- MicroStrategy has spent about $3.8 billion acquiring 175,000 bitcoins, with an average purchase price around $21,000 per bitcoin. With bitcoin’s current price over $55,000, MicroStrategy is sitting on unrealized gains of over $2 billion on its bitcoin investment.

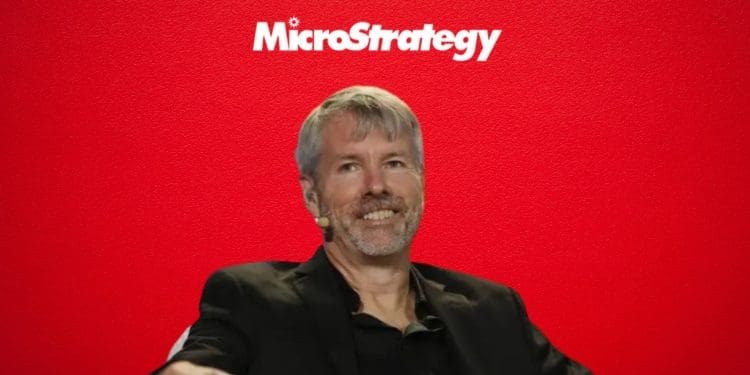

- MicroStrategy and its CEO Michael Saylor believe bitcoin is “digital gold” and a long-term store of value that can diversify away from inflationary fiat currencies.

- Owning bitcoin has benefited MicroStrategy through price appreciation, inflation hedging, minimizing geopolitical risks, and generating publicity for the company. MicroStrategy remains committed to accumulating more bitcoin over time.

MicroStrategy held nearly 175,000 bitcoins in its treasury as of the end of November. This represents a significant investment in the volatile cryptocurrency that has paid off handsomely for the business intelligence software company.

MicroStrategy’s Bitcoin Purchases

MicroStrategy first bought bitcoin in August 2020 and has continued making additional purchases throughout 2021. In total, the company has spent about $3.8 billion acquiring its bitcoin holdings.

The average purchase price for MicroStrategy’s bitcoins is approximately $21,000. With bitcoin currently trading above $55,000, the company is sitting on unrealized gains of over $2 billion.

MicroStrategy’s CEO Michael Saylor has been one of the most vocal proponents of bitcoin, touting it as “digital gold” and a long-term store of value. Saylor and MicroStrategy remain unfazed by bitcoin’s volatility and continue holding it as part of their corporate treasury strategy.

Benefits of Bitcoin for MicroStrategy

Owning bitcoin has provided several benefits to MicroStrategy beyond the huge price appreciation.

First, it provides diversification away from cash holdings that are losing value to inflation. Bitcoin has a fixed supply and cannot be devalued by central bank policies in the same way as fiat currencies.

Second, bitcoin serves as a hedge against global uncertainty. Its decentralized nature makes it less susceptible to geopolitical risks.

Finally, MicroStrategy’s bitcoin purchases have attracted increased attention and publicity for the company and its products. This marketing angle provides value whether or not bitcoin prices continue rising.

Future Outlook

MicroStrategy remains committed to buying and holding bitcoin despite its volatility. With the Fed signaling interest rate hikes in 2022, bitcoin could benefit from flows out of other risk assets.

As long as Michael Saylor is CEO, expect MicroStrategy to continue accumulating more bitcoin on any significant price dips. If bitcoin eventually becomes a widespread corporate treasury asset, MicroStrategy will look prescient in its early and aggressive adoption.