- MicroStrategy buys $243M worth of Bitcoin, raising its total to 450,000 BTC.

- The company sold 710,425 shares to fund purchases, averaging $95,972 per BTC.

- Saylor’s ambitious 21/21 plan aims for $42B in Bitcoin acquisitions.

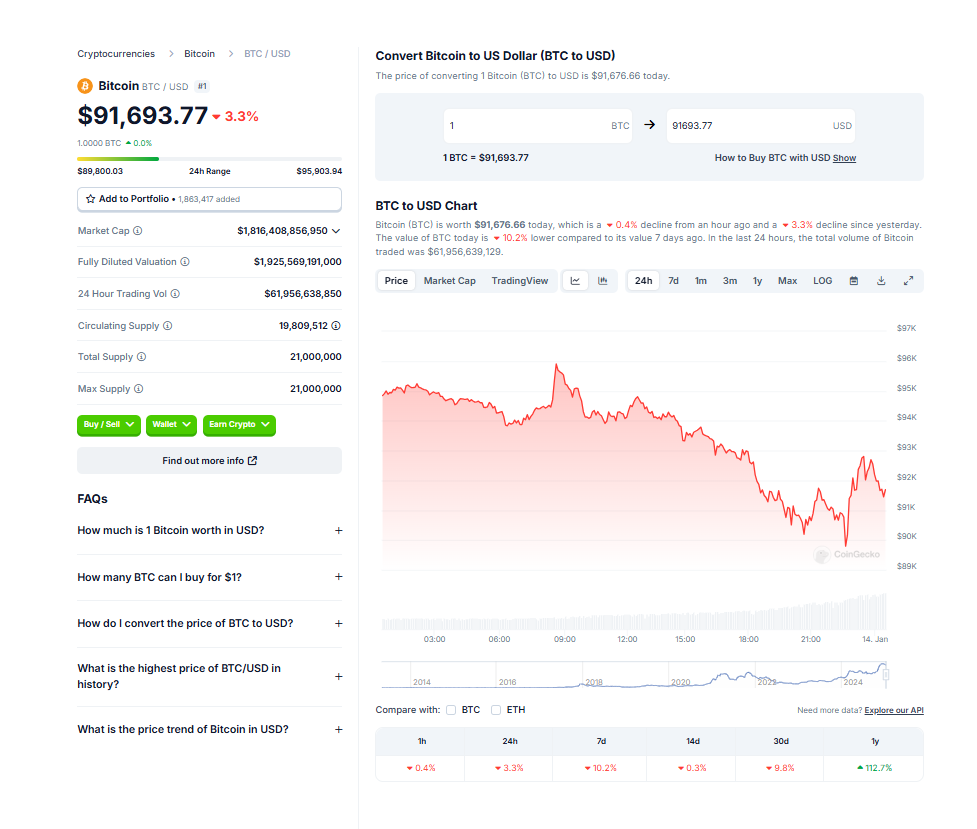

Michael Saylor’s MicroStrategy is back at it again, making headlines with yet another massive Bitcoin purchase. This time, the business intelligence firm spent $243 million, adding 2,530 BTC to its already impressive holdings. With this latest acquisition, the company’s total stash has surpassed 450,000 BTC, cementing its position as one of the largest corporate holders of the cryptocurrency.

Since August 2020, MicroStrategy has been relentless in its Bitcoin buying strategy. And honestly? It’s paid off. Last year, during Bitcoin’s monumental rise, MicroStrategy’s stock (MSTR) soared to an all-time high of $473 in November. With BTC primed for another strong performance in 2025, the company shows no signs of slowing down its appetite for the world’s leading digital asset.

Funding the Dream: Share Sales Fuel Bitcoin Buys

To fund this latest purchase, MicroStrategy sold 710,425 shares, raising just enough to cover the acquisition. The average price paid for the new Bitcoin was $95,972 per BTC—a hefty sum, but one that aligns with the company’s long-term vision.

Michael Saylor’s ambitions don’t stop here. Under the firm’s 21/21 plan, MicroStrategy has $6.53 billion worth of shares still available for sale. The goal? Raise $21 billion through equity offerings and another $21 billion from fixed-income securities. If successful, the company aims to invest a jaw-dropping $42 billion into Bitcoin acquisitions, solidifying its status as one of the most bullish players in the crypto space.

The Bigger Picture: Bitcoin and 2025’s Potential

2025 is shaping up to be another pivotal year for Bitcoin and the broader crypto industry. After hitting a six-figure price in 2024 and witnessing the approval of crypto-based ETFs, Bitcoin’s momentum shows no signs of slowing. For MicroStrategy, that momentum represents opportunity—an opportunity to double down on its conviction in Bitcoin’s long-term value.

With Saylor at the helm, MicroStrategy’s strategy is as clear as ever: Buy more Bitcoin, no matter the market conditions. It’s a bold move, and whether it pays off remains to be seen, but one thing’s for sure—this is a company that’s fully committed to the digital asset revolution.