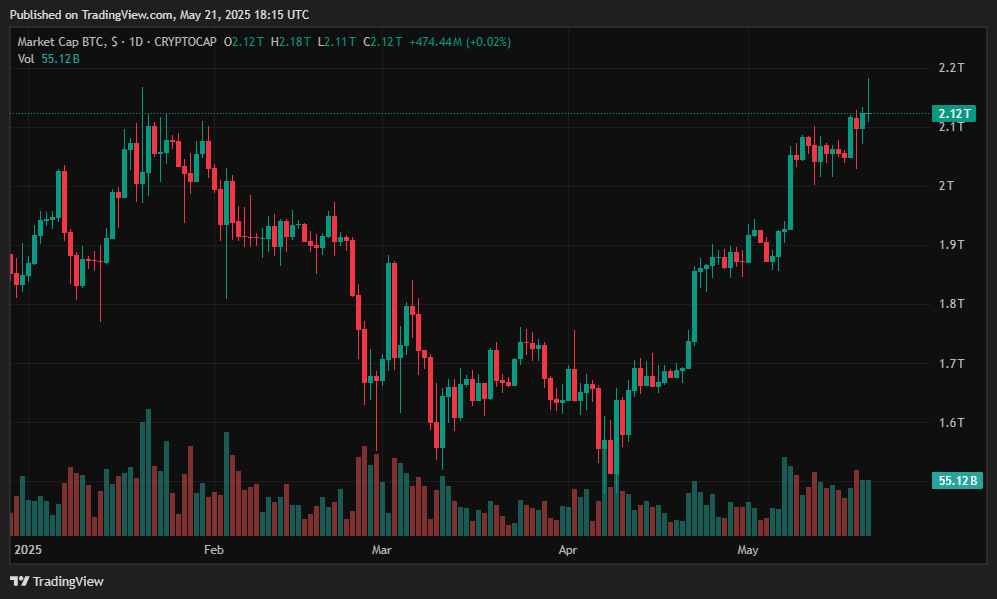

- The global crypto market cap surged by $133 billion in the past 24 hours, reaching $3.53 trillion.

- Bitcoin hit a new all-time high of $109,760, driven by optimism over U.S. crypto regulations and institutional investments.

- Altcoins like Ethereum, Dogecoin, and Cardano also posted significant gains, reflecting broad market enthusiasm.

The cryptocurrency market witnessed a significant surge, adding $133 billion to its total market capitalization within 24 hours, bringing the total to $3.53 trillion. This remarkable growth is attributed to a combination of regulatory optimism, institutional investments, and positive market sentiment.

Bitcoin Reaches $109,760 Amid Regulatory Optimism

Bitcoin (BTC) led the rally, reaching a new all-time high of $109,760 on May 21, 2025. This milestone surpasses its previous peak from January and is fueled by growing optimism over impending U.S. regulations for digital assets. The advancement of the Genius Act, legislation aimed at establishing a regulatory framework for stablecoins, has been a significant driver of investor confidence.

Institutional interest has also played a crucial role. Strategy (formerly MicroStrategy), the largest corporate holder of Bitcoin, recently acquired an additional 7,390 BTC, bringing its total holdings to 576,230 BTC, worth approximately $61 billion. Such corporate investments have bolstered market sentiment and contributed to Bitcoin’s price surge.

Altcoins Follow Suit with Notable Gains

The positive momentum extended beyond Bitcoin, with several major altcoins recording significant gains:

- Ethereum (ETH) rose by 3.8%, trading around $2,487.

- Dogecoin (DOGE) increased by 5.7%, reaching approximately $0.2255.

- Cardano (ADA) climbed by 4.8%, trading near $0.7503.

These gains reflect a broader market enthusiasm and investor confidence in the cryptocurrency sector.

Outlook: Continued Growth Amid Regulatory Developments

Analysts remain optimistic about the cryptocurrency market’s trajectory, citing the potential for further growth as regulatory frameworks become clearer and institutional adoption increases. The ongoing developments in U.S. crypto regulations, particularly concerning stablecoins, are expected to provide a more secure environment for investors and could lead to sustained market expansion.

However, experts caution that while the current rally is promising, the market remains susceptible to volatility. Investors are advised to stay informed about regulatory changes and market trends to navigate the dynamic crypto landscape effectively.