- Bitcoin surged toward $94,000, closing key price gaps and signaling bullish momentum.

- A newly formed CME gap between $84,650 and $94,000 introduces market uncertainty.

- Trump’s Bitcoin Reserve plan has fueled optimism, with analysts predicting potential new highs.

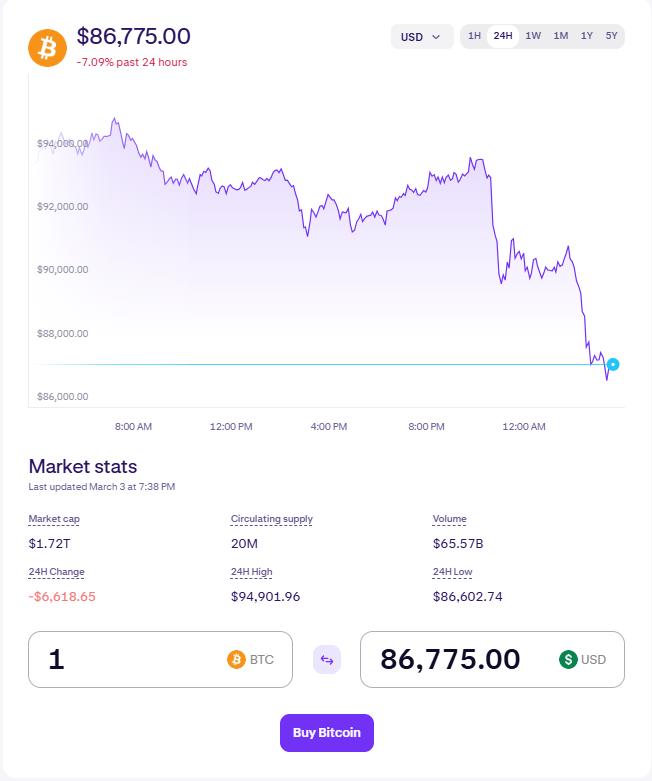

After a wild stretch of volatility, Bitcoin seems to have found its rhythm again, surging back toward the $94,000 mark. This renewed push upward has allowed BTC to close key price gaps, signaling a potentially bullish outlook.

CME Gap Finally Closes as Bitcoin Rebounds

Bitcoin’s recent price action has helped it reclaim critical resistance levels that had previously slowed its momentum. Market analyst Rekt Capital highlighted that BTC successfully closed a major price gap left by last week’s sharp decline—an event that traders watch closely for signs of a potential market shift.

According to Rekt Capital, Bitcoin has now officially filled its CME price gap between $92,800 and $94,000. This development is often seen as a shift in sentiment, possibly indicating that BTC has bottomed out and is preparing for another leg up.

Biggest CME Gap Closure in Bitcoin’s History

While the closure of this gap is confirmed, Rekt Capital noted that it won’t be fully reflected on charts until later today. Interestingly, Bitcoin also narrowed another CME gap in the $78,000–$80,700 range, making this one of the largest CME gap closures in BTC’s history.

Now, Bitcoin sits at a crossroads—either it maintains its newfound momentum and pushes higher, or it enters a consolidation phase. One thing is certain: traders are watching closely.

New Gap Forms as Bitcoin Holds Strong

Despite closing its recent CME gap, Bitcoin has now formed a fresh one between $84,650 and $94,000. This introduces an element of uncertainty, as the market waits to see whether BTC will continue its push or correct lower to fill this newly created gap.

BTC Pullbacks: A Buying Opportunity?

Bitcoin’s recent dip may have rattled some investors, but according to crypto analyst Miles Deutscher, pullbacks like this present strong buying opportunities.

Deutscher pointed out that BTC’s 28.5% drawdown from peak to trough was one of the largest in this market cycle. However, he also noted that historical trends suggest dips between 20% and 30% have often led to strong rebounds.

Trump’s Bitcoin Reserve Plan Sparks Market Optimism

Adding to the bullish sentiment, U.S. President Donald Trump recently reiterated his plan for a national Bitcoin Reserve, fueling excitement across the crypto community. This renewed optimism has seen investors scoop up more BTC, pushing its price higher.

Many analysts believe that if Trump’s strategic Bitcoin reserve comes to fruition, BTC could soar to new all-time highs. For now, all eyes remain on Bitcoin’s next move—whether it’s another leg up or a period of consolidation before the next big breakout.