- Bitcoin remained flat on Friday amid soft year-end trading volumes, while investors stayed cautious about the prospect of cryptocurrencies after the Federal Reserve turned hawkish last week.

- Bitcoin was set to fall for the second consecutive week as a rally induced by Donald Trump’s presidential election victory lost steam after the Fed meeting hindered.

- Other cryptocurrencies rose slightly on Friday but were set for weekly losses as demand for speculative assets remained subdued after the hawkish Fed spurred liquidity concerns.

As the year draws to a close, the cryptocurrency market continues to exhibit its volatile nature. Amid soft trading volumes, the performance of Bitcoin remains relatively flat, with investors treading cautiously following the Federal Reserve‘s recent shift to a more hawkish stance.

“Bitcoin’s Unsteady Climb: A Daily Analysis”

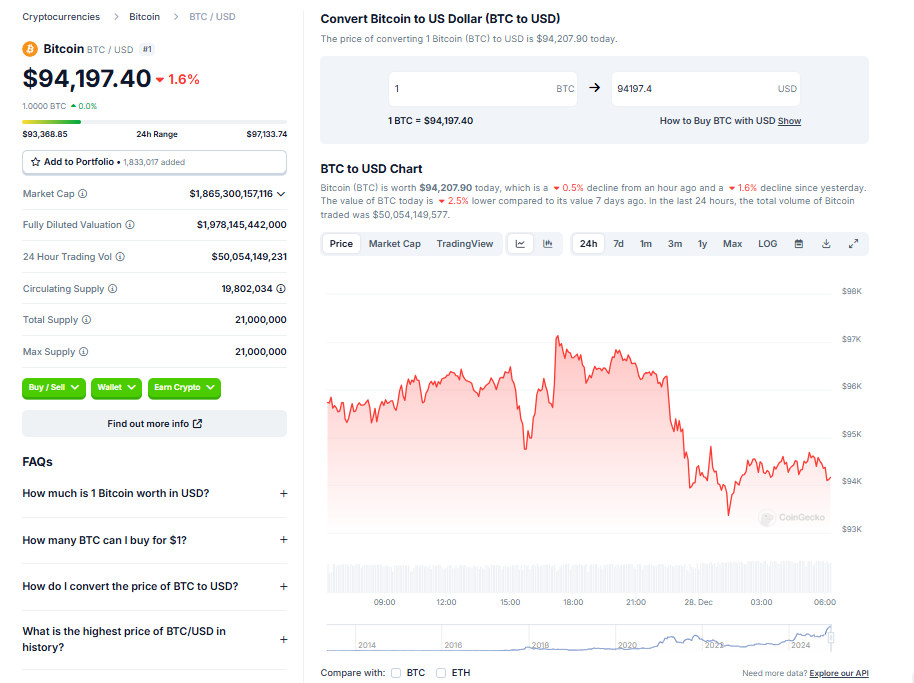

On Friday, Bitcoin experienced a 1.7% decrease, settling at $94,488.7 by 3:55 p.m. ET (20:55 GMT). This came after the popular cryptocurrency had earlier reached a peak of $97,000. The previous day, Bitcoin’s performance was influenced by a misleading data glitch on TradingView‘s platform. This anomaly, which falsely demonstrated Bitcoin’s dominance of the total crypto market cap as plummeting to 0%, led to a reactionary sell-off that drove Bitcoin’s price down to near $95,000. Even after the error was corrected, the market felt the aftershocks, with CoinGlass data indicating that approximately $33 million in Bitcoin long positions were liquidated within four hours.

“Two Weeks of Decline: The Impact of External Factors on Bitcoin”

Bitcoin appears set to suffer for the second consecutive week. A rally sparked by Donald Trump‘s presidential election victory began to falter following the Federal Reserve’s recent meeting. The rally had previously driven prices to an all-time high of $108,244.9, but since then, the value has decreased due to profit-taking and macroeconomic pressures stemming from the Fed’s rate outlook. The central bank’s decision to lower rates by 25 basis points, while signaling only two rate cuts for the upcoming year (as opposed to the previously expected four) prompted investors to reassess their positions in speculative assets such as Bitcoin, further contributing to its price decline.

“The State of Altcoins: Limited Gains Amidst Market Uncertainty”

Meanwhile, other cryptocurrencies saw modest gains on Friday, but still faced weekly losses. This was due to subdued demand for speculative assets, driven by liquidity concerns following hawkish sentiments from the Federal Reserve. Ether, the world’s second-largest cryptocurrency, observed a 0.4% increase, settling at $3,344.52 after a near 5% drop the previous day. Similarly, XRP, the third-largest cryptocurrency, increased by 0.7% to $2.1677, but was projected to fall nearly 4% over the week. Other altcoins like Solana, Polygon, and Cardano witnessed mixed performances, while Dogecoin, a popular meme token, added 0.40%

Conclusion

As we observe the ebb and flow of the cryptocurrency market, it’s clear that external factors such as political events and macroeconomic policies significantly impact market dynamics. As the year ends, investors and market watchers remain vigilant, closely monitoring these unpredictable market trends.