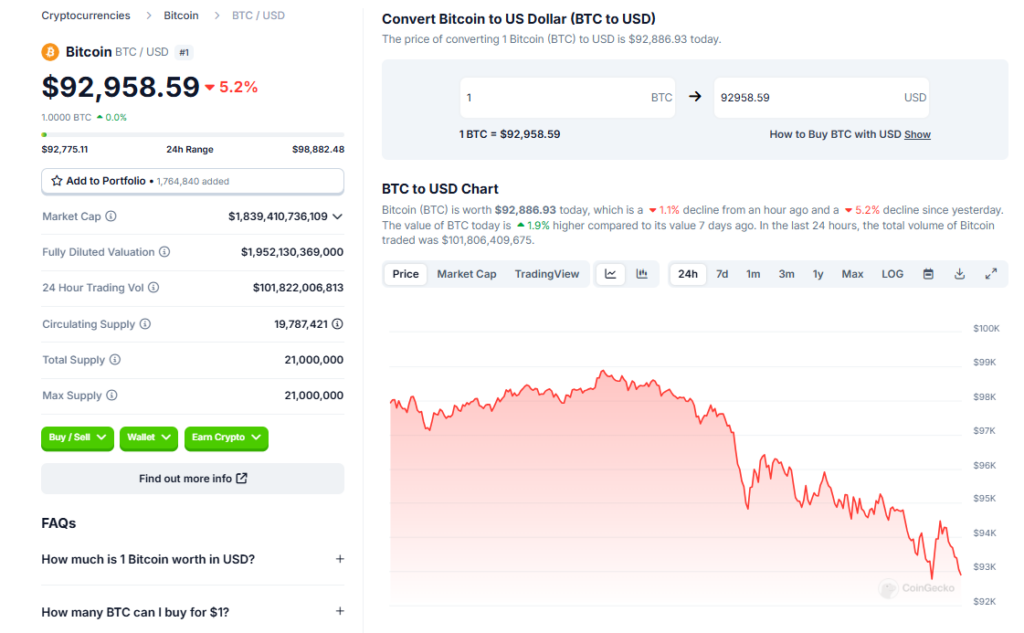

- Bitcoin witnessed a sharp sell-off on Monday, falling 4.8% to just above $93,000, giving up more than half of the gains made last week.

- Market makers may be intentionally driving prices down to trigger a liquidation of leveraged longs, or those betting on higher prices.

- Liquidations spiked on Monday to $550 million, with 70% coming from long positions, following a similar trend observed on Sunday.

Bitcoin witnessed a sharp sell-off on Monday, with the asset’s single-day performance giving up more than half of the gains made last week. The world’s largest crypto fell 4.8% on the day to just above $93,000, with Monday’s drop totaling more than $4,800. For context, that’s more than 5.5% of last week’s $8,100 runup.

Market Maker Manipulation

Still, analysts say the move is likely part of traders rebalancing their positions as they look to the end of the year, particularly in late December which has proven to be a favorable month in the past.

Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital, pointed to two catalysts pushing Bitcoin’s price down temporarily:

Sell Wall Near $100k

He pointed to a sell wall just below the psychological barrier right around $100,000 where traders are looking to capitalize on an explosive run following President-elect Donald Trump’s victory three weeks ago.

Liquidation of Leveraged Longs

McMillin also pointed to a build-up of leveraged longs, or those betting on higher prices, as too tempting for market makers not to chase. In other words, market makers who facilitate liquidity may intentionally drive prices down to trigger a liquidation of those leveraged longs.

Liquidations spiked on Monday to $550 million, 70% of which came from long positions. It follows a similar trend observed on Sunday. Still, McMillin says this is just part of normal market behavior.

Support Around $92k

There isn’t much liquidity below $92,000 so that looks like the floor for this move,” McMillin said. “We expect the market to go and retest $100,000 before the week is out.”

Conclusion

Others agree, claiming Monday’s move is a part of typical market dynamics, with traders hedging against potential downside risks, likely in response to recent moves.

Nick Forster, founder of DeFi derivatives protocol Derive, tolld: “Pullbacks like these are not uncommon in bull markets. We are seeing strong structural tailwinds for Bitcoin, bolstered by favorable conditions such as the interest-rate cutting cycle and evolving regulatory frameworks.”

Other cryptos in the top 10 by market capitalization have also dipped, with Dogecoin (DOGE) taking the most significant hit, down about 9.5% to $0.038, CoinGecko data shows.