- Germany sold 49,858 BTC in mid-2024 for approximately $2.86 billion, averaging $57,900 per coin.

- By May 2025, those coins would be worth over $5.2 billion, indicating a missed profit of around $2.3 billion.

- This scenario highlights the potential benefits of long-term Bitcoin holding and the risks of premature liquidation.

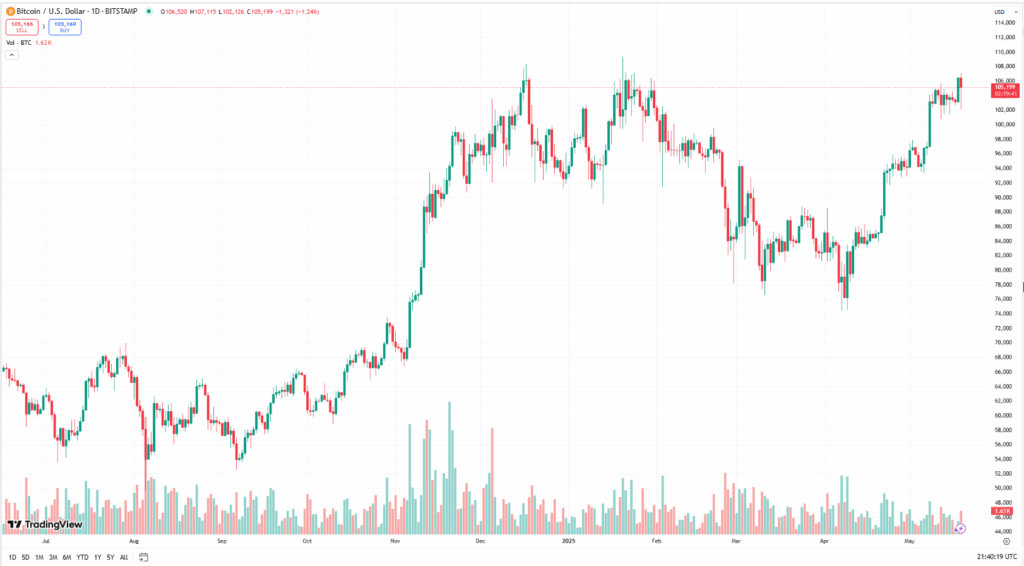

In mid-2024, German authorities sold off 49,858 BTC—seized from the Movie2K piracy case—between June 19 and July 12, netting approximately $2.86 billion at an average price of $57,900 per coin. The sale was conducted across multiple exchanges, including Bitstamp, Kraken, and Coinbase, to mitigate market impact.

The Missed Opportunity

Fast forward to May 2025, and Bitcoin‘s price has surged to over $107,000 and now sits around $105K at the time of writing. The BTC sold by Germany would now be worth approximately $5.2 billion, indicating a missed profit of around $2.3 billion.

Legal Obligations and Market Impact

Under German law, seized assets must be sold if their value fluctuates by more than 10% to prevent potential losses due to volatility. This legal requirement compelled the authorities to liquidate the Bitcoin holdings promptly.

However, the large-scale sale exerted downward pressure on Bitcoin’s price during that period, contributing to a market dip.

Lessons Learned

Germany’s experience underscores the challenges of managing digital assets within rigid legal frameworks. While the sale was legally mandated, the timing resulted in significant missed gains.

For individual investors, this serves as a reminder of Bitcoin’s long-term potential. Holding through volatility, rather than reacting to short-term market movements, can lead to substantial gains.

Conclusion

Germany’s $2.3 billion missed opportunity illustrates the importance of strategic decision-making in asset management. For Bitcoin holders, it reinforces the value of patience and long-term perspective in navigating the cryptocurrency market.