Bitcoin hasn’t fared well as a hedge against inflation. The big crypto is down more than 70% from its November peak of around $69,000, giving the case for Bitcoin as a hedge against inflation a severe blow.

Last week, the U.S. The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 8.2% in the previous 12 months, with core CPI coming in at 6.6%. CPI is not slowing at the rate consumers expected and is still far from where government officials want it to be. Therefore, there is no doubt that inflation will remain high and markets will struggle. As a result, it is causing investors to drop risk-on assets.

Markets responded to the CPI reading with extreme volatility, with massive sell-offs in all risk assets that saw the prices of equities, metal, and digital assets fall. Following the CPI report’s release, as had been predicted, Bitcoin dipped to hit $17,985, marking the lowest score since September 21.

However, the flagship crypto has managed to ward off the fully-fledged CPI incursion and recover above the $19,000 level. It is still slightly above where it was before the CPI reading on Thursday. This raises the question of whether the most valuable crypto by market capitalization is indeed an inflation hedge. Most Bitcoin maximalists think so, and here is why.

Bitcoin Has Been Front-running CPI Readings

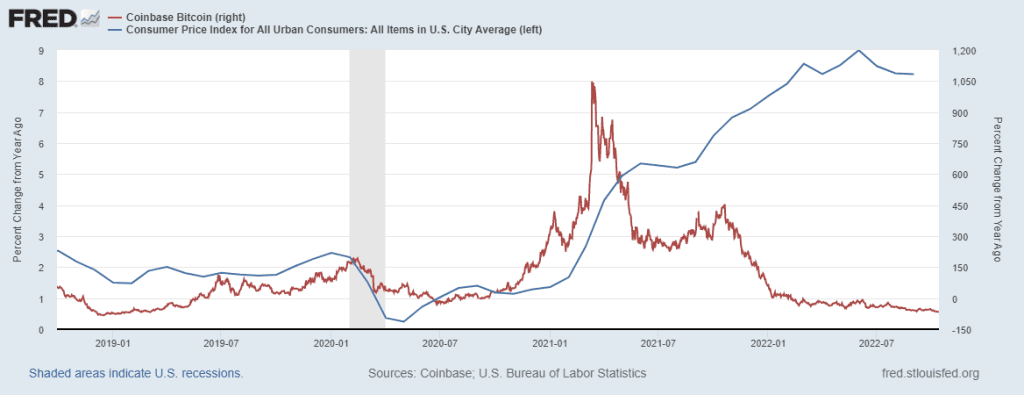

Since the market is forward-looking, it would be reasonable to give Bitcoin some credit for tailgating the high CPI readings over the past 18 months. The chart below shows the year-on-year change in CPI with that of Bitcoin. The chart reveals that the bellwether cryptocurrency front ran the elevated CPI rates for the last one and a half years, indicating that it is indeed a hedge against inflation.

Bitcoin has been labeled a purely speculative asset with no intrinsic value, utility, or future. There have been many phrases saying “Bitcoin is dead” every time a bubble pops. However, the big crypto is still here, and every cycle has seen BTC prices produce a higher high and a high low, which is a bullish technical signal. Taking this much more comprehensive view of Bitcoin’s history, it can be deduced that it serves as a hedge against inflation.

It’s all In The Code

One characteristic that makes Bitcoin a possible hedge against inflation is its limited supply. Bitcoin’s code is programmed to fix its total supply at 21 million BTC. About 19 million have already been mined. In addition, the 21 million coins were programmed to be released following a specific schedule where fewer and fewer bitcoins enter circulation every four years. A four-year cycle is referred to as halving.

Bitcoin miners are rewarded for successfully verifying (“mining”) transactions of the next block on Bitcoin’s blockchain. In the beginning, the miners were rewarded with 50 BTC. Nearly four years later, the earnings were 25 BTC, half of what they received in the previous cycle. Today, miners earn just 6.25 BTC. When the next halving occurs in early2024, that reward will dwindle to 3.125 BTC.

A fixed supply means that new bitcoins cannot enter circulation once every coin is mined, thus removing the risk of inflation. Contrastingly, a country like the United States can increase the supply of the U.S. dollar by spending and buying government bonds to lower interest rates and reduce the dollar’s spending power. This is referred to as quantitative easing.

Since the 2008/2009 financial crisis, the U.S. federal reserve’s balance sheet has expanded by more than 300%. While advocates of quantitative easing view it as a necessary sacrifice to ensure that businesses and families could stay afloat through times of economic hardships, it didn’t come without consequences, and it has unintentionally caused inflation.

Bitcoin Is Behaving More Like Gold

Although markets worldwide have been adversely affected by inflation, it is evident that Bitcoin is performing just as it was designed to, even with its recent slump in price. The pioneer cryptocurrency still holds above $19,000 at the time of writing, when the macro conditions would suggest that it would have fallen hard after the recent CPI readings.

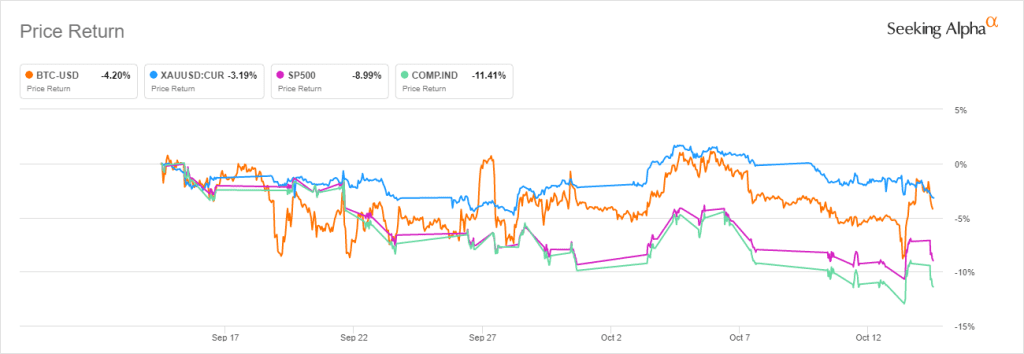

Moreover, Bitcoin has been behaving more like Gold than equities over the last month, as seen from the chart below.

It is safe to think Bitcoin has started to anticipate a policy change. Gold, just like Bitcoin, has also front-ran the CPI inflation for the last one and a half years and has shown poor performance since March this year.

In a nutshell, Bitcoin’s inherent characteristics help drive its long-term value. When considering the Fed’s recent approach to monetary policy, some of the main factors behind BTC’s creation become more obvious: to sidestep currency debasement and ensure your money holds its value.