- 57% of institutional investors plan to increase crypto allocations, survey reports.

- Regulatory clarity and Bitcoin ETF approval drive positive sentiment toward digital assets.

- Top crypto interests include layer-1 solutions and Web3, while DeFi interest declines.

Growing interest in cryptocurrency has led many institutional investors to consider expanding their crypto holdings, according to the Future Finance survey by Swiss crypto bank Sygnum. The survey, released on November 14, found that more than half of the 400 institutional respondents across 27 countries intend to increase their allocations to digital assets over the next six months.

According to Martin Burgherr, Sygnum’s chief clients officer, improving regulations have bolstered market optimism. He noted that recent U.S. approval of Bitcoin Spot ETFs may further fuel institutional adoption by establishing more confidence in digital assets.

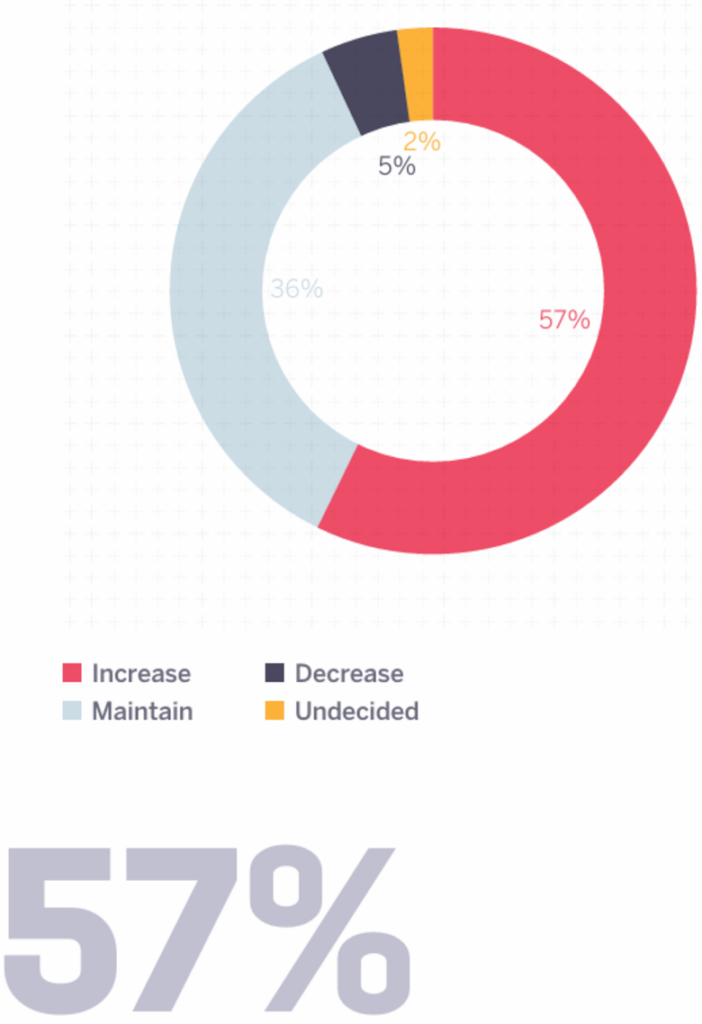

The survey revealed that 57% of investors plan to raise their crypto investments, with 31% intending to do so in the next quarter and 32% over the following six months. Only a small portion, 5%, plan to reduce crypto holdings, while 2% remain undecided.

Source: Sygnum

Preferences and Obstacles for Institutional Investors

Despite increasing interest, some investors favor single-token investments, while others lean toward actively managed portfolios. Roughly 44% plan to stick with single-token strategies, while 40% prefer actively managed exposures, indicating a cautious approach to navigating the crypto landscape.

Persistent challenges include volatility, security, and custody issues, though regulatory clarity has lessened some former hesitations. A majority (81%) expressed that better access to crypto information would facilitate greater investments, showing a shift in focus from regulatory to market-specific concerns.

Key Interests Shift to Layer-1 and Web3 Infrastructure

Investors continue to focus on scalable layer-1 solutions, particularly Bitcoin, Solana, and stablecoins. Interest in Web3 infrastructure is also growing, fueled by developments in decentralized physical infrastructure (DePIN) and artificial intelligence. Meanwhile, the appeal of decentralized finance (DeFi) has waned due to high-profile hacks and losses, reducing its appeal among institutional players.

Comparing interest with last year, institutional investors have shifted focus from real estate to other asset classes like equities, corporate bonds, and mutual funds, aligning with broader market trends.