- Over $120 million in liquidity has flowed into Solana from other chains like Ethereum and Arbitrum, signaling renewed user confidence and boosting activity in Solana-based memecoins.

- Technical indicators show growing bullish momentum, with rising OBV and RSI flipping positive — but Solana must break the $143 resistance level to confirm a full trend reversal.

- Key zones to watch include $150–$160 (potential breakout target) and $123 (major support and liquidation cluster), as traders eye a breakout or possible retrace.

Solana’s been quietly heating up behind the scenes. Over the past month, more than $120 million in liquidity has been bridged into the network — and that’s no small signal. Users are clearly showing some renewed trust in SOL, pulling funds in from rival chains.

Where’s it all coming from? The usual suspects:

- $41.5M from Ethereum

- $37.3M from Arbitrum

The rest trickled in from other networks like Base and BNB Chain. And the result? Memecoins like POPCAT started ripping from the recent lows. Meanwhile, Solana itself is trying to flip the script on its still-bearish daily structure.

The $143 Level Could Be the Game-Changer

Let’s talk structure. On the 1-day chart, SOL is still technically in a downtrend. That’s because it hasn’t managed to crack the last lower high around $143. So for now, bears are technically still in the driver’s seat.

But zoom in a bit? And it’s a different vibe.

Since pushing past $120, Solana’s been showing real strength on the lower timeframes. Volume’s climbing. OBV (On-Balance Volume) has pushed past its March highs and is heading straight for January’s peak — that’s real buying pressure, not just noise.

Even the RSI has flipped 50 into support — a key sign momentum is shifting bullish.

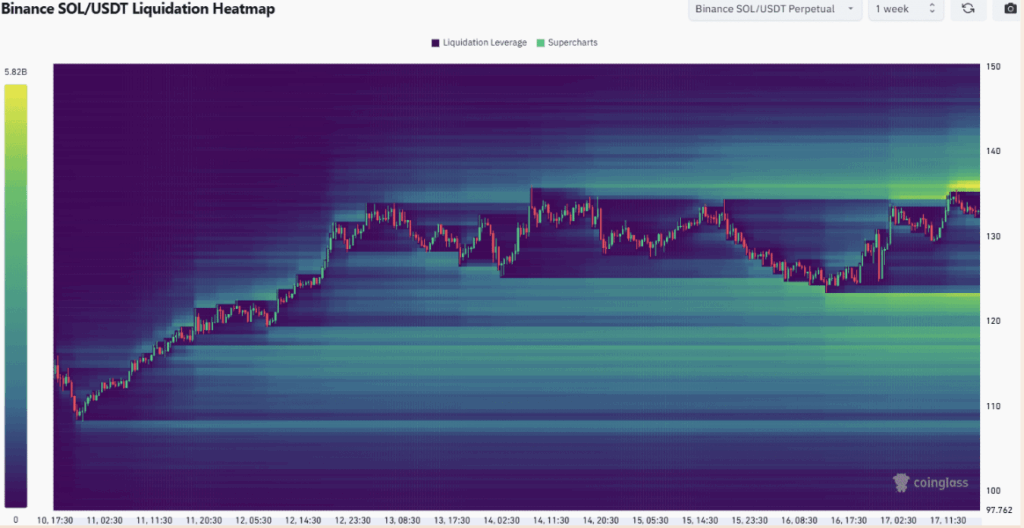

Liquidation Zones Suggest $150–$160 Could Be in Play

According to Coinglass data, there’s a dense liquidation cluster between $150 and $160, which could act like a magnet for price if this breakout holds.

But we’re not there yet. The $140–$143 zone still needs to be conquered first — only about 6% away, but big psychologically and structurally.

On the flip side, if Solana loses steam and dips, keep your eyes on the $123 zone. That level’s loaded with nearly $5 billion in liquidations, making it a possible bounce zone if the price retraces.

It’s also the lower bound of what some are calling the current accumulation range — between $120 and $130 — a level that’s drawing plenty of buyer interest.

Final Thoughts: SOL’s Momentum Is Building — But It Needs That Breakout

Solana’s got serious inflows, strong volume, and memecoin hype fueling its short-term surge — but without clearing that stubborn $143 level, it’s still stuck under bear control on the bigger picture.

If it breaks it, though? The door’s wide open to $150+, and maybe beyond.

For now, traders are watching that zone like hawks. One clean move above, and this quiet accumulation phase might just turn into Solana’s next big run.