Ethereum bulls are yet to stage a comeback against the bears who have weighed down the price this month. Even Ethereum’s successful transition to proof-of-stake (PoS) on September 15 failed to ignite Ether’s (ETH) upside recovery as ETH miners added to the selling pressure.

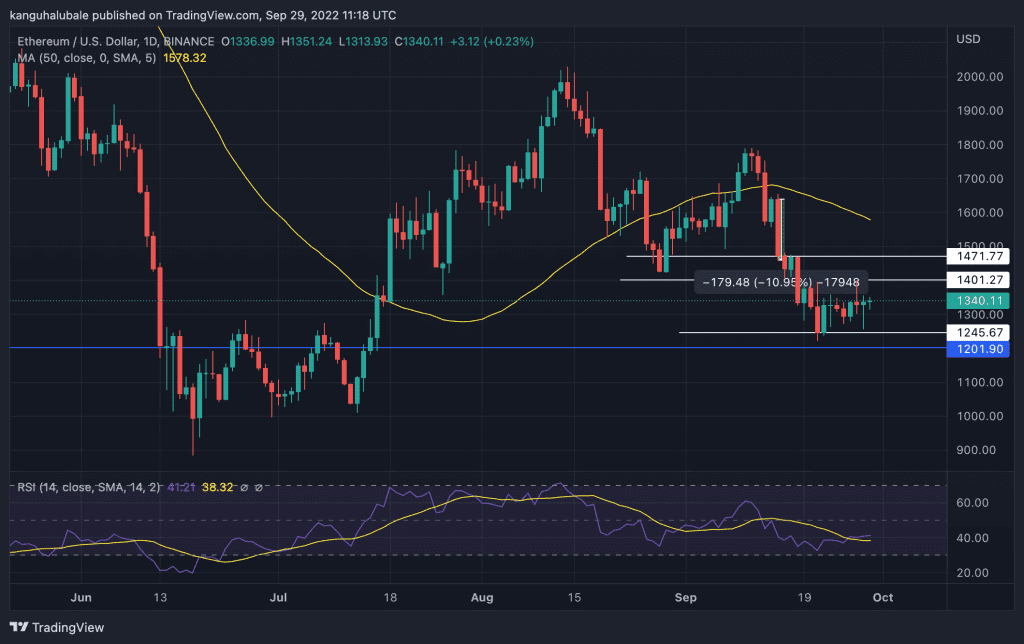

Bears started the onslaught before the Merge resulting in a steep decline that saw the smart contracts token drop from September 10’s opening at $1,717 to the $1,221 swing low reached on September 21. Investors sold the news on The Merge, causing Ethereum’s price to plummet 11% on September 15, the day of the upgrade.

The downtrend fuels a grim outlook surrounding the Ethereum Merge as miners offload their ETH reserves.

Ethereum Miners Dump $140 Million worth of ETH Because Of The Merge

Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism means that the network no longer needs to be supported by miners. Those who mined the token pre-Merge still hold large amounts of Ethereum, and it was feared that they could drag down ETH price if they sell enmasse as mining revenue stops.

Data reveals that the drop in ETH price on September 15 coincided with increased Ethereum supply on exchanges. This came as Ethereum miners sought to exit the market.

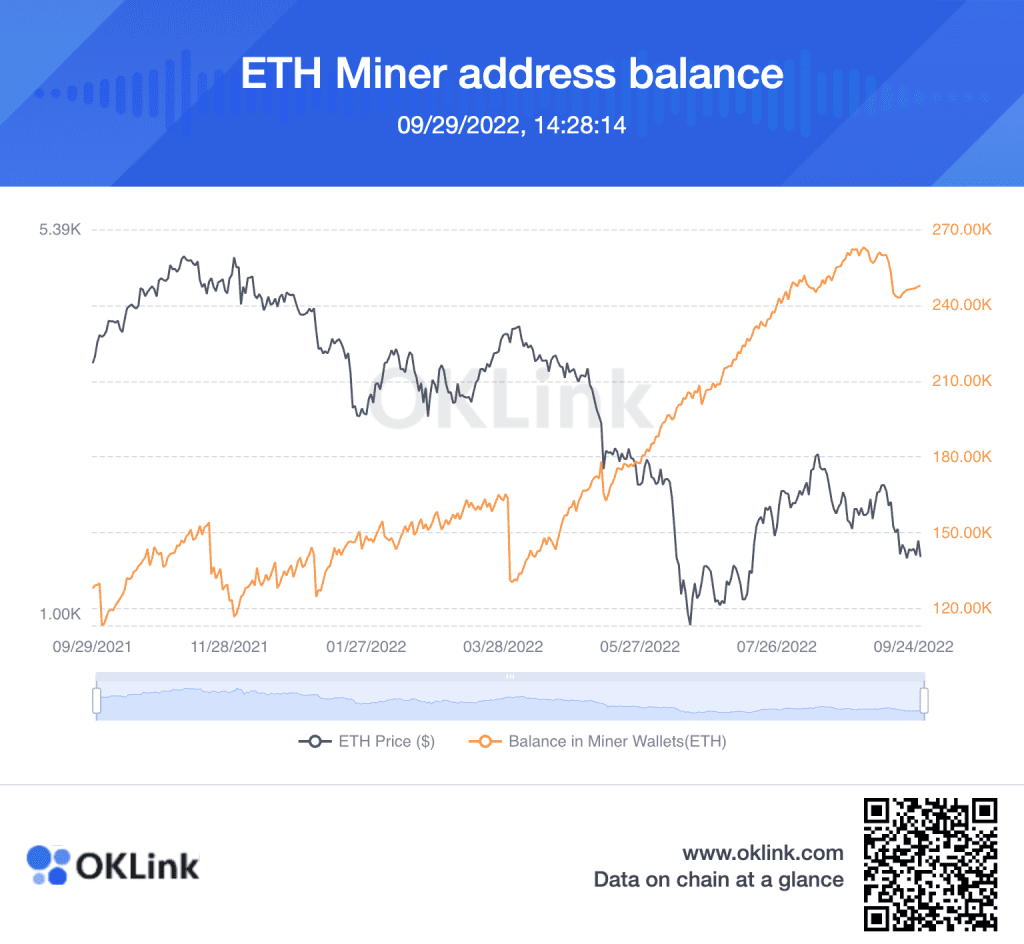

Miners have sold about $139,263,000 between September 10 and September 28, dumping as much as 30,000 ETH over the same period, according to data from OKLink.

Some analysts, however, think that the concerns about outflows from miners’ wallets may have been blown out of proportion. They argue that some Ethereum miners may choose to hold or sell their ETH. If they choose the former, there ought to be no negative impact on the price, and there is a limit to how much they can eventually sell.

According to the ETH miner address balance chart from OKLink, the number of tokens held by miners peaked at 262 144 ETH on September 3, but the value has been declining post-merge both in terms of coins held and U.S. dollars.

At the peak of last year’s bull run on November 10, 2021, Ethereum miners held around $740 million worth of ETH, but this number has gradually dwindled to just over $318 million at the time of writing.

Miners May Drag The Price To $1,200

An article by Tom’s Hardware claims that the GPU miners industry may be headed for extinction since Ethereum as a PoS network doesn’t require miners’ services. While this benefits the platform in the long term, the miners are not bound, and they may want to take as many profits as possible in a short time due to future uncertainties.

At press time, Ethereum was trading at $1,340 as bulls attempted to flip $1,400 back to support. The relative strength index (RSI) is moving away from the oversold region, which could entice counter-trend traders to enter the market for a rise back into the 50-day SMA at $1,578. Still, the play may be too risky as the bulls have not produced a daily candlestick close above the $1,500 psychological level since the Merge.

On the downside, there is a possibility that the price of the largest altcoin by market capitalization could fall flat and wipe out the $1,200 support level. Invalidation of this bearish scenario – with targets at $1,200 could be a break of the September 11 range high at $1,789.