- GameStop (GME) stock has surged over 70% in the past month, nearing the $20 mark, reigniting discussion about the resurgence of meme stocks.

- The prominent GameStop supporter Keith Gill, also known as Roaring Kitty, has resurfaced after a 3-year hiatus, potentially leading another surge in the stock.

- While GameStop’s short interest percentage stands at 24%, far from its peak of 140% in 2021, traders are betting against those shorting the stock.

GameStop (NYSE: GME) stock has been the subject of much speculation lately. It has surged over 70% in the past month and was nearing the $20 mark in the latest trading session.

Recent Price Action Suggests Further Gains

With premarket gains of 20%, GME stock appears poised to hit $20 before markets open this week, reigniting discussion about the resurgence of meme stocks in the current bull market.

The impressive performance hasn’t gone unnoticed, especially by its prominent supporter Keith Gill, also known as Roaring Kitty, who seems poised to return after a 3-year hiatus.

Roaring Kitty Could Lead Another GameStop Stock Surge

Almost three years after his last post on X, Keith Gill, commonly known as Roaring Kitty, just posted an intricate photo that could signify that he is back in action and ready to lead an army of traders.

GameStop shares, once soaring to $483 in the frantic days of 2021 as depicted in the movie Dumb Money, have since lost much of their meme appeal. However, the stock has been on a rapid ascent in the past month alone.

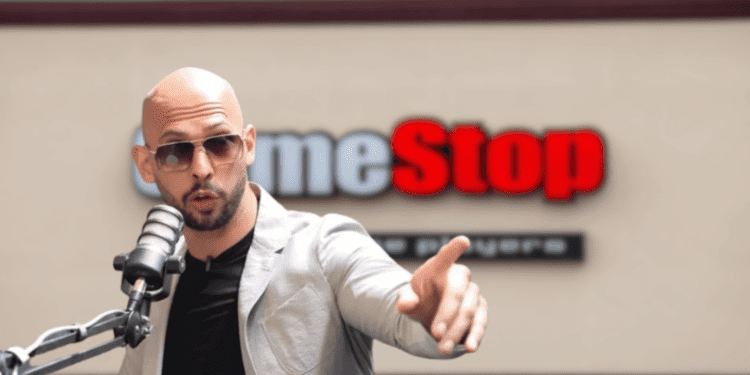

Such hype hasn’t gone unnoticed by Andrew Tate, who recently offered to buy $1 million worth of GME stock. An occasion that aligns with the potential comeback of Roaring Kitty.

GME Short-Interest Is Far From Its All-Time High

Similar to previous instances, investors are betting against those shorting the stock. The short percentage of GameStop shares outstanding currently stands at 24%, a far cry from the peak of 140% in 2021.

While GameStop did report its most robust earnings per share performance in three years for its fiscal fourth quarter ending Feb 3, the company opted not to hold a conference call to discuss the results.

The company, with 2,915 stores in the US and 1,254 overseas, is striving to transform its business and position itself as the top choice for games and entertainment products.

Conclusion

With signs pointing to another potential short squeeze, GameStop stock could be poised for further gains if momentum continues. The possible return of Roaring Kitty makes the setup even more interesting for speculative traders.