- Ether breaks multi-year support against Bitcoin, with analysts predicting further declines in the ETH/BTC pair.

- Ethereum’s market dominance drops as investors favor Bitcoin and competitors like Solana gain ground.

- Technical analysis suggests ETH/BTC could fall another 50% if current trends persist.

Ethereum’s performance against Bitcoin has weakened significantly, with the ETH/BTC trading pair falling below a long-standing support level. This trend has prompted market analysts to suggest that Ether may face continued pressure in the coming months.

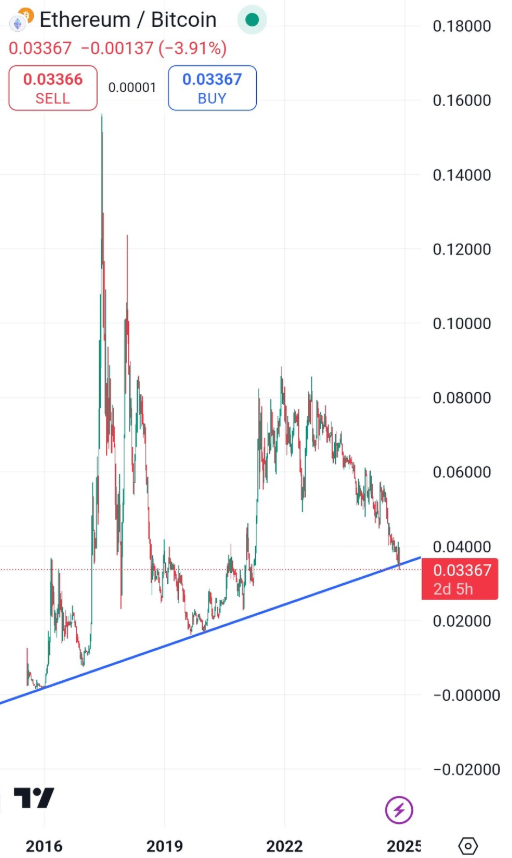

Since 2016, the ETH/BTC pair has rebounded multiple times from a key ascending trendline. These rebounds included a 1,800% rise in 2017 and a 300% gain in 2020-2021. However, in November 2024, the pair failed to hold this support, declining by 15% alongside increased trading volumes, signaling heightened selling pressure.

Source: Rajat Soni

Shifting Market Dynamics

The launch of spot Bitcoin exchange-traded funds (ETFs) in the United States and Bitcoin’s April halving have shifted investor focus toward BTC. Additionally, Ethereum’s own spot ETF has underperformed, further weakening its position.

Solana, a major competitor in the smart contract space, has also gained traction. Since late 2022, the SOL/ETH pair has risen by over 925%, reflecting growing interest in Solana’s ecosystem.

Ethereum has also struggled to remain in the spotlight, as recent headlines and political developments, including Donald Trump’s advocacy for Bitcoin as a strategic reserve asset, have largely excluded Ether.

These factors have contributed to Ethereum’s declining dominance in the crypto market, now at its lowest level since April 2021.

Potential Downside Ahead

Technical indicators suggest that Ethereum’s decline may not be over. The ETH/BTC pair is forming an inverse cup-and-handle pattern, which often signals further downside.

If the pair continues to follow this pattern, ETH/BTC could drop to 0.017 BTC by 2024, a level last seen in early 2020. This would represent a 50% decline from current prices. However, a strong rebound from the 0.0317 BTC support level could invalidate this bearish scenario, potentially pushing ETH/BTC toward 0.043 BTC by the end of next year. Ethereum’s challenges underscore the shifting dynamics in the cryptocurrency market as Bitcoin and emerging platforms like Solana capture investor attention.