- Solana’s holding strong near $144, with $145 being the key breakout level in the short term.

- Analysts project a potential fifth-wave move to $270–$320—if $109 support holds.

- A $20M short squeeze hints at bullish momentum building fast.

Solana’s been a bit choppy lately, bouncing around without any real follow-through. But now? Things are looking different. As of June 24, SOL is hovering close to $144, slowly inching toward the crucial $145 resistance. If it manages to flip that into support, we might be staring at the start of something way bigger. Traders are watching closely—because this could be the trigger for a real move.

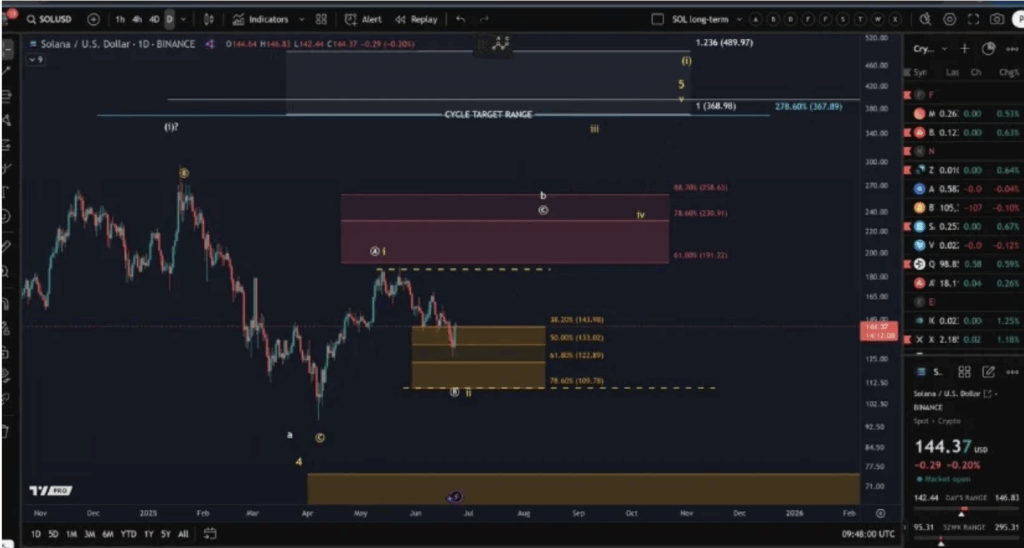

More Crypto Online says SOL’s still in a textbook Elliott Wave pattern, specifically in wave 4. If support around $109 holds, then a classic wave 5 extension might be on the table, pushing the price somewhere between $270 and $320. But yeah, that $109 level? If it breaks—bye-bye bullish setup. All eyes on that zone.

Pressure Builds as Short Squeeze Shakes Up Market

In the past 24 hours, more than $20 million worth of shorts got liquidated on Solana. That’s huge. The single biggest liquidation? $1.66 million around the $141 mark. All this info comes from SolanaFloor—and these kinds of wipeouts tend to reset the board. Bears get cleared out, and bulls usually smell blood. It doesn’t always guarantee a breakout, but it sure amps up the odds.

On the 4-hour chart, $145 is acting like the final boss. If SOL clears it with some conviction, we could see a sprint toward $165 or even $179. The descending trendline resistance is already being tested, so a flip here could confirm a short-term trend reversal.

Solana Reclaims Key Support, Momentum Builds

Down on the weekly time frame, Solana’s finding solid footing between $120 and $125—exactly where demand’s been piling up. Crypto analyst CJ pointed out that SOL’s structure is bouncing nicely from that range, aiming now toward $160 or maybe $170. The horizontal range is clean. If buyers keep stepping in, that $150 resistance zone could turn into a springboard.

What’s especially interesting here is how the market structure is aligning across timeframes. Weekly support’s in play, short-term momentum is swinging upward, and even sentiment is slowly turning bullish. It’s like all the ingredients are there… they just haven’t mixed quite yet.

Final Thoughts: Could Solana Be Ready for Liftoff?

So, what’s the vibe? Well, it’s definitely not boring. With $109 holding up and short sellers getting booted from the game, Solana’s sitting in a solid spot. Break $145 cleanly, and this thing might catch fire.

But caution’s still key—false breakouts are real, especially when volume’s thin. If SOL clears $150 and then pushes through $165, things get spicy fast. And if it makes a serious run, $270 to $320 is still within range according to cycle structure.