- Bitcoin dropped below $109K after hitting an ATH, triggering over $544M in liquidations across crypto.

- Long traders took the brunt, losing $402M, with Ethereum and XRP also seeing major wipeouts.

- A recent golden cross on Bitcoin offers hope for a rebound despite shaken market sentiment.

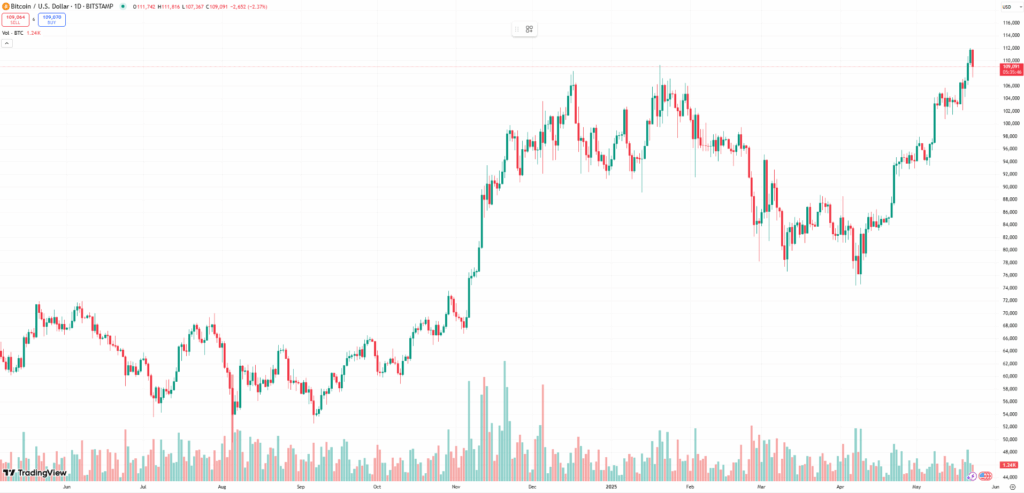

The bullish wave sweeping through crypto just hit a bump. After pushing to a fresh all-time high of $111,970, Bitcoin suddenly slipped below $109K, triggering what can only be described as a liquidation bloodbath.

According to CoinGlass, nearly $545 million in positions were wiped out in just 24 hours—and yeah, most of that came from traders who were betting on more upside. It’s been rough.

Long Traders Get Slammed as BTC Falls

Out of the total liquidations, long positions took the biggest hit—roughly $402 million of it. Just for Bitcoin alone, $139.4 million was liquidated, with longs accounting for over $113 million. That’s a brutal wake-up call for bulls who thought the rally would keep going uninterrupted.

And it wasn’t just BTC that got hit. Ethereum suffered too—losing $137.6 million in liquidations, with longs once again on the losing end ($100.7 million gone). XRP, which has been creeping toward that elusive $3 mark, saw $10.5 million in long positions liquidated as well.

Trading volume? Down 32% to around $63.9 billion, which kind of tells you how shook the market is right now.

Golden Cross Might Be the Silver Lining

Despite the sea of red, not everything’s doom and gloom. Some traders are pointing to Bitcoin’s recent golden cross—a bullish technical indicator—as a potential sign that the dip might not last forever. Could this be a short-term reset before another leg up? Maybe.

In the meantime, XRP’s trading volume dropped by $300 million in a single day, hinting at cooling retail activity or a dip in institutional flows. Either way, sentiment is rattled.

So now all eyes are back on Bitcoin, waiting to see if it can steady itself and spark a fresh recovery—or if the market has more pain to dish out first.