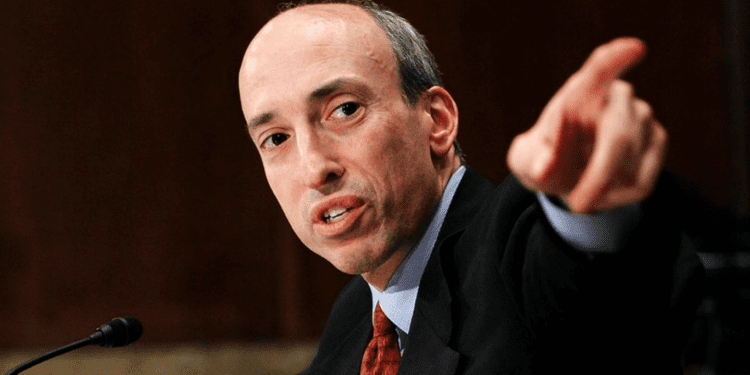

- SEC Chairman Gary Gensler asked Congress for more funding when he appeared before the U.S. Senate on Wednesday.

- The extra funding is supposed to assist SEC deal with risks in the crypto markets, which he has termed the “wild west”.

- After making what could be termed a strong case for President Biden’s budget for SEC, it is a wait-and-see whether the Senate will approve the extra funding.

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has asked Congress for more funding to deal with “risks in the crypto markets.” In what he terms the “wild west” of the crypto market, the Chairman explained that the sector is rife with noncompliance, where investors have put hard-earned assets at risk in a highly speculative asset class.

Gary Gensler discussed cryptocurrency during his testimony on Wednesday before the U.S. Senate Appropriations Subcommittee on Financial Services and General Government regarding the SEC’s Fiscal Year (FY) 2024 budget request.

While supporting President Biden’s 2024 budget request of $2.436 billion for SEC operations, the Chairman outlined tremendous growth and changes in the U.S. capital markets

The wild wild west of finance

The term wild west is a name given to the western part of the U.S. during the time when Europeans were first beginning to live there leading to a fight between them and the Native Americans. This happened before the establishment of a stable government and was therefore characterised by lawlessness and violence.

The choice of words reveals Gary’s views on the crypto sector, which he sees as lacking regulation and oversight and therefore exposing investors to significant risk in this speculative asset class.

From the tone of his language, it seems Gary Gensler is not done with cracking down on the non-compliant cryptocurrency firms.

Interestingly, this is not the first time Gensler is likening the Crypto Currency industry to the wild west. In September 2021, in testimony before the Senate Banking Committee, he said

“Frankly, at this time, it’s more like the Wild West or the old world of “buyer beware” that existed before the securities laws were enacted. This asset class is rife with fraud, scams, and abuse in certain applications. We can do better”

The Chairman who describes himself as the cop on the beat, went on to say, SEC should be given more funding so that they can be able to meet the match of bad actors, further stating that they required funding to meet the scale of their operations and be in a position to become a stronger advocate for the American people, Issuers and Investors. SEC Chairman also intends to cyber and information security, and the resiliency of critical market infrastructure

Gary mentioned that the bulk of the budget increase would be to support currently authorized staffing levels given the inflation. The FY 2024 request is supposed to help the Division of Enforcement grow to 1,144 FTEs (full-time equivalents) in order to allow them to keep pace with the market challenges.

Gensler has always come under criticism for regulating the crypto sector by enforcement. In recent times, SEC has attempted to classify crypto tokens as securities, even the ones in the secondary market. A ruling by the Southern District of New York ruled that XRP is not a security, a ruling which made Gensler and SEC quite disappointed.