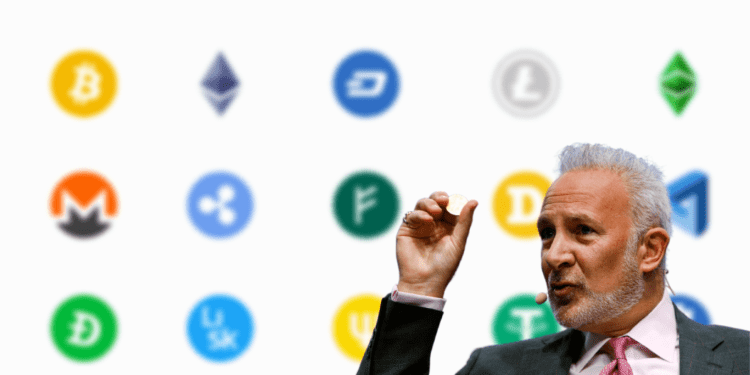

Peter Schiff blames altcoins for the collapse of Bitcoin. The CEO and founder of Schiff Gold say that original crypto coins are losing market to altcoins.

“Not only is #Bitcoin crashing, but its dominance has fallen to 38.1%, its lowest since June 2018. Competing withalmost 21,000 other intrinsically worthless digital tokens,NFTs and # crypto-related equities are taking a toll. Even if Bitcoin is scarce. Its alternatives are not.”

Bitcoin has not been doing well within the past few months. A few days ago, the coin hit a new low, $18,000. This was on 7 September 2022. When writing this article, the coin now sits at $20,972, with an 8.6% gain within the past 24 hours.

Reactions to Peter Schiff’s Argument

The CEO of Binance, Changpeng Zhao, believes Peter Schiff is wrong. According to Changpeng Zhao, Bitcoin is the original cryptocurrency coin, and no other coin can outperform it. Altcoins do not affect the performance of Bitcoin in any way, but Bitcoin affects the performance of Altcoins.

Changpeng Zhao says:

“It’s like saying new internet companies weaken Google. No, the more internet companies there are, the more valuable Google becomes.”

The truth is not all cryptocurrencies follow the traditional Bitcoin structure. Not every altcoin uses PoW or limits the maximum supply to 21 million coins. However, Bitcoin is not in competition with other cryptocurrencies. Google cannot collapse because of google-like emerging businesses; instead, Google can affect these businesses. Likewise, altcoins cannot affect Bitcoin.

Moreover, altcoins do not cause any digital scarcity. The cryptocurrencies are not competing for the same users within a limited market fragment; users can hold multiple coins simultaneously. The upcoming cryptocurrencies also offer different financial solutions to Bitcoin. Even Spencer Schiff, Peter Schiff’s son, disagrees with the statement.

Is Peter Schiff Right? Do Altcoins Affect Bitcoin Dominance and Popularity?

According to researcher and cryptocurrency analyst Kyle MacDonald, Peter Schiff is correct. Altcoins are eating into Bitcoin’s market share. MacDonald validates his argument with the Ethereum Merge. MacDonald says that after the Ethereum Merge, many investors and regulators will realize how Proof of Work (PoW) is useless and dump Bitcoin. There will be a massive crash in the price of Bitcoin after the Ethereum Merge.

Bitcoin’s mining algorithm uses PoW to solve SHA-256 problems. This consumes a lot of energy in the form of electricity. Therefore, Peter Schiff’s argument is credible. Over the past week, too, Bitcoin whales have been circulating and liquidating. Wallets with Bitcoin bought close to 8 years ago are now moving the coins. Some are transferring to exchanges such as Kraken, and some are liquidating.

Researchers say that this might be in preparation for the Ethereum Upgrade, Cardano Vasil Hard Fork Upgrade, and the LUNC Tax Burn, which are scheduled to occur this month. It is common practice for whales to move assets during a bear market. It is a method used to prepare for loss recovery.

Is it Altcoins or the Stock Market?

However, many people attribute Bitcoin’s crash to the stock market. For years, financial markets have always been interdependent. The cryptocurrency market is not independent for now but depends on the fiat market. Therefore, a collapse in the stock market leads to a failure in the cryptocurrency markets.