- Most Ethereum layer-2 networks rely on centralized sequencers, raising questions about censorship resistance and system fragility.

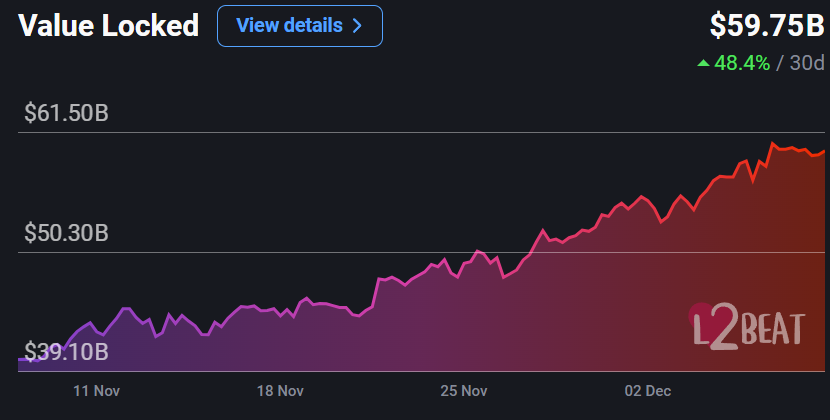

- Ethereum’s total value locked across layer-2 networks exceeded $60 billion in early December 2024, showing rapid growth.

- Plans to achieve 100,000 transactions per second could reshape Ethereum’s scalability and interoperability by 2025.

Ethereum’s layer-2 networks, designed to improve scalability and transaction speeds, now handle the majority of daily activity on the Ethereum blockchain. However, concerns about centralization have surfaced as these solutions often depend on single sequencers, which can potentially lead to vulnerabilities.

Elena Sinelnikova, co-founder of Metis, noted that roughly 97% of Ethereum transactions occur on layer-2 platforms, most of which lack decentralized sequencers. She emphasized that users may not realize they are relying on centralized systems that could be shut down or controlled. Sinelnikova proposed that integrating decentralized sequencers could enhance system resilience and reduce censorship risks.

The Ethereum Foundation has also explored improving decentralization by fostering interoperability among layer-2 networks. Sinelnikova suggested decentralized sequencers might be a more straightforward solution to address centralization concerns while maintaining efficiency.

Growth and Future Goals for Layer-2 Networks

Activity on Ethereum’s layer-2 platforms has soared over the past year, according to L2Beat. By November 2024, daily transaction data tripled compared to March, and total value locked (TVL) across layer-2 networks reached $51.5 billion, marking a 205% year-over-year increase. That figure climbed further to over $60 billion in early December, with Arbitrum One and Base leading the sector.

Ethereum co-founder Vitalik Buterin previously outlined an ambitious goal of achieving 100,000 transactions per second through a roadmap initiative called “The Surge.” This effort aims to enhance scalability while increasing interoperability among Ethereum’s base layer and layer-2 networks.

As Ethereum continues to expand, balancing decentralization with scalability will likely shape its trajectory in 2025 and beyond. With TVL numbers surging and innovative solutions being proposed, the layer-2 ecosystem remains a critical area of focus for the blockchain’s development.