- Tigran Gambaryan’s bail hearing in Abuja postponed until April 22, remains in custody at Kuje correctional center.

- Gambaryan faces charges of money laundering, with allegations of concealing $35.4 million; pleads not guilty.

- Binance grappling with legal issues in Nigeria, including tax evasion and violations related to foreign exchange.

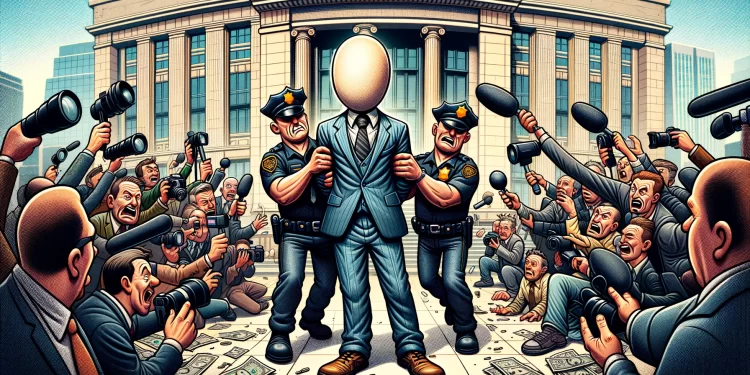

A recent court session in Abuja, Nigeria, has led to the postponement of a crucial bail hearing for Tigran Gambaryan, a Binance executive currently held at the Kuje correctional facility. Originally scheduled for April 18, the hearing has been moved to April 22, as reported by Nairametrics.

Legal Developments

During this session, the Economic and Financial Crimes Commission (EFCC) informed Justice Emeka Nwite that Gambaryan’s defense had introduced new evidence, necessitating additional time for review to ensure a fair process. This led to the rescheduling of the hearing to allow the prosecution time to prepare a proper response.

Broader Implications

Mark Mordi, representing Gambaryan, expressed frustration over the prosecution’s delay in responding to the defense’s submissions. He stressed that Gambaryan has been in federal custody for more than two weeks, emphasizing the need for a fair and speedy trial. The judge has since required the EFCC to give their response before the rescheduled date.

The charges against Gambaryan and his colleague Nadeem Anjarwalla involve allegations of laundering over $35 million through their operations in Nigeria. Both executives pleaded not guilty, with Binance facing additional scrutiny from Nigerian authorities over tax evasion and foreign exchange violations.

Furthermore, Gambaryan has filed a lawsuit against the Nigerian government, claiming that his detention and the confiscation of his passport breach his constitutional rights to liberty. This legal battle comes in the wake of Nigeria’s broader crackdown on cryptocurrency operations, which included the arrests of Gambaryan and Anjarwalla under dramatic circumstances, highlighting ongoing tensions between global crypto businesses and Nigerian regulatory bodies.