- Bitcoin rebounded above $100K after a steep flush, as dip-buyers stepped in and weak hands were cleared out.

- Leverage reset and short squeezes fueled the bounce, while macro fears calmed and equities turned positive.

- The recovery looks more like a healthy bull-market correction than a dead-cat bounce, though risks remain if new negative headlines emerge.

After that wild flush below six figures yesterday, Bitcoin’s back on the attack. In just a few hours, roughly $140 billion has flowed back into crypto. BTC’s holding the line above $100,000 again, and altcoins — especially the spicy ones — are ripping like they’ve been waiting for this moment. Kinda crazy how fast the mood flipped, right? Yesterday everyone was panicking about the “end of the bull run,” and now it’s all “was that the dip??”

So, what’s really behind the bounce — and is this just a dead-cat pop or an actual healthy reset?

1. “Buy the dip” at $100K actually worked — the line held

That quick dive under $100K was ugly. No sugarcoating it. But it did something important: it shook out the weak hands.

Bitcoin dipped under six figures for the first time since June, dropping about 7.4% in one day — nearly 20% off last month’s top near $126K. On-chain data shows long-term holders dumped ~400,000 BTC (that’s around $45 billion worth!) into that chaos. Big coins moved from old wallets into fresh hands.

Today, that pain’s getting bought back. BTC’s around $103K–$104K again, roughly +2% on the day. The $100K zone was the “line in the sand,” technically and psychologically. Once price wicked below and then snapped back, traders saw it as the classic “stop hunt, then reverse” setup.

You could feel the mood swing. Panic tweets turned into “last chance under 100K?” memes overnight. Even Standard Chartered’s desk said recently that any move below $100K would probably be short-lived — maybe the last one ever. Dip-buyers love that kind of talk.

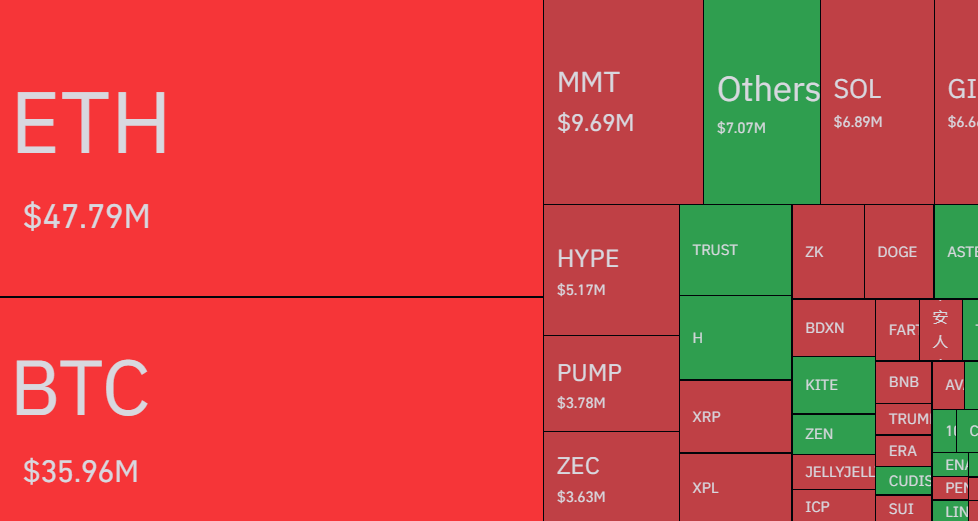

And now? Altcoins are riding the same wave. ETH, BNB, SOL, and XRP all flipped green — SOL and BNB up around 3–4%. Riskier names like PUMP and ASTER are bouncing even harder as traders chase liquidity.

Still, whether it’s real strength or reflex will depend on the next few things…

2. Leverage imploded — and shorts got trapped next

This one’s key: leverage finally broke.

When BTC plunged toward $100K, the derivatives market got wrecked. Over $1.6B in long positions were liquidated in about a day. Once those forced sells started, it snowballed — each margin call triggered the next, and so on.

Now we’re seeing the other side of that. The junk got flushed. Funding rates normalized. Open interest dropped. Shorts piled in after the first bounce — but as spot bids came in, they got squeezed. A lot of today’s move is just that feedback loop: trapped shorts closing into strength.

You can see the difference now: open interest’s still lower even as price recovers. That’s healthier — it means this rally’s being driven by real buying, not just leverage ping-pong.

Dead-cat? Maybe not. If BTC grinds sideways-up near $100K–$105K without leverage exploding again, that’s textbook consolidation after a reset.

3. Macro fear paused — and stocks bounced, too

This isn’t happening in isolation. Equities caught a bid today, and that’s helping.

Yesterday’s tech-led puke took everything down — AI stocks, Nasdaq, S&P, you name it. BTC cracked under $100K at the same time. But today, the Dow, S&P, and Nasdaq are all green. Yields ticked slightly up (10Y at ~4.16%), but investors are tiptoeing back into risk-on mode.

Basically, no new disaster hit the tape. The U.S. shutdown mess, Fed confusion, and Trump-China tariff noise are all still there, but nothing worse came out today. So markets are breathing a bit.

BTC’s still 18–20% off its ATH, but for funds that still believe in the halving cycle and ETF story, this kind of drawdown screams “buy the dip.” Quiet macro + clean positioning = room for a rebound.

4. ETF flows: bad news already baked in

Here’s an interesting twist: this pump isn’t coming from ETFs. In fact, they’re still bleeding.

Bitcoin and Ethereum ETFs saw ~$800M in outflows today — biggest since late summer. That’s part of what crushed price yesterday. But by the time BTC tagged $100K, most of that selling pressure was already priced in.

Now, with outflows steady but not worsening, spot buyers have space to take control. Exchange data shows strong cash volume — meaning people are actually buying coins again, not just paper futures.

If ETF flows flip green again soon, that could add major fuel. Historically, local bottoms lined up right when outflows turned flat or positive. For now, spot’s doing the heavy lifting — and that’s a good sign.

5. Altcoins going wild again — “beta bounce” in full effect

Once Bitcoin stopped falling, the alts went nuts. Classic.

After the liquidation wave, many altcoins were down 15–20% intraday. Now? They’re snapping right back. ETH’s around $3.4K (+0.7%), BNB near $960 (+4%), SOL at $161 (+3%), and XRP at $2.28 (+2%).

Smaller speculative stuff — like DEX and memecoin plays — always move like leverage on top of BTC. They overreact both ways. Traders are already bragging about +40% rebounds on microcaps they “caught at the bottom.”

Will it last? Some of those mini-bounces are probably fakeouts, sure. But majors recovering cleanly while BTC stabilizes — that’s what you want to see in a healthy bull correction, not a death spiral.

If BTC can just hold above $100K–$102K through the next macro headline or two, the whole market gets permission to keep climbing instead of rolling over again.

So… dead-cat bounce or healthy reset?

Right now, it’s leaning bullish. Maybe not “new ATH next week” bullish, but solid.

We’ve got:

- $100K tested and defended.

- Leverage purged.

- Spot buyers stepping up.

- Macro fear easing a touch.

Could another ugly headline knock us back? Sure — the Fed, shutdown chaos, or tariff drama could all do it. But unless something truly breaks, this looks more like a classic bull-market shakeout than the end of the run.

Short version: crypto’s pumping today because the market finally cleared its lungs. The problems didn’t vanish overnight, but the worst of the leverage did. If you’re trading it — don’t get greedy. Respect the $100K line, stay nimble, and let everyone else celebrate the green candles while you keep your stops tight.