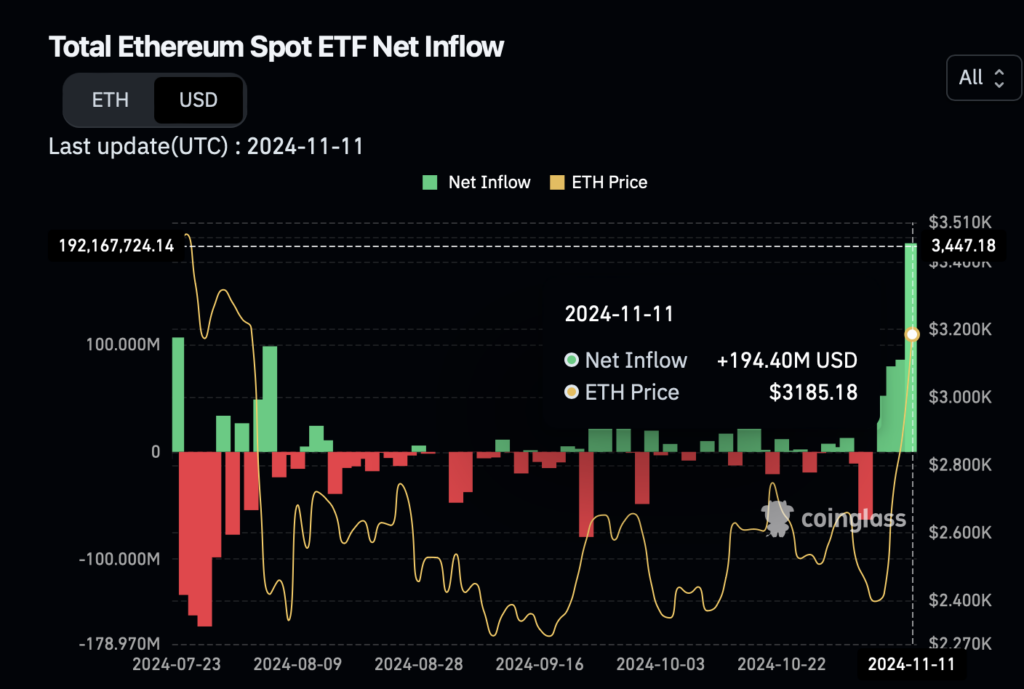

- The US spot Ether ETFs hit a record $295 million inflow on November 11, surpassing the previous record of $106.6 million on their launch day on July 23.

- The Fidelity Ethereum Fund (FETH) led with $115.5 million in inflows, followed by the BlackRock iShares Ethereum Trust ETF (ETHA) with $100.5 million.

- Ether’s price rallied 8.4% to a 14-week high of $1,384 on November 11, playing catch up with Bitcoin, Solana and others that have outperformed it in this bull cycle.

The United States’ spot Ether exchange-traded funds (ETFs) saw their biggest day of inflows in history on Nov. 11 as the crypto market continues to rally after Trump’s election victory. This surge highlights Ethereum’s potential, but it still lags behind competitors like Bitcoin and Solana.

Massive Inflows for Ether ETFs

The ETFs, which launched in July, recorded $295 million in inflows on Nov. 11 – smashing its previous record of $106 million on launch day.

The Fidelity Ethereum Fund (FETH) led the pack with $115 million in inflows, a record for the fund. The BlackRock-issued iShares Ethereum Trust ETF (ETHA) came in second with $100 million in inflows according to Farside Investors and Tree News.

The Grayscale Ethereum Mini Trust ETF (ETH) rounded out the top three with $63 million in inflows while the Bitwise Ethereum ETF (ETHW) posted $15 million. All other US spot Ether ETFs recorded zero inflow.

source: CoinGlass

Ether Price Surges

It comes as Ether (ETH) soared 8% to a 14-week high of $3,384 on Nov. 11, in line with the broader market’s near-10% price rise over the same timeframe according to CoinGecko data.

Ether Playing Catch Up

However, Ether is playing catch up with Bitcoin (BTC), Solana (SOL) and other competitors that have outperformed Ether this bull cycle, according to BTC Markets crypto analyst Rachael Lucas.

After being a laggard for most of this cycle, Ethereum is starting to catch a bid, Lucas said, pointing to spot Ether ETFs gaining momentum after a relatively slow start.

Lucas believes Ether staking returns, not accessible through United States spot Ether ETFs, will also become more appealing to traditional investors as they consider Ether’s bull case.

CK Zheng, a founder at ZX Squared Capital, told Cointelegraph that Ether would likely benefit from a pro-crypto Trump administration in the coming months.

Since launch, US spot Ether ETFs have accumulated nearly $3.1 billion in inflows when excluding outflows from the Grayscale Ethereum Trust (ETHE), which has bled $3.125 billion. BlackRock’s ETHA leads all with over $1.5 billion worth of inflows since the investment products launched on July 23.