- Gary Gensler, SEC Chair, remains focused on having crypto under SEC regulation despite facing legal setbacks.

- Notable court decisions against SEC include cases with Ripple on July 13 and Grayscale on August 29.

- Gensler believes most crypto assets meet the criteria of the Howey Test, deeming them securities.

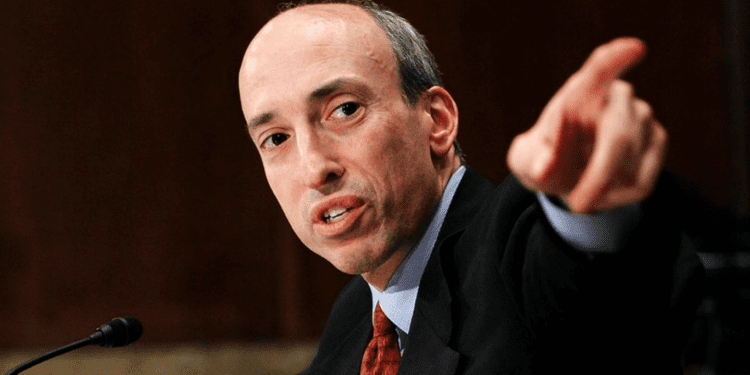

The head of the United States Securities and Exchange Commission (SEC), Gary Gensler, is forging ahead with his mission to bring cryptocurrency into the SEC’s regulatory circle, even in the face of recent legal roadblocks. Gensler’s intent will be shared during a Senate Banking Committee meeting on September 12.

In the past two months, cryptocurrency stalwarts like Ripple and Grayscale have won in court against the SEC. Still, these setbacks haven’t shaken Gensler’s resolve about the need for cryptocurrency oversight.

During his Senate testimony, Gensler is set to underline the SEC’s viewpoint: that crypto assets can be classified as securities. He draws connections between today’s bustling cryptocurrency market and the financial scenes of the 1920s, which existed before the introduction of federal securities regulations.

A key point in Gensler’s argument is the Howey Test, a legal yardstick that helps identify if a certain asset is a security. According to Gensler, most cryptocurrency tokens probably meet the criteria set by this test. This is the cornerstone of his argument for why cryptocurrency, including those who operate within it, should comply with securities regulations.

The SEC’s stand on cryptocurrency came under fire on July 13. This happened when Judge Analisa Torres mostly agreed with Ripple’s stance, stating that sales of the XRP token to everyday buyers did not breach federal securities rules. Following this outcome, the SEC decided to lodge an appeal. This case has garnered attention, with other cryptocurrency businesses likely referencing the Ripple verdict when facing their own legal issues with the regulator.

The SEC experienced another jolt on August 29. Their previous decision to reject Grayscale’s proposal to switch its Bitcoin Trust into a Bitcoin exchange traded fund (ETF) was overturned by a judge. The judge voiced concerns over the SEC’s decision being weakly justified.

These significant court outcomes have prompted a ripple effect across the industry. Take for example, the blockchain-centric payment platform LBRY. After facing charges in July for breaking securities rules, LBRY is now reevaluating and pondering an appeal.

However, these challenges aside, Gary Gensler is steadfast. He is determined in his stance that cryptocurrency is a form of security and should be monitored by the SEC.

Gensler Balances Crypto Regulation, Investor Protection

SEC Chair Gary Gensler has come under scrutiny for his firm position on the growing cryptocurrency market. Despite criticisms and suggestions of a bias against digital currencies, his role primarily focuses on ensuring transparency and fairness in financial markets, which includes burgeoning sectors like cryptocurrencies. Recent media coverage has highlighted the perceived severity of his approach, hinting at a potential “failure” in handling the U.S. crypto sector.

Yet, navigating the waters of emergent technologies has always been intricate for regulatory bodies. The SEC, under Gensler’s leadership, is wrestling to find a middle ground between spurring innovation and safeguarding the public. This apparent tug-of-war between progress and protection stems from the need to prevent the pitfalls of past financial systems that operated without sufficient oversight. At the heart of the matter, Gensler’s primary objective remains aligned with the SEC’s core mission: upholding market integrity and shielding investors, rather than expressing an inherent opposition to crypto technology.