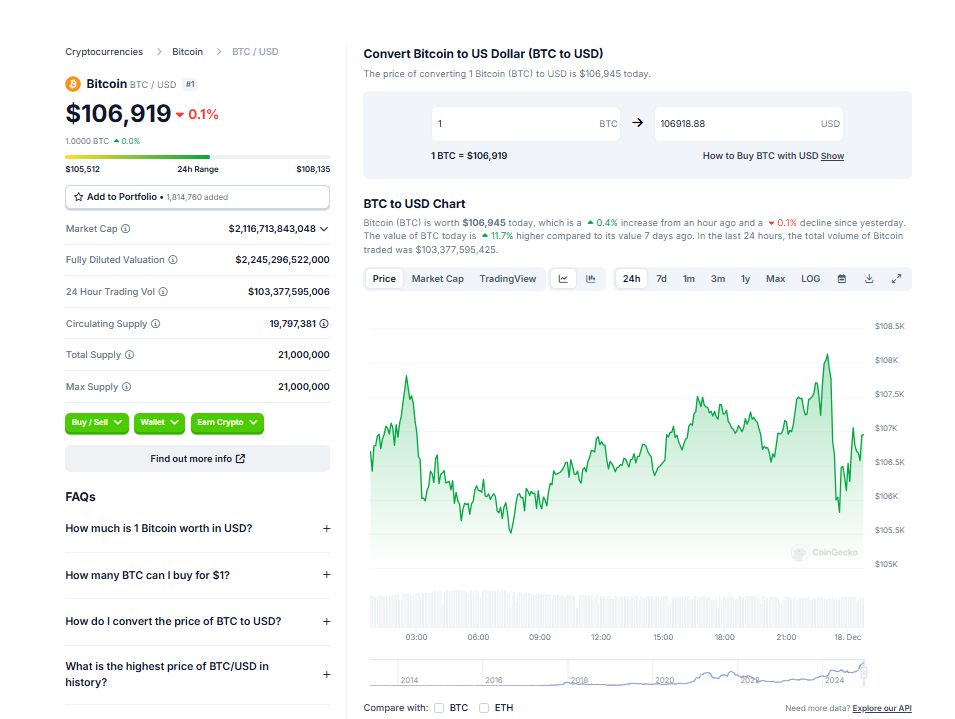

- Bitcoin price hit a new all-time high of $107,778 on Monday, fueled by expectations of the incoming Trump administration’s support for cryptocurrencies.

- The crypto rally is attributed to President-elect Donald Trump’s promises to create a strategic Bitcoin reserve and nominate crypto advocates to key positions like leading the SEC.

- With MicroStrategy, the largest Bitcoin holder, being added to the Nasdaq 100 index, crypto bulls are eyeing Bitcoin reaching $150,000 to $200,000 by the end of 2025.

As the world’s largest cryptocurrency, Bitcoin, continues its meteoric rise, it is inching ever-closer to the $108,000 mark. This significant increase has been fueled by the high expectations of the incoming Trump administration and their purportedly crypto-friendly approach.

Bitcoin’s Record-Breaking Performance

Bitcoin has recently punched through another record, topping $107,000 in the early hours of Tuesday. This surge has been credited to President-elect Donald Trump and his favorable stance towards cryptocurrencies. Over the last 24 hours, Bitcoin has seen an increase of 2.3%, with its value standing at $107,017, as per CoinDesk data. The price of Bitcoin reached an all-time high of $107,778 on Monday afternoon.

The Link Between Bitcoin’s Rise and Political Factors

According to Eric Schiffer of the Patriarch Organization, a venture-capital firm, Bitcoin crossing the $100K mark is entirely due to the strength of policies and pro-crypto cabinet and leadership appointees that have arisen from Trump’s victory. Since the election, Bitcoin has seen a nearly 60% increase, largely due to the incoming administration’s support for cryptocurrencies, including Trump’s promises to establish a strategic Bitcoin reserve.

Changes in the Securities and Exchange Commission and Their Impact on Bitcoin

Trump’s nomination of Paul Atkins, a known crypto-advocate, to lead the Securities and Exchange Commission, replacing Gary Gensler who has been attempting to regulate digital assets more tightly, is also significant. James Lavish, Managing Partner at Bitcoin Opportunity Fund, noted that discussions are underway for a U.S. Bitcoin treasury and changes in Financial Accounting Standards Board (FASB) rules now allow companies to hold Bitcoin on their balance sheet without penalty, further legitimizing Bitcoin as a corporate asset.

Inclusion of Major Bitcoin Holder in Nasdaq 100

MicroStrategy, the largest holder of Bitcoin, is set to be added to the Nasdaq 100 on December 23, along with Palantir Technologies and Axon. This move has crypto bulls eyeing even higher peaks, with some analysts predicting Bitcoin values between $150,000 and $200,000 by the end of 2025.

Conclusion

The recent surge in Bitcoin’s price, coupled with a supportive political climate and changing financial regulations, suggests a promising future for the cryptocurrency. As Bitcoin continues to break records and gain legitimacy as a corporate asset, the world waits to see just how high it can soar.