- FTX has filed a lawsuit against Binance and its founder Changpeng Zhao (CZ), seeking $1.8 billion in damages.

- The lawsuit alleges that in 2021, Binance and CZ misled FTX during a buyback agreement involving FTX’s exchange token FTT and Binance’s tokens BNB and BUSD.

- The lawsuit also accuses CZ of posting false and misleading tweets aimed at destroying FTX before its collapse, and Binance’s planned sale of its FTT holdings worth $529 million triggered massive withdrawals from FTX.

Cryptocurrency exchange FTX has filed a massive lawsuit against rival exchange Binance and its founder Changpeng Zhao. This latest legal battle stems from a stock buyback deal between the two companies in 2021.

Background on the Buyback Deal

In July 2021, FTX co-founder Sam Bankman-Fried entered into an agreement with Binance to buy back shares in FTX’s international and US-based platforms.

Bankman-Fried used a combination of FTX’s native token FTT and Binance’s native tokens BNB and BUSD, worth $2.1 billion at the time, to pay for the buyback. FTX’s sister firm Alameda Research was also involved in the deal.

Allegations Against Binance and CZ

In its lawsuit, FTX alleges that CZ intentionally spread false information on social media to undermine confidence in FTX. This includes tweets about Binance planning to sell its large FTT holdings, which triggered mass withdrawals from FTX.

FTX also claims that Alameda Research was insolvent when the buyback deal was made in 2021, and that Binance and CZ knew about this.

The lawsuit seeks damages of $1.8 billion from Binance and CZ over the buyback deal.

Impact on the Crypto Market

The lawsuit has added to the ongoing troubles plaguing Binance. It also comes on the heels of FTX’s high-profile collapse.

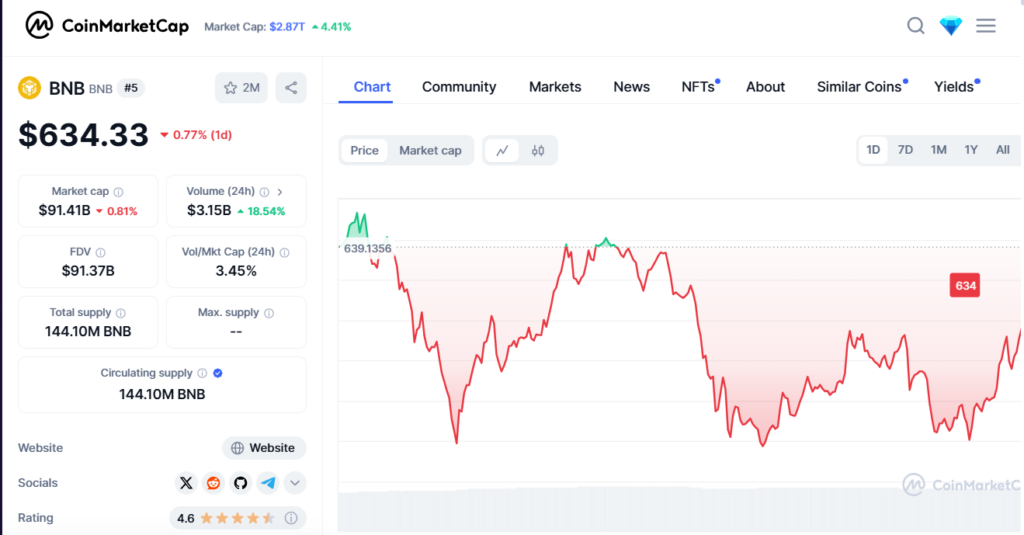

Binance’s native token BNB has fallen over the past day amid the lawsuit news. However, the overall crypto market continues to recover from recent crashes.

This latest legal battle between the two exchanges will likely drag on for some time. It represents another period of uncertainty for the crypto industry as it seeks to rebuild trust after a turbulent year.