- Tether, the issuer of the $140 billion stablecoin USDT, increased its Bitcoin holdings by $700 million

- Tether added 7,629 Bitcoin (BTC) worth approximately $700 million to its corporate crypto reserve address on December 30, 2024

- With this addition, Tether now holds 82,983 BTC worth $7.7 billion at current Bitcoin prices

In a significant move, Tether, the entity behind the leading stablecoin USDT with a market cap of $140 billion, has amplified its Bitcoin holdings by a staggering $700 million. This development is a testament to the growing prominence of Bitcoin in the financial reserves of major corporations.

Tether’s Substantial Addition to Bitcoin Reserves

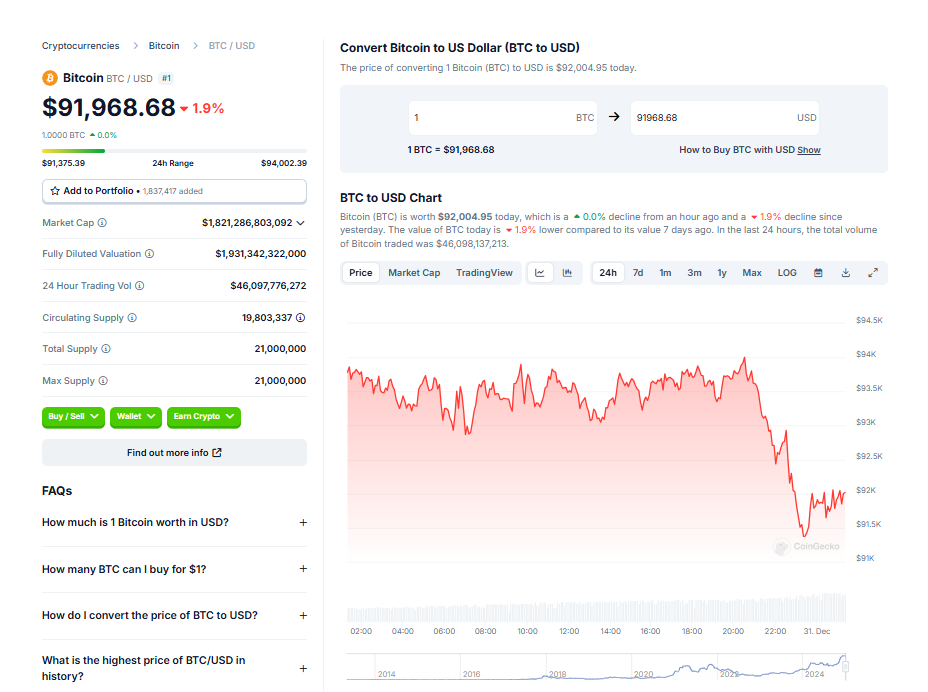

Tether has made a notable addition of 7,629 Bitcoins, valued at approximately $700 million, to its corporate cryptocurrency reserve address on December 30, 2024. This information is based on transaction data from on-chain insight provider, Arkham. The Tether stablecoin operator now possesses an impressive 82,983 BTC, worth $7.7 billion at current Bitcoin prices of $92,300.

Title for Section 2: Tether’s Diversification Strategy and Future Plans

Back in May 2023, Tether made public its strategy of diversifying its portfolio and revenue streams by investing in Bitcoin. The company has been acquiring Bitcoin both through purchases and its own mining operations. However, it remains unclear if the recent addition of Bitcoin was a result of direct purchasing or mining. Tether’s CEO Paolo Ardoino has been vocal about his ambitions of venturing into other technological sectors such as artificial intelligence and energy. Tether is expected to realize some of its artificial intelligence plans by 2025.

Other Companies Increasing Bitcoin Reserves

Tether is not alone in the trend of increasing Bitcoin reserves. Other companies savvy with cryptocurrency, like MicroStrategy, have also been bolstering their Bitcoin holdings. MicroStrategy recently added $209 million worth of Bitcoin to its corporate treasury.

Conclusion

The move by Tether to significantly boost its Bitcoin reserves underscores the growing trust and acceptance of Bitcoin as a valuable asset. Other companies following suit further confirms this trend. As more corporations diversify their holdings with cryptocurrency, it will be interesting to see how this impacts the overall cryptocurrency market and its acceptance in mainstream finance.