- Bitcoin saw a 100x-long liquidation event near $94,200, triggering a rebound toward $98,000.

- Over $45 million in BTC liquidations occurred in the last 24 hours, highlighting leveraged trading risks.

- Analysts warn that a drop below $99,000 could trigger $1.3 billion in further liquidations.

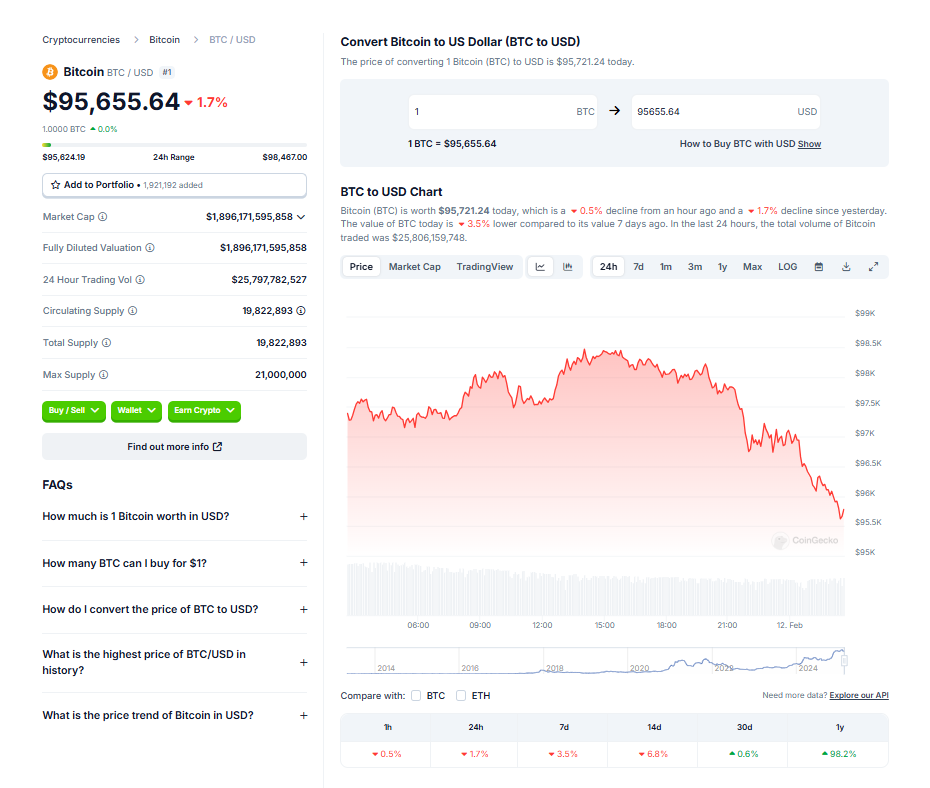

Bitcoin’s liquidation heatmap has revealed a wild 100x-long liquidation event in the last 48 hours. According to a tweet from Bitcoinsensus, a major liquidity grab occurred near $94,200, sparking a rebound that pushed BTC back up toward $98,000. However, resistance is already forming around that level, keeping traders on edge.

Liquidations happen when leveraged traders can’t meet their margin requirements, forcing exchanges to automatically close their positions. High-leverage trades—like those infamous 100x longs—are particularly risky. They become easy targets for price manipulation, leading to abrupt price swings that often catch over-leveraged traders off guard.

CoinGlass’s heatmap highlights zones of intense liquidation activity, shedding light on key price levels where liquidity is clustered. Recent data indicates that BTC’s liquidation zones are centered around $94,400 to $95,500, suggesting that large players may be engineering these moves to capture liquidity before prices either bounce back or drop further.

Bitcoin Liquidations Cross $45 Million Mark

The numbers are staggering. Over the past 24 hours, 120,563 traders were liquidated, bringing total liquidations to $247.08 million. Bitcoin alone accounted for $45 million of this, with long positions losing $28.95 million and shorts taking a $14.81 million hit. These figures highlight the inherent risks of leveraged trading, especially in a volatile market like Bitcoin.

Despite the chaos, BTC has remained relatively stable, holding above critical liquidity zones. As of now, Bitcoin is trading around $97,311, up a modest 0.19% in the last 24 hours. Analysts view this stability as a sign of strong market support, which could potentially lead to a bullish breakout. However, there’s a catch: if BTC falls below $99,000, it could trigger an additional $1.3 billion in liquidations—setting off another wave of selling pressure.

What’s Next?

Traders are watching every move. Bitcoin’s elevated volatility has put the entire market on high alert. Some are optimistic, hoping the stability above liquidity zones will spark upward momentum. Others warn that another sharp drop could escalate liquidations, worsening market conditions.

In these turbulent waters, tools like liquidation heatmaps are invaluable. They provide insight into where liquidity is concentrated and help traders avoid—or exploit—potential traps. With BTC hanging around crucial price points, its next moves could ripple through the broader cryptocurrency landscape, keeping everyone guessing.

For now, all eyes are on Bitcoin’s price action. Will it hold the line or break through resistance? The answer may come sooner than we think.