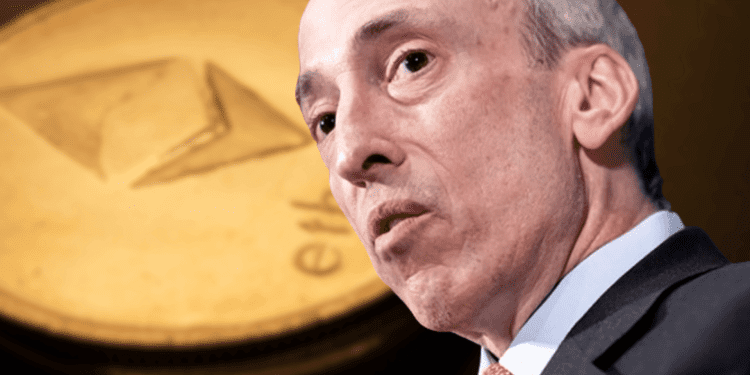

• SEC Chair Gary Gensler says the Ethereum ETF approval process is going smoothly

• Gensler expects the Ethereum ETFs to launch sometime over the course of this summer

• Gensler reiterated his critiques of the crypto industry, referring to many cryptocurrencies as securities lacking proper disclosures

The approval process for a spot Ethereum exchange-traded fund (ETF) is moving along smoothly, according to SEC Chair Gary Gensler. An Ethereum ETF would allow mainstream investors easy exposure to the second-largest cryptocurrency by market capitalization.

SEC Chair Provides Update on Ethereum ETF Approval

Speaking at the Bloomberg Invest Summit this week, Gensler said the SEC is currently working with issuers as they go through the registration process for an Ethereum ETF. He stated that this is “working smoothly” and he envisions launch timeframes “sometime over the course of this summer.”

Gensler had indicated in earlier comments before the Senate that after issuers finish their filings, disclosure and registration are all that’s left before Ethereum ETFs can begin trading. The SEC chair has previously predicted approval and launch timeframes by September 2022.

ETF Providers Await Approval

Several ETF providers have filed for spot Ethereum ETFs, including VanEck, Valkyrie, and Grayscale. These issuers are now awaiting official approval from the SEC before their funds can launch.

Many experts predict the first U.S. spot Ethereum ETF will debut sometime in July, allowing easy access for retail investors to gain exposure to the asset. An Ethereum ETF is expected to see high demand similar to the eagerly anticipated Bitcoin ETF.

Gensler Remains Wary of Crypto Industry

Despite smooth progress on an Ethereum ETF, Gensler reiterated common concerns around crypto markets. He stated much of the industry uses “non-compliant rails” and issues tokens he considers securities without proper disclosures.

Gensler referred to the need for more investor protections in the largely unregulated crypto asset market. However, an SEC-approved Ethereum ETF would provide managed exposure under the agency’s oversight.

Conclusion

The SEC is working steadily toward approval of a spot Ethereum ETF in the coming months. This would open the door to mainstream crypto investment similar to the popular Bitcoin ETF. The product’s launch could also boost prices for Ethereum. While wary of crypto markets, Gensler acknowledges an Ethereum ETF meets key regulatory standards.