- BNB Breaks Out of Symmetrical Triangle: BNB surged past the $644 resistance level after breaking out of a symmetrical triangle pattern, forming a double-bottom structure with a target of $732 and potential for further gains toward $1,000.

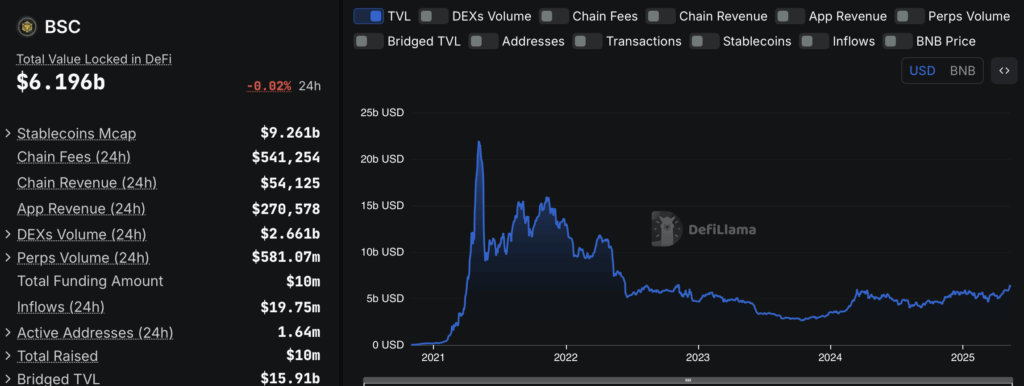

- Binance Chain Fee Reduction Boosts Network Activity: Binance Chain slashed gas fees by 90%, driving Total Value Locked (TVL) to over $8 billion and DEX volumes to a six-week high of $2.12 billion, signaling increased user activity.

- Short Squeeze and Key Resistance Levels: Over $3 million in short positions were liquidated as BNB climbed past $600, intensifying buying pressure. The next key levels to watch are $650 and $700, with potential for a breakout to $732 if momentum holds.

After weeks of flat, sideways trading, BNB is finally making some noise. The token just busted through the upper trendline of a symmetrical triangle pattern on the daily chart, hinting at a potential breakout. And it’s not just the technicals — on-chain data and rising network activity are all pointing in the same direction: up.

Symmetrical Triangle Breakout and Double-Bottom Pattern

BNB’s breakout above the triangle pattern was no fluke. The move was followed by a clean retest, where the old resistance line flipped to support. Now, BNB is testing the $644 resistance area, a key level to watch.

Adding to the bullish setup, a double-bottom pattern has also emerged, with the neckline right around $644. If BNB can clear this level, the projected target sits at approximately $732. A breakout there could open the door for a run toward $1,000, but that’s a big ‘if’ for now.

Technical indicators are backing the bullish outlook. The Awesome Oscillator (AO) has flipped to green bars, and the MACD is showing increasing bullish divergence — both signs that buyers are gaining ground.

Binance Chain Fee Reduction Spurs Network Activity

Meanwhile, a major network development is also in play. Binance Chain just slashed its gas fees from 1 gwei to 0.1 gwei — a 90% reduction. This move, proposed by Binance founder CZ, is already shaking things up.

Following the fee cut, network usage has spiked. Data from BSC Scan and DeFiLlama shows Total Value Locked (TVL) on Binance Chain has surged past $8 billion — the highest since 2024. The lower fees have made it cheaper for users to interact with dApps, driving up activity across the board.

DEX volumes are also climbing, hitting a six-week high of $2.12 billion. This uptick in trading is a clear sign that more traders are flocking to Binance Chain-based platforms, further supporting BNB’s bullish trend.

Short Squeeze Sends Prices Higher

The rally is also catching short sellers off guard. According to Coinglass, over $3 million in short positions were liquidated on May 8 and 9 as BNB’s price pushed past $600.

The squeeze has forced many shorts to cover, adding more buying pressure to the market. Since mid-April, liquidation volumes have been relatively low, suggesting that volatility is easing and market sentiment is stabilizing.

Key Resistance Levels and Path Toward New Highs

BNB is now eyeing a crucial resistance level at $650. If the price can break and hold above this zone, the next target is $700. Beyond that, the double-bottom pattern points to a target around $732.

If the bullish structure holds and volume continues to rise, the push to $1,000 could come into play. But for now, $650 and $700 remain the immediate levels to watch.

At the time of writing, BNB is trading around $650.91, up sharply from its lows in early April. With network activity rising and technicals leaning bullish, the stage could be set for a sustained rally — but only if buyers can maintain control at these key resistance levels.