• Bitcoin price broke above $90,000 on Tuesday, setting a new all-time high and securing the milestone after a close call late Monday.

• Bitcoin’s surge is attributed to the “Trump Trade,” with analysts viewing it as a high-conviction play following Donald Trump’s re-election and anticipation of crypto-friendly policies.

• Bitwise’s Chief Investment Officer Matt Hougan expects Bitcoin to breach $100,000 by year’s end and $200,000 by the end of 2025.

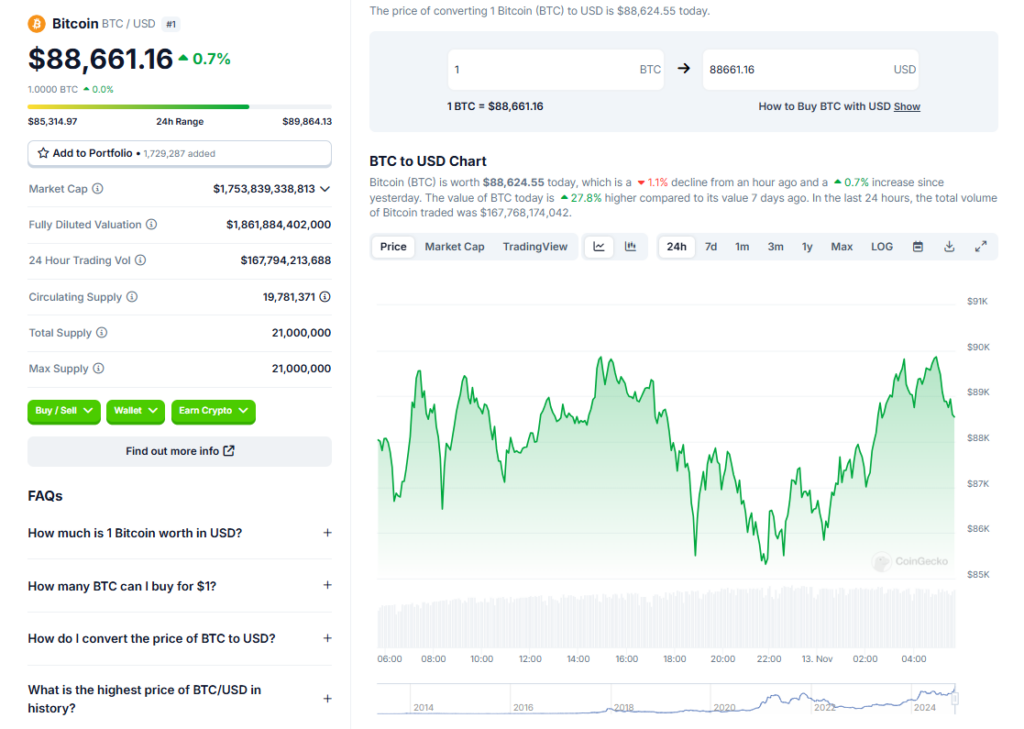

Bitcoin has been on a historic bull run, spiking to new heights on Tuesday and setting an early precedent for what analysts forecast is just the beginning. The leading cryptocurrency rose above $90,000 on Tuesday afternoon, securing the milestone after a close call late Monday.

Bitcoin Hits New Highs

The asset is up 115% this year, more than doubling its January 1 price of $42,000. Meanwhile, crypto‘s total market capitalization has peaked above $3.1 trillion, breaking its November 2021 record of approximately $3.07 trillion.

Bitcoin rose above $90,000 on Tuesday afternoon, Coinbase data shows. It comes amid a surge in bullish sentiment across digital assets and broader equities following President-elect Donald Trump’s successful return bid for the White House last week.

Dubbed the “Trump Trade,” analysts previously told Decrypt they view Bitcoin and digital assets as a high-conviction play, particularly following the former president’s inauguration on January 20.

Market Reaction

With the election overhang now behind us, the rally in crypto markets appears sustainable, buoyed by positive forward signals from the US, according to Julien Auchecorne, head of Auros Ventures.

Exceeding forecasts made earlier in the year, the S&P 500 also rose above 6,000 points briefly for the first time last week, bolstered by a dovish US Federal Reserve and easing interest rates. That’s expected to lower borrowing costs and fuel further momentum into risk assets, including crypto.

Price Predictions

So where to from here? Bitwise’s Chief Investment Officer Matt Hougan expects Bitcoin to breach $100,000 by year’s end and $200,000 by the end of 2025. Others, including New York’s global investment management and research firm Bernstein, have offered similar targets.

Meanwhile, Bitwise’s European Head Bradley Duke sees crypto riding on strong tailwinds—at least for the foreseeable future—with a changing political landscape in the US likely to usher in a “golden age” for the industry.

Conclusion

For now, Bitcoin doesn’t seem to care about any potential risks on the horizon. The cryptocurrency continues to surge to new highs amid growing institutional adoption and bullish sentiment around digital assets. With Trump’s pro-business policies expected to further boost momentum, analysts remain overwhelmingly optimistic about Bitcoin’s trajectory over the next few years.