- Bitcoin’s post-election surge and historical patterns point toward a possible $100,000 milestone.

- November historically boosts Bitcoin returns, currently up 20% this month, CoinGlass reports.

- Leverage levels rising; analysts advise caution amid bullish projections for BTC’s price.

Bitcoin’s price may soon cross the $100,000 mark, according to analysts citing historical trends and increased investor enthusiasm following the U.S. presidential election. Surpassing $90,000 on Nov. 13, Bitcoin has more than doubled in value this year, with many experts forecasting a continued upward trajectory.

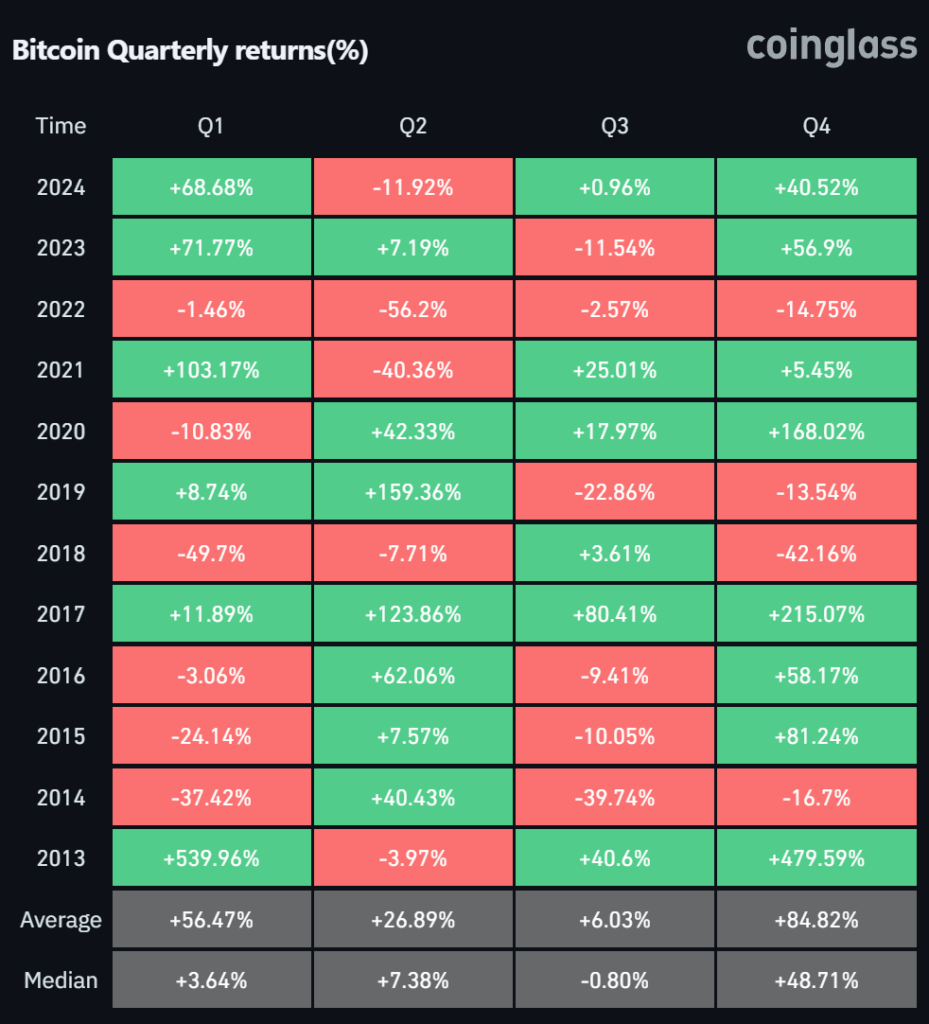

Ryan Lee, chief analyst at Bitget Research, pointed to Bitcoin’s strong historical performance in November, often its best month for returns. Lee noted that a projected 14.7% gain could push Bitcoin to the long-awaited $100,000 target before the end of the month, aligning with the typical gains seen in post-halving cycles.

Source: Coinglass

Market Sentiment Boosts Prospects

Lee’s projections come as Bitcoin posted its strongest weekly gains since the U.S. banking crisis in early 2023, setting new all-time highs and reinforcing the bullish sentiment. Bitfinex analysts also expect that Bitcoin could reach the $100,000 level within a few months, supported by a favorable regulatory outlook under President-elect Donald Trump and expectations of U.S. interest rate cuts. Analysts believe these factors, combined with the recent halving, will sustain momentum well into 2025.

Leverage Concerns and Market Risks

However, some analysts caution that market leverage is approaching unsustainable levels. Kris Marszalek, CEO of Crypto.com, advised investors to exercise caution, warning that the current leverage ratio across crypto exchanges, recently recorded at 0.215, could require a reduction before Bitcoin’s next push. The elevated leverage levels underscore potential volatility, although confidence in Bitcoin’s upward trend remains robust.

Bitcoin’s recent rally, along with growing institutional interest and a supportive economic environment, has set the stage for what analysts hope could be a record-breaking month.