- Ethereum price eyes new all-time highs, with analysts predicting an ETH price above $15,000

- Multiple on-chain and technical metrics point toward Ethereum price rallying, including decreasing ETH supply on exchanges, increasing whale accumulation, and soaring institutional demand for Ether products

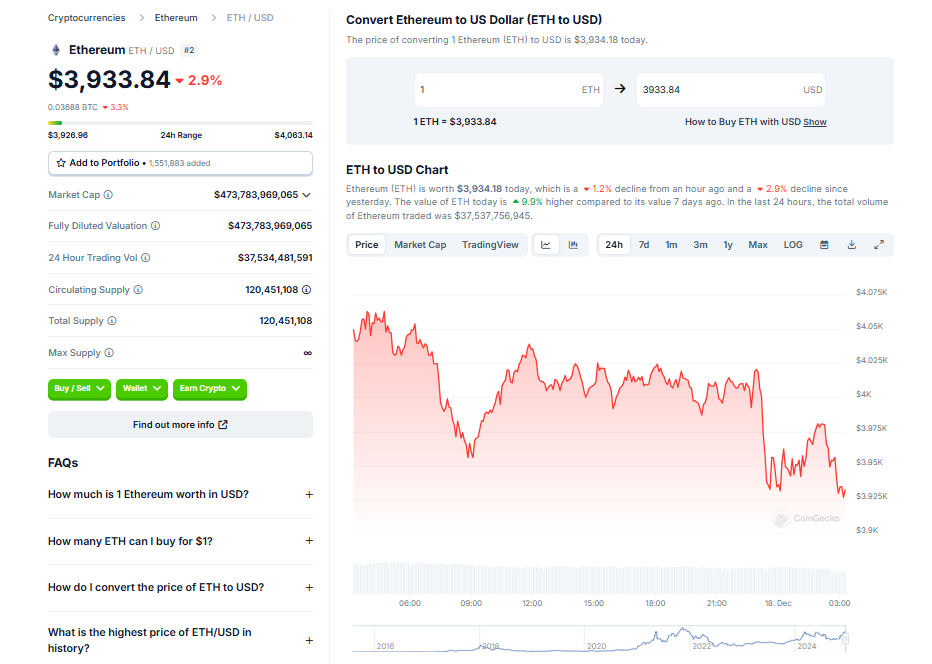

- The fight for $4,000 continues as a potential launchpad for Ethereum to reach new all-time highs beyond its previous record of $4,891

Ethereum, the second-largest cryptocurrency by market capitalization, has been experiencing a significant surge in its price. With multiple on-chain and technical metrics pointing toward an all-time high, industry experts are making bold predictions about Ethereum’s potential to exceed $15,000.

Current Market Performance

The price of Ethereum (ETH) is showing remarkable strength, rallying above $4,000. This upward trend appears to have the potential to surpass the 2021 all-time high of under $5,000. As of December 16, Ethereum touched a new year-to-date high of $4,108, reflecting an 8% gain over the past week and a 28% increase over the last 30 days. In the past year, Ethereum’s price has surged by 82%.

Factors Driving Ethereum’s Price Surge

A significant factor supporting Ethereum’s rise is the reducing supply of ETH on exchanges. Data from market intelligence firm CryptoQuant shows that ETH balances on exchanges have reached an 8.5-year low. This reduced supply is partly due to an increase in accumulation by large holders or ‘whales,’ who currently own around 57% of all ETH in circulation.

Institutional Demand and Ethereum’s Future

Ethereum’s future seems promising, with United States-based spot Ether exchange-traded funds (ETFs) recording positive inflows consistently since November 22. As a result, investor sentiment towards Ethereum has improved dramatically. If this institutional sentiment remains elevated, Ethereum’s price is likely to push toward its November 2021 all-time highs in the coming days.

Analysts’ Predictions for Ethereum’s Price

Several analysts have set five-figure targets for Ethereum’s price. For instance, Venturefounder, a crypto analyst, suggests that Ethereum could reach a price target above $15,000. Michaell van de Poppe, founder of MN Capital, anticipates a cycle top for Ethereum between $15,000 and $25,000. However, other market participants are considering more conservative price targets, with VanEck predicting a $6,000 cycle top for Ethereum.

Conclusion

Though Ethereum’s price surge and the predictions of analysts are optimistic, it’s important to note that every investment and trading move involves risk. Therefore, potential investors should conduct thorough research before making a decision. If Ethereum can continue this upward trend, it could be a game-changer for the cryptocurrency market.