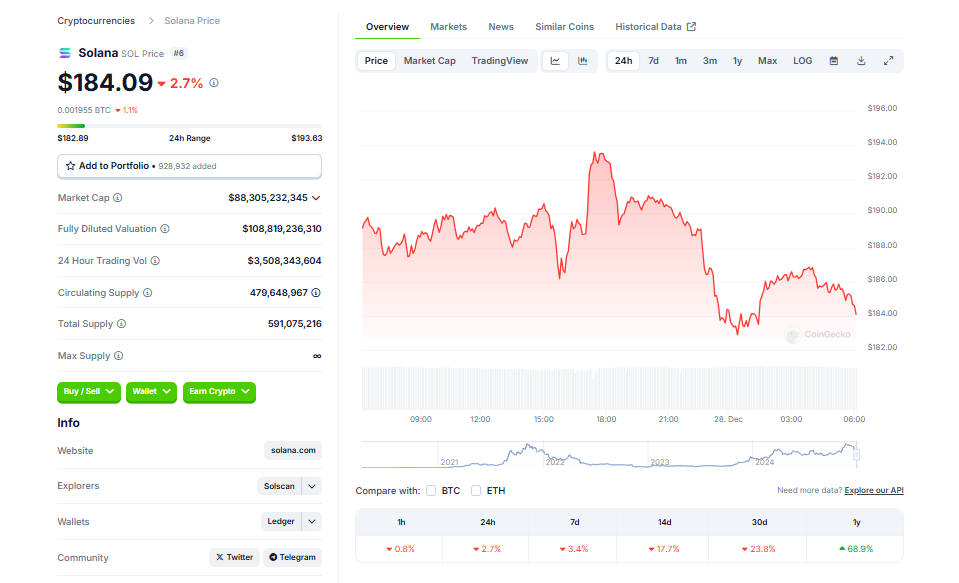

- Solana’s native token SOL failed to sustain levels above $200 after multiple rejections, underperforming the broader cryptocurrency market with a 51% correction.

- Solana’s on-chain network volumes dropped by 30% over seven days, and activity for DApps like Orca, Phoenix, and Raydium declined significantly, raising concerns about potential further price declines.

- • Despite the price decline, the derivatives market has shown resilience, with the SOL futures annualized premium remaining at a neutral-to-bullish level of around 10%, suggesting limited downside risk below $180.

Solana’s native token, SOL, has been facing numerous challenges recently, including a significant drop in on-chain network volumes and a declining interest in memecoins. Despite these issues, some data suggest that the coin might still hold its value above $180. This article delves into the factors contributing to Solana’s current situation and provides insights from various market data sources.

The Market Performance of SOL

Solana (SOL) has been struggling to maintain its price above the $200 mark, facing multiple rejections between December 25 and 26. This downtrend aligns with the broader cryptocurrency market, which experienced a 3.5% decline over two days, ending on December 27. SOL, however, underperformed with a 5.1% correction, causing traders to worry about potential further price drops. A significant concern is the 30% drop in Solana’s on-chain network volumes over the past week.

Comparison with Other Blockchains

Compared to other blockchains, Solana has recorded the worst performance among the top 10, despite securing the second place in weekly volumes with $20.9 billion. For instance, Ethereum‘s on-chain volumes fell by only 15%, and Sui experienced an 8% decline. When considering layer-2 solutions like Arbitrum, Optimism, Base, and Polygon, Ethereum’s ecosystem solidifies its lead even further.

The Impact of Memecoins on Solana

Memecoins on Solana, which have been a significant attraction for new users, have shown disappointing 30-day performance. For example, Popcat fell 42%, Dogwifhat (WIF) declined 40%, and BONK dropped 25%. This declining interest in memecoins is a considerable concern, as on-chain activity, including token launches, staking, and trading, is a crucial driver of demand for SOL.

Total Deposits on Solana Network

Despite the challenges, the total deposits on the Solana network, as measured by total value locked (TVL), reached a two-year high of 44 million SOL. This 16% monthly increase was primarily driven by platforms like Binance Staked SOL, Jupiter Drift, and Orca.

SOL Futures Signaling Resilience

Despite SOL’s price decline, the derivatives market data indicates resilience, suggesting that professional traders have not yet turned bearish on SOL. For instance, even though it’s lower than the 20% premium recorded on December 18, the current 10% premium is at the threshold of neutral-to-bullish sentiment.

Retail Traders Sentiment and SOL Perpetual Futures

To understand retail traders’ sentiment, it’s essential to analyze SOL perpetual futures. Over the past month, the SOL funding rate has remained below 0.015, indicating a neutral market. However, on December 27, the rate turned negative, signaling reduced demand from leveraged longs (buyers).

Conclusion

The sharp drop in Solana’s on-chain activity and declining interest in memecoins suggest a moderately bearish outlook for SOL’s short-term price. However, derivatives data indicate that big players and market makers remain optimistic, suggesting limited downside risk below $180. Nevertheless, the situation remains volatile, and further developments need to be closely monitored.