- A whale opened a $7.9M leveraged long on ZEC via HyperLiquid, signaling strong confidence.

- Zcash is up 7%, trading near $464, with trendline support still holding.

- Rising Open Interest and Taker Buy dominance suggest a bullish breakout toward $500–$520 is on the horizon.

A fresh whale move just lit up the market. A newly created wallet dropped $7.9 million in USDC onto HyperLiquid, opening a 5x leveraged long position on Zcash (ZEC). The order is set to expand through a TWAP strategy — meaning it’s building up gradually, not all at once. That kind of precision suggests this isn’t just a gamble; it’s confidence in a trend that’s already forming.

Whales don’t usually move this heavy unless they’re expecting momentum. This long entry lines up with a wider rise in ZEC Open Interest and a noticeable uptick in buy-side derivatives activity, both classic signs of speculative demand building up. When whales and traders align like this, the market tends to wake up fast — and volatility usually follows.

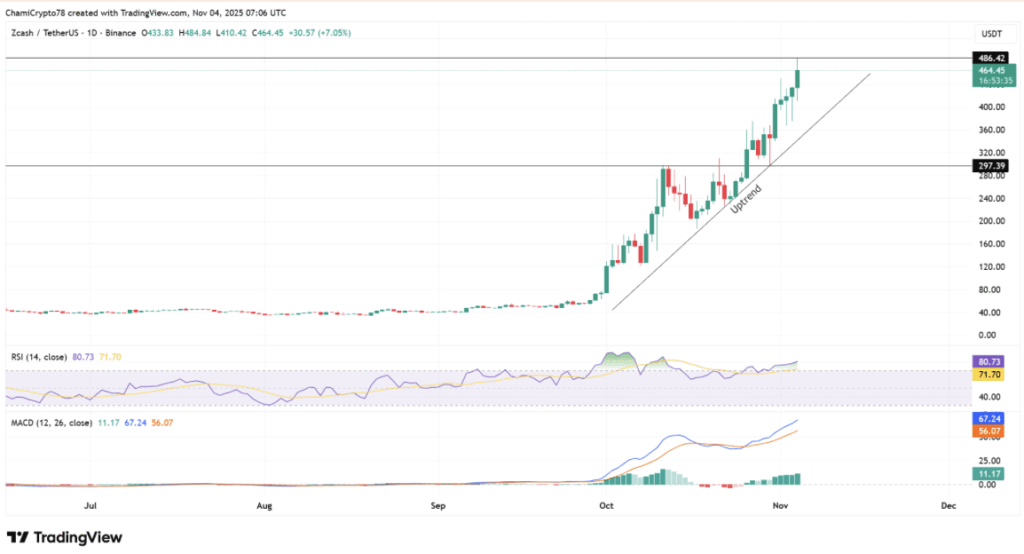

Buyers Keep Control as ZEC Rides Its Trendline

ZEC’s price has been holding steady within a solid uptrend, up more than 7% and trading near $464 at the time of writing. The daily chart shows a string of higher lows, with a clean ascending trendline acting like a backbone for the rally. Every dip toward it has attracted fresh buyers — a sign that accumulation’s still strong.

That said, there’s a bit of heat in the market. The RSI is sitting around 80.7, signaling that things might be getting stretched in the short term. The MACD histogram remains firmly positive though, suggesting that momentum hasn’t run out yet. Still, the zone between $480 and $500 looks tricky; it’s where sellers previously rejected price action back in early October. If bulls can clear that ceiling, ZEC could push toward $520, while staying above $440 keeps the trend intact.

Derivatives Point to Rising Speculation

Zcash’s Open Interest surged 27.6% to roughly $734.7 million, showing a sharp increase in speculative positioning. This isn’t the kind of OI spike that comes from short covering — it’s active buying, traders piling in expecting more upside. Historically, that combination (rising OI + rising price) hints at bullish conviction, not desperation.

Still, the bigger the leverage, the bigger the risk. If volatility picks up suddenly, those leveraged longs could face heavy liquidations. For now, though, both spot and futures data are showing synchronized strength — meaning there’s real capital flowing into ZEC across markets, not just leverage-driven hype.

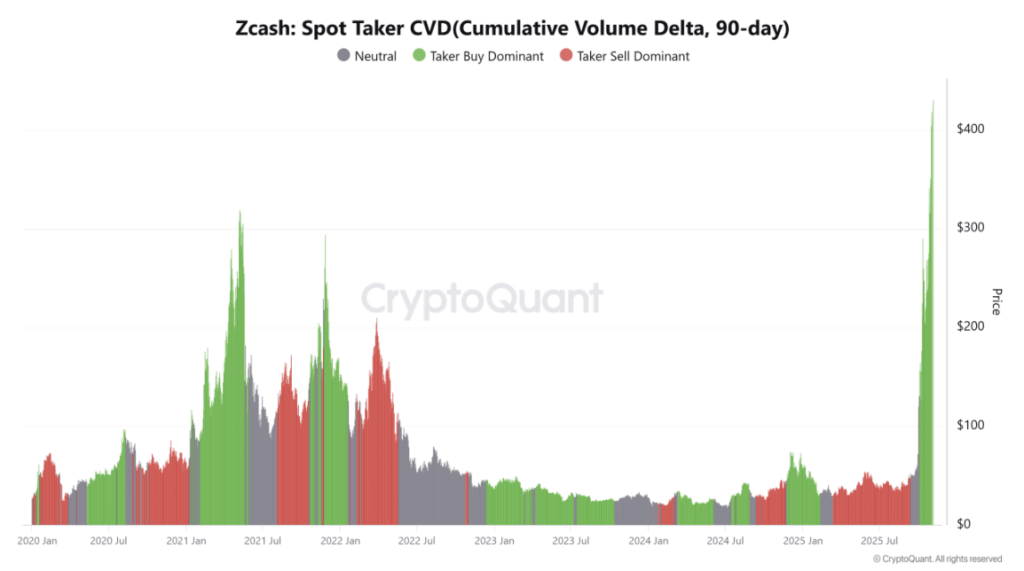

Strong Buy-Side Signals Despite Overheated RSI

Spot data adds another layer to the story. Taker CVD metrics show that buyers are aggressively lifting offers, not just waiting for dips. That’s a powerful sign — it means real conviction on the buy side, both from retail and institutions. Even though RSI looks overheated, the persistent Taker Buy dominance implies strong liquidity absorption, allowing ZEC to hold higher support zones even during pullbacks.

If that continues, the coin’s structure could stay bullish longer than most expect. It’s rare to see this much demand hold steady while momentum indicators flash red — but ZEC seems to be doing exactly that.

Can Zcash Break $500?

All signs point to ZEC having a legitimate shot at breaching $500 soon. The combination of whale accumulation, expanding Open Interest, and aggressive buy-side flow is exactly what fuels short-term rallies.

Unless sentiment suddenly flips or a broader market selloff hits, Zcash looks positioned for a breakout phase, potentially carrying the next leg toward $520 and beyond. The trendline’s solid, buyers are still stepping in, and for now, the whales seem to be leading the charge.