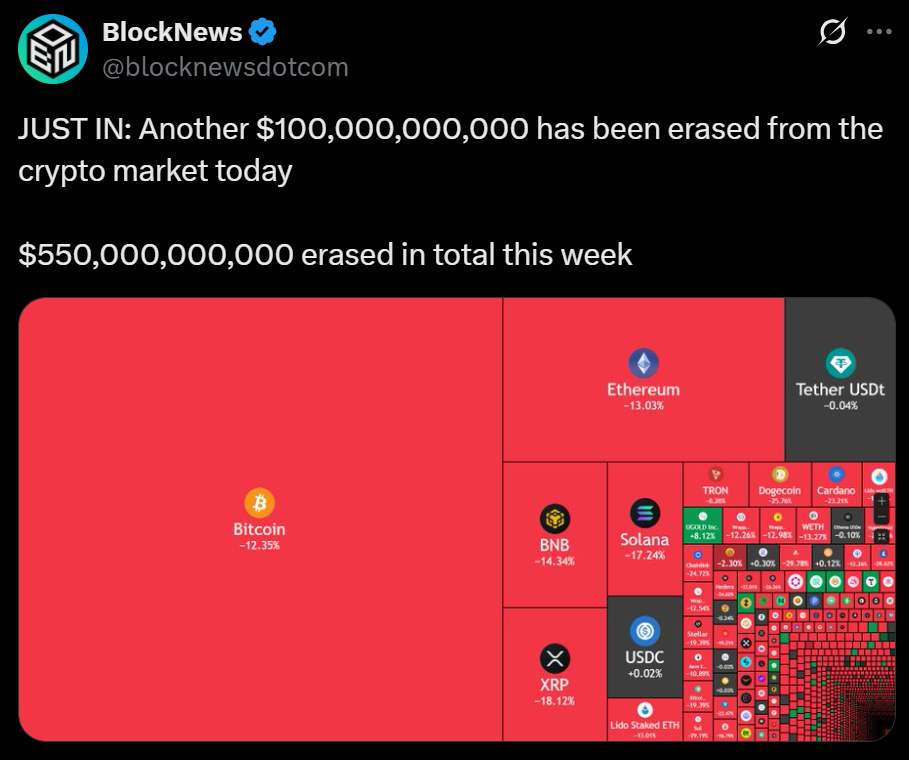

- $550 billion wiped from crypto’s market cap as risk-off panic returned.

- Gold and metals absorbed safety flows, sidelining the “digital gold” trade.

- ETF outflows and liquidation cascades deepened the selloff.

The crypto market just wiped out around $550 billion in value, falling from the low-$4 trillion range to roughly $3.57 trillion. Bitcoin dropped into the $104–107K pocket, Ethereum slipped below $4K, and altcoins bled across the board. There wasn’t one single spark—it was a messy overlap of macro fear, capital rotation, and structural unwinds. Here’s what really drove the selloff.

Trump–China Tensions Ignite Risk-Off Panic

Trade war chatter came roaring back. Fresh tariff threats and talk of tighter export controls between the U.S. and China reignited global market anxiety. The sequence played out predictably: tariff headlines hit → equities sold off → bank stocks stumbled → crypto followed the risk curve lower. Bitcoin broke to a 3-month low near $104.7K as U.S. and European indices sank on credit concerns. Even though some officials tried to downplay “100% tariffs,” traders are treating November’s policy window as a live risk event. In these risk-off phases, liquidity vanishes and dip-buyers hesitate, making each down-move sharper and faster.

Gold Takes the Safe-Haven Spotlight

When fear hit, money fled—but not into crypto. Gold ripped through $4,300 per ounce, setting new all-time highs as traders bet on rate cuts and geopolitical strain. Silver tagged along, reinforcing the metal trade as the preferred shelter. That flight to old-school safety undercut crypto’s “digital gold” pitch. Even as gold cooled briefly, its double-digit monthly gain kept investor focus glued to metals, not tokens. For allocators, gold worked; Bitcoin didn’t. Until that dynamic flips, it’s tough for crypto to reclaim its store-of-value glow.

ETFs Bled and Leverage Snapped

Then came the structural flush. Spot Bitcoin ETFs in the U.S. saw roughly $536 million in outflows on a single day—the biggest since August. That steady demand pipeline dried up just as futures markets got hit with about $1 billion in long-side liquidations. Bitcoin briefly sliced below $106K before rebounding weakly, while altcoins spiraled lower on thin books. It’s the classic feedback loop: ETFs bleed, perps unwind, liquidity collapses, and volatility feeds on itself. Until outflows reverse and liquidations settle, the market stays stuck in chop mode, not recovery mode.