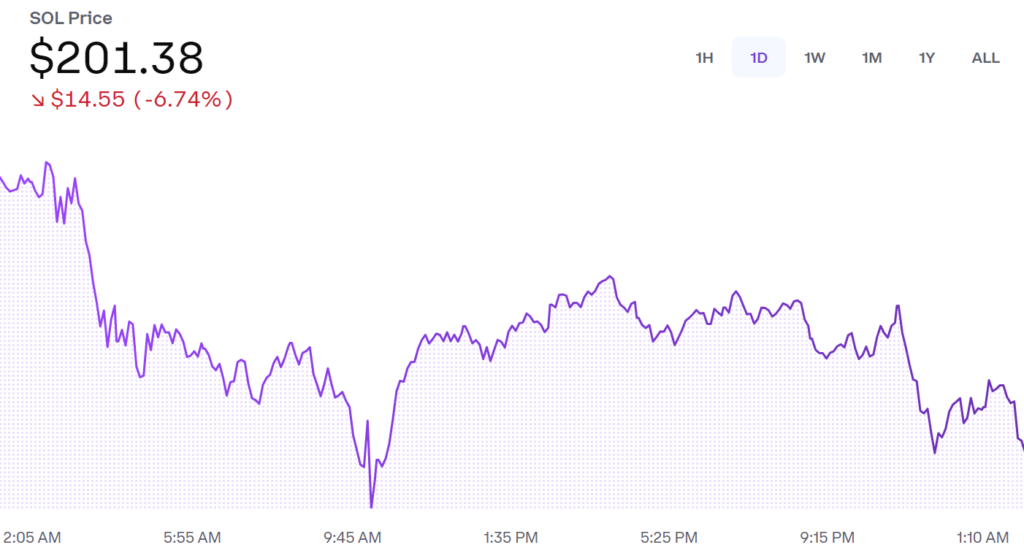

- Solana closed the day at $201.38, marking a 6.74% decrease.

- Selling pressure drove the price below key support levels, sparking cautious market sentiment.

- Traders focus on $200 as a critical psychological and technical support level.

Solana experienced a notable decline on December 19, 2024, with its value dropping by 6.74% to close at $201.38. The asset opened the day in Coinbase at $215.93 but faced significant downward momentum throughout the trading session, reflecting broader market volatility and a cautious sentiment among investors.

After an initial attempt to stabilize above the $210 level, selling activity accelerated in the morning, pushing the price below $205. By mid-afternoon, Solana briefly dipped under the $200 threshold before recovering slightly. Despite minor rebounds, the cryptocurrency struggled to regain its footing, ending the day near its session low.

Market Sentiment and Price Drivers

The decline in Solana’s price can be attributed to heightened uncertainty in the cryptocurrency market. Analysts point to macroeconomic challenges, including interest rate adjustments and regulatory developments, as contributors to the current bearish environment. Additionally, Solana’s trading volumes have seen a downturn, signaling reduced participation and growing caution among investors.

From a technical perspective, the $200 mark has emerged as a crucial psychological support level for Solana. Should this level fail to hold, the next support may lie around $190, with $220 acting as the nearest resistance. The Relative Strength Index (RSI) indicates that Solana is approaching oversold conditions, suggesting potential for a short-term bounce.

The blockchain’s ongoing development and its ecosystem’s expansion remain fundamental strengths. However, market sentiment continues to dominate short-term price movements, as traders react to external factors rather than project-specific updates.

Outlook and Key Levels to Watch

Solana’s ability to maintain its price above $200 will likely determine its immediate trajectory. If support holds, the asset could attempt a recovery toward $220 or higher, providing a potential opportunity for buyers to re-enter the market. On the downside, a sustained break below $200 could open the door to further declines, testing lower support levels.

Traders and investors are keeping a close eye on macroeconomic trends and market liquidity, which are expected to play a critical role in shaping Solana’s performance in the coming days. The cryptocurrency remains a significant player in the decentralized finance and NFT spaces, and its long-term potential continues to attract interest despite current market challenges.