circulating supply. That’s a big chunk of the stablecoin market—and it’s turned into a quiet but powerful cash stream for Coinbase. The financial synergy here is strong and investors are clearly taking notice.

S&P 500 Listing Adds More Fire to COIN’s Rally

Coinbase’s inclusion in the S&P 500 index, effective May 19, added another layer of legitimacy and exposure. It’s the first ever crypto-native company to be added to the benchmark index, making it more appealing to institutional investors and fund managers.

Analysts are bullish, to say the least. Bernstein recently raised its price target for COIN to $510 and dubbed it the “Amazon of crypto financial services.” That’s a massive vote of confidence—and so far, the price action seems to be backing it up.