- BNB struggles to reclaim previous highs as resistance remains strong.

- The price structure forms a zigzag pattern, hinting at possible trend shifts.

- A key support zone has emerged, but further confirmation is needed.

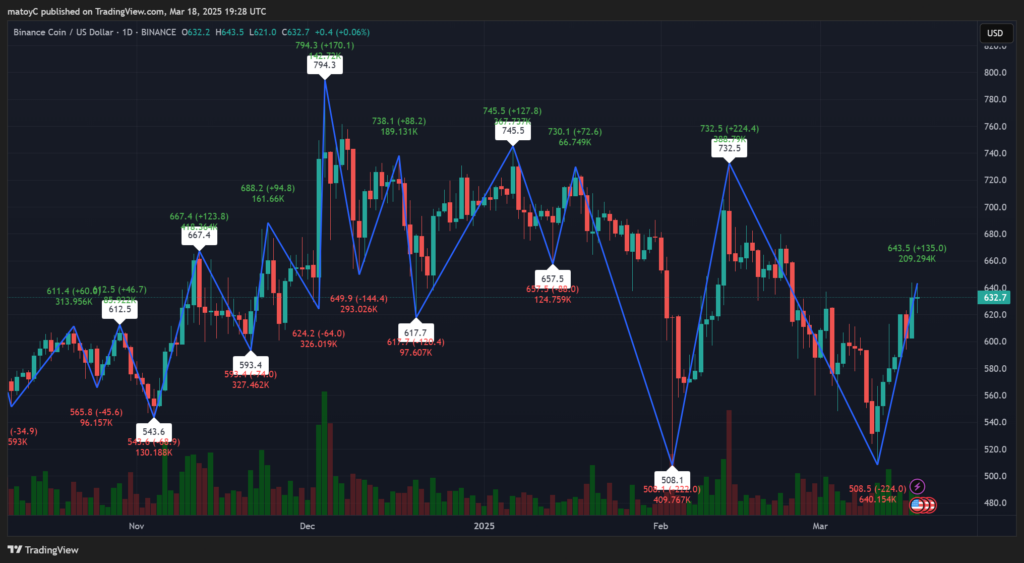

BNB has repeatedly tested the upper resistance zone but has yet to break through convincingly. The asset climbed to around 794 before sellers stepped in, pushing prices back down. This level has acted as a ceiling for previous rally attempts, creating a tough challenge for bulls. Unless BNB can clear this area with strong momentum, further pullbacks remain a real possibility.

A pattern of lower highs has been forming, which could indicate waning bullish strength. Even when the price attempted a recovery, sellers quickly regained control at critical resistance zones. Without a breakout above this region, BNB risks sliding back to lower support levels, making the next few moves crucial for defining the broader trend.

Support Zones Holding—For Now

BNB recently tested a support zone near the 508 level, which previously acted as a base for upward moves. Buyers stepped in, pushing prices higher from this point, signaling strong demand. However, this support level has already been tested multiple times, raising the question of whether it will continue to hold if another retest occurs.

If BNB fails to sustain above this range, the next significant support area lies further down, potentially leading to a deeper correction. But if buyers successfully defend this level again, a short-term rally could be in play, targeting key resistance points once more. Watching how the price reacts to this support level in the coming sessions will offer insight into the asset’s next direction.

What’s Next for BNB?

With BNB consolidating within a defined range, traders are looking for signals of the next major move. A confirmed breakout above resistance could ignite fresh buying interest, with a potential climb toward the next supply zone. However, failure to hold key support may lead to further downside pressure, particularly if bearish momentum gains traction.

The overall pattern suggests a battle between bulls and bears, with no clear winner just yet. If BNB can reclaim lost ground and push past its recent highs, a renewed uptrend may be on the horizon. On the other hand, breaking below its current support could spell trouble, leading to extended losses before any potential recovery.

The Origins of BNB

Binance Coin (BNB) was initially launched in 2017 as part of the Binance exchange ecosystem. It started as an ERC-20 token before migrating to Binance Chain, where it plays a central role in transaction fees, staking, and other use cases. Over time, BNB has expanded beyond Binance, becoming a widely used asset in the broader crypto space. Whether it’s powering DeFi applications or facilitating trading discounts, BNB remains one of the most influential utility tokens in the market.