- Only 16.6% of Hyperliquid traders are turning profits, with average daily losses near $5,600.

- Generous HYPE token rewards favored high-volume users, widening the gap between top and bottom.

- Despite the losses, Hyperliquid now dominates 60% of DeFi perpetuals trading and is gaining on Binance.

So, Hyperliquid’s gaining serious steam in the crypto world. It’s one of the hottest decentralized futures exchanges out there right now. But here’s the thing: while more people are jumping in, most of them? They’re not making money. In fact, the numbers are kind of brutal.

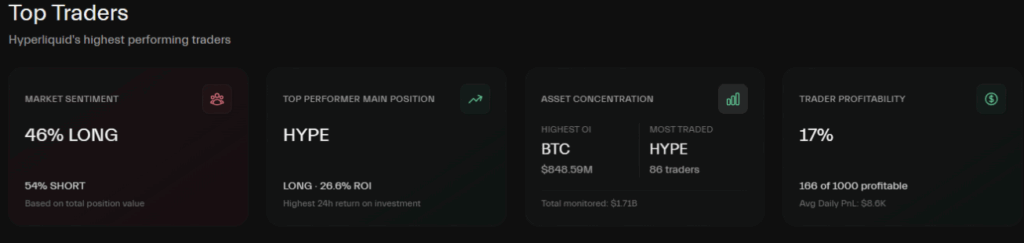

A fresh report from Hyperdash analytics (June 2025) looked at 1,000 traders using the platform. Only 166 of them — yep, just 16.6% — came out ahead. On average, traders were losing about $5,600 per day. Sure, a lucky few managed to stack millions, but the vast majority? Deep in the red.

Leverage Gives… and Then It Takes Away

Hyperliquid lets users trade perpetual futures — which basically means you can keep your position open forever (if you can afford it). Add leverage to the mix — where traders borrow money to go bigger — and you’ve got a recipe for either big gains… or painful losses.

Out of all the users, just 170 traders reportedly earned more than $10 million, while 1,589 accounts made at least a million. Sounds great, right? But most of these “winners” didn’t pull it off with wild percentage gains — they just started with huge capital or got rewarded with hefty token drops.

That’s the other piece of the puzzle: rewards. Hyperliquid launched with generous HYPE token airdrops for early users, mostly based on how much you traded. The more you traded, the more you got — and yeah, that helped some folks book big wins. But again, about 20% of users ended up getting 80% of those tokens, so the wealth was heavily concentrated at the top.

Risk Is Real — And It’s Hitting Smaller Traders Hard

Leverage cuts both ways. Even a 5% move against you can wipe your position if you’re using 10× leverage. Add in stuff like slippage, trading fees, and funding costs, and… it’s no wonder smaller traders are getting wrecked. Honestly, this isn’t even new — traditional futures markets show similar outcomes, where most retail traders lose over time.

And yet, despite the losses, Hyperliquid’s market share is exploding. It’s now the biggest DeFi platform for perpetuals, owning over 60% of the market according to Dune Analytics. In just the last month, trading volume hit $188 billion. That’s massive — and it’s lapping the likes of dYdX and GMX.

Even more interesting, Hyperliquid is starting to chip away at centralized giants like Binance and Bybit. Back in late 2024, it had just 2% of Binance’s daily trading volume. Now it’s close to 9%, and analysts think it could hit 20% by the end of the year. That’s a serious shift.

No Middlemen, No KYC — But Still a High-Stakes Game

One big reason for Hyperliquid’s rise is its structure. Everything runs on-chain, so there’s no centralized exchange holding your coins, and no annoying KYC process. Traders keep full control of their funds.

But that also means you’re on your own. You’ve got to manage risk, eat the slippage, pay funding fees — and deal with the consequences if it all goes sideways.

The platform’s exploding in popularity, no doubt. But the story underneath the surface is a tough one. Most traders are still losing — often big — while a small group reaps the rewards, thanks to early positioning, big capital, or just high volume.