- Bitcoin miner withdrawals have dropped dramatically, down by 85% since April’s halving, indicating reduced sell pressure.

- The decrease in miner withdrawals follows significant changes in mining economics, including reduced profits and machine obsolescence.

- CryptoQuant anticipates positive market movements in the third quarter of 2024 as miners adjust to new realities.

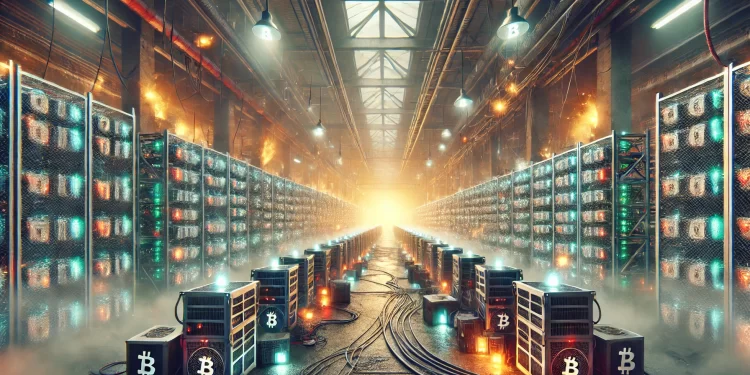

Data from the on-chain analytics platform CryptoQuant has revealed a significant decrease in Bitcoin miner withdrawals since the latest block subsidy halving in April, suggesting a decrease in selling pressure from miners. This change comes as the mining community adjusts to the new economic environment where the reward for mining a block is halved, impacting profitability and operational decisions.

Before the halving, miner withdrawals peaked with over 53,000 transactions recorded from known miner wallets on April 10. However, by June 27, this number had plummeted to approximately 8,000, marking an 85% reduction. This dramatic decline in withdrawals indicates a shift in miner strategy, potentially moving from selling to hoarding in anticipation of future price increases.

Adjusting to New Realities

The halving event, which reduced the mining reward by 50%, has necessitated a reassessment of operations by Bitcoin miners. Older mining machines, which are less efficient, have become economically unviable, leading to their phase-out. This adjustment has been reflected in the network’s fundamentals, with both the hash rate and mining difficulty experiencing declines from previous highs.

The situation has been described by CryptoQuant contributor Crypto Dan as a period of “capitulation” among miners, with the 30-day moving average hash rate falling below its 60-day counterpart. While traditionally this scenario is seen as a buy signal for traders, it also underscores the pressures faced by the mining industry post-halving.

Market Outlook and Hash Price Concerns

As the market absorbs the sell-off from miners, the reduced flow of Bitcoin from miner wallets to the market is seen as a precursor to potential stability and subsequent upward movements in the cryptocurrency’s price. The decline in hash price, which measures expected revenue per exahash, has placed additional stress on smaller-scale miners. From June 8 to June 24, the hash price halved, exacerbating the challenges for less efficient mining operations. This economic pressure is compounded by recent price corrections, which further squeeze the revenue potential for these miners.