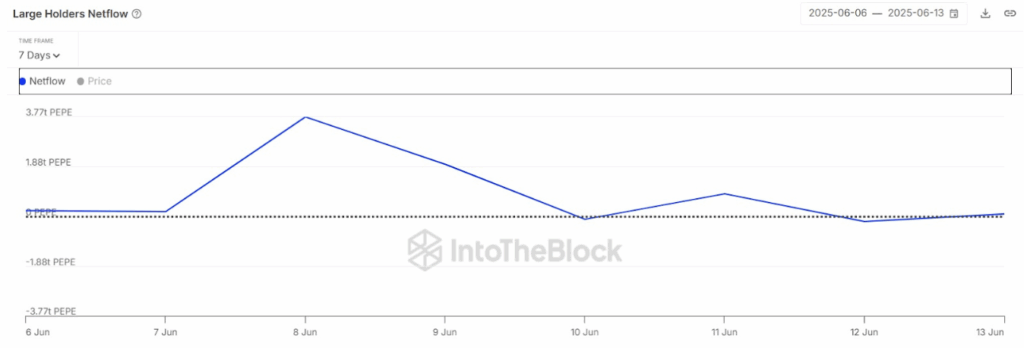

- Whale netflows for PEPE dropped 97% in one week, signaling heavy distribution and lack of accumulation.

- A descending triangle and weak RSI/MACD hint at a bearish setup unless $0.00000115 is reclaimed with volume.

- Despite some bullish bets, the market is indecisive, with drying volume and rising open interest suggesting traders are waiting for a clear move.

Pepe Coin (PEPE) looks like it’s slipping into shaky ground. A bunch of red flags are popping up—whale wallets are thinning out, bearish patterns are forming on the charts, and the hype? Yeah, it’s cooling off fast. The market’s getting twitchy, especially as PEPE hovers around its support level. With whale netflows plunging 97% in just a few days, talk of a 30% correction is no longer far-fetched—it’s knocking at the door.

Whale Behavior Signals Weak Hands

According to IntoTheBlock, whale netflows have nosedived from 3.77 trillion to just 95 billion PEPE in one week. That’s not just a dip—it’s a massive unloading, and it smells like distribution. When the big wallets bail like this, retail usually ends up holding the bag. While PEPE’s up 6% in the last 24 hours and trades around $0.0000117, this mini rally could be a trapdoor. If this dump pattern keeps going, we might see a drop below $0.0000106 and maybe even a fall toward $0.00000750 if the descending triangle breaks down.

Traders Split While Volume Dries Up

Even with warning signs all over, not everyone’s bearish. The global long/short ratio is hanging around 1.0052—not exactly screaming panic, but not bullish either. Binance looks neutral, but OKX users are oddly bullish with a 2.34 long/short ratio. That said, open interest is up 5.77% to $518M, but volume’s down 33%. That’s usually a sign traders are stuck in limbo, waiting for a clear direction. Liquidation stats show shorts getting squeezed a bit more than longs, but nothing decisive—yet.

Charts Point to Bearish Bias, But It’s Not Game Over

The technical side? It’s wobbly. PEPE’s trading just above the $0.00000107 support, which held before but might not this time. The candles are tiny, showing no real conviction. A descending triangle is forming too, not great news. The MACD is still negative but slowly inching toward a bullish crossover. RSI sits at 39, up from oversold, but it hasn’t cracked 50—so momentum is weak. If PEPE can hold $0.00000107 and flip $0.00000115 with some decent volume, a recovery might be in the cards. But for now, the trend’s still leaning down.