- SUI’s stablecoin supply just hit a record $746.81M, signaling major liquidity growth—up 99.82% this year.

- Chart patterns like a wedge + positive RSI hint at a potential bullish breakout, especially if SUI clears the $2.90 level.

- A new partnership with Greece’s Stock Exchange adds real-world utility, boosting adoption and long-term price potential.

SUI hasn’t exactly been cruising lately—market volatility’s kept the token from gaining strong momentum. But under the surface, things are looking… interesting. Between a spike in stablecoin supply and some big-name partnerships, SUI might just be warming up for its next move.

Stablecoin Supply Hits All-Time High—Liquidity On the Rise

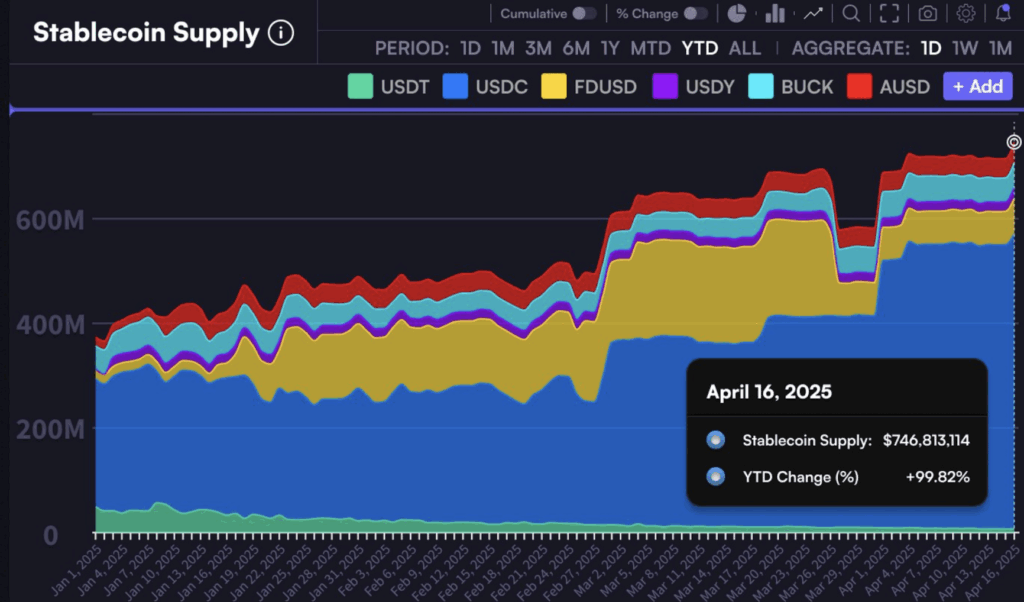

So here’s a big one: the SUI blockchain just logged a record-breaking stablecoin supply, hitting $746.81 million. That’s a massive deal. Year-to-date, that’s a 99.82% increase, according to data shared by Torero Romero on X.

Now, why does that matter? More stablecoins on the network = more liquidity. And more liquidity usually leads to smoother transactions, more user activity, and—if things go well—stronger price performance. Basically, it helps the whole ecosystem breathe a bit easier.

Some market watchers say this kind of growth in stablecoin supply could be a key factor behind SUI’s long-term value. It’s like giving the network extra fuel to scale up dApps, smart contracts, and attract bigger players.

Wedge Pattern Hints at Breakout—Up or Down?

On the charts, SUI’s showing signs of pressure building up. A wedge pattern is forming—and if you’ve been around the crypto block, you know these usually end with a bang.

Even after a steep 60% pullback, SUI’s holding the $2 line pretty well. That wedge is getting tighter, and sooner or later, something’s gotta give.

The Relative Strength Index (RSI) is rising too—pulling away from oversold territory. Bearish momentum’s cooling off, and that might be the cue bulls have been waiting for. A jump above $3? Could be on the table.

Despite a Dip, SUI Stays Strong Above $2

Yes, SUI’s seen better days—it’s down 7.38% for the month—but it’s still clinging to that key $2 level. That’s a solid psychological support, and so far, it’s holding.

After four red candles in a row, a small bullish one just popped up. Nothing wild, but it’s the kind of early signal that gets technical analysts talking. If SUI manages to clear the $2.90 resistance level, that could open the door to $5 territory, according to CryptoWZRD.

Greece Partnership Adds a Real-World Boost

And here’s the kicker—SUI just teamed up with Greece’s National Stock Exchange. Yeah, that’s not your average DeFi collab. The two plan to build out a blockchain-powered fundraising system using SUI’s infrastructure.

That kind of real-world utility? Huge. It doesn’t just prove SUI’s tech works—it builds trust with traditional financial players. And more trust means more adoption, which could drive up demand (and price).

Final Thoughts

At the time of writing, SUI’s trading at $2.14, up just under 1% on the day. The token briefly tested $2.12 before bouncing around a bit—pretty standard consolidation stuff.

But when you put it all together—rising liquidity, technical setups, and high-profile partnerships—SUI might just be loading the slingshot. Whether it fires straight to $5 or takes its time, momentum is starting to stir.