- BlackRock’s Bitcoin ETF surpasses $30 billion in assets in under 10 months

- Bitcoin ETF inflows continue to rise as U.S. election approaches, analysts report

- Bitcoin ETFs may soon surpass 1 million BTC in cumulative holdings, nearing a new milestone

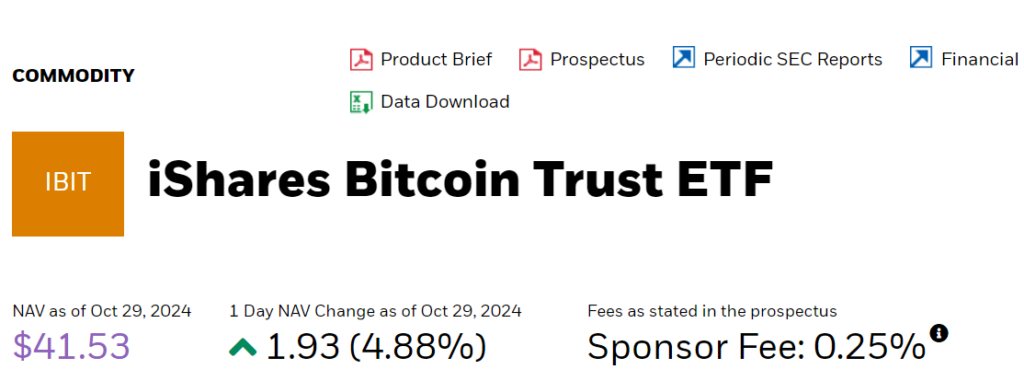

BlackRock’s Bitcoin exchange-traded fund (ETF) reached a milestone of over $30 billion in assets just 10 months after its launch, marking a new record for speed in ETF growth. The world’s largest asset manager now holds more than 417,000 Bitcoin, valued at $30.4 billion as of October 29. Rising interest in Bitcoin ETFs has driven inflows to nearly $870 million, the second-highest single-day inflow since March.

Bloomberg’s senior ETF analyst Eric Balchunas noted this achievement, stating that BlackRock’s ETF reached this mark faster than any previous ETF, surpassing popular funds like $JEPI and $GLD, which took over three years to reach similar levels.

Source: iShares

Bitcoin ETFs Near Key 1 Million BTC Milestone

Bitcoin ETFs in the United States are rapidly closing in on another landmark, with holdings set to reach a cumulative 1 million BTC, valued at over $71.7 billion. Analysts like Balchunas believe that this milestone could position Bitcoin ETFs as the largest collective holders of Bitcoin, surpassing even the holdings associated with the pseudonymous creator Satoshi Nakamoto.

Since the launch of U.S.-based spot Bitcoin ETFs, they have accounted for a significant portion of new investments in Bitcoin, contributing to the recent price rise to nearly $72,000. Analysts at Bitfinex predict further gains, potentially reaching $80,000 by year’s end, with growing ETF demand and potential election outcomes adding to investor enthusiasm.

Outlook for Bitcoin Price and ETF Market Impact

While many analysts view these inflows as a signal of renewed market confidence, others caution that macroeconomic factors might prevent a substantial new high for Bitcoin. Some have speculated that the Bitcoin rally could be a temporary “Trump hedge” trade, as investors await clarity on U.S. political developments and potential impacts on cryptocurrency regulations.