- Binance CEO CZ was allegedly aware of and directed wash trading activities at BinanceUS, as per a Wall Street Journal investigation.

- The US SEC accused Sigma Chain, a Swiss company supposedly controlled by CZ, of inflating 70% of trading volume on BinanceUS.

- Binance firmly denied the allegations of wash trading, attributing them to a misunderstanding of facts and laws by the SEC.

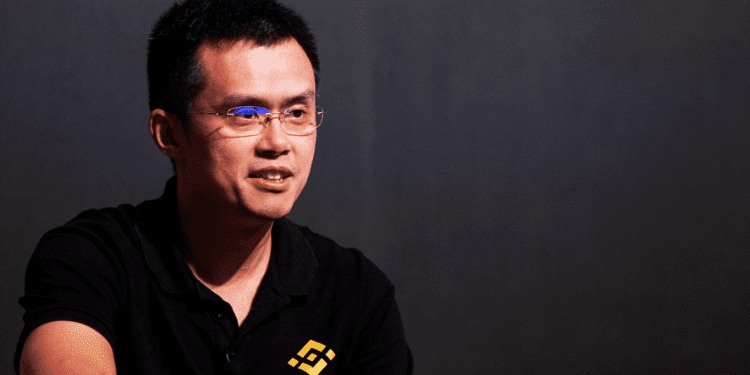

Binance, the world’s largest crypto exchange by trading volume, is coming under the spotlight again. A Wall Street Journal (WSJ) investigation reportedly reveals that Binance CEO Changpeng Zhao (CZ) was not only aware of wash trading at the American branch of Binance, known as BinanceUS, but he also allegedly directed these activities.

Wash trading is a deceptive and illegal practice in regulated financial markets, including the cryptocurrency market. It involves an entity artificially inflating trading volumes by repeatedly buying and selling an asset, giving an illusion of higher market activity. The intent is to manipulate market sentiment, attract more traders, and potentially inflate the asset’s price.

According to the WSJ report, within the first hour of BinanceUS’s launch, approximately $70,000 worth of Bitcoin was traded. Internal communications obtained by WSJ imply that CZ allegedly admitted this volume wasn’t solely from external traders, with a quote attributed to him stating, “That was ourself, I think.”

The report further alleges that Binance’s global exchange was involved in wash trading around 46% of its total volume, raising questions about the legitimacy of the reported trading volumes.

The SEC Steps In: A Closer Look

Adding weight to these allegations, the US Securities and Exchange Commission (SEC) claims that Sigma Chain, a Swiss trading company allegedly controlled by CZ, was instrumental in inflating 70% of the trading volume on BinanceUS.

The SEC’s accusations add fuel to an already raging fire of legal and regulatory challenges for Binance, including a lawsuit from the Commodities Futures Trading Commission (CFTC). Binance is currently attempting to have the CFTC lawsuit dismissed, while also dealing with a substantial wave of layoffs. Amid these challenges, CZ has reportedly introduced a voluntary resignation option for employees, the reasons for which remain uncertain.

Binance’s Response and the Market Impact

Binance has firmly denied the allegations. A spokesperson for the US arm stated that BinanceUS and CZ had never participated in or condoned wash trading. Furthermore, Binance argues that the SEC’s allegations are “unfounded” and stem from a “fundamental misunderstanding of the facts and a misapplication of the relevant law.”

Nonetheless, the allegations and ensuing controversy appear to have had a palpable impact on the cryptocurrency market. Bitcoin’s value dropped more than 2.5% shortly after the WSJ published the report, falling to around $29,000.

In the broader context, regulatory uncertainty surrounding Binance is perceived to weigh heavily on cryptocurrency prices. The current controversy will undoubtedly continue to draw scrutiny from regulators and market watchers worldwide. The actions taken by Binance in the coming months will likely have significant implications for the future of cryptocurrency markets.